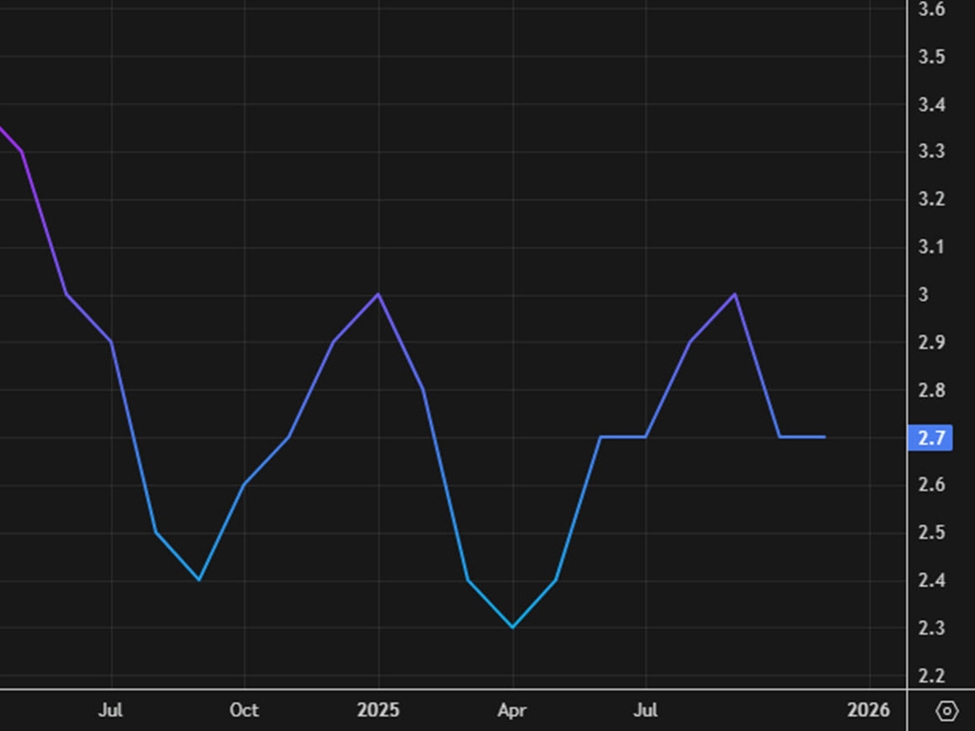

Prior was +2.7%m/m CPI +0.2% vs +0.3% expected Prior m/m reading was +0.3%Real weekly earnings +0.5% vs -0.3% prior (revised to -0.5%)Core inflation :Ex food and energy +2.5% vs +2.5% y/y expectedPrior ex food and energy +2.5%Core m/m +0.3% vs +0.3% exp Prior core m/m +0.2%Core goods +1.1%Core services +2.9% y/ySupercore +2.7% y/yUnrounded numbers:Core +0.281% m/m seasonally adjusted, +0.437% NSAThere has been a slight dovish shift in Fed pricing following the data and we can see that in a softer US dollar as well. S&P 500 futures are now flat, erasing the earlier decline.Notably, October CPI data was not collected due to a government shutdown, and November data collection began later than usual, capturing more seasonal holiday discounting. Economists widely cautioned that these disruptions may have artificially depressed the readings. Meat prices were a standout concern, soaring 8.9% annually — the sharpest increase since 2022 — with raw ground beef up nearly 15%. While the cooler-than-expected report was welcomed by markets and supported the case for continued Fed rate cuts, analysts stressed that the December report would provide a clearer picture of underlying inflation trends.On a two-month basis (September to November), the all items index rose 0.2% seasonally adjusted, with core CPI also up 0.2% over that span, implying roughly 0.1% monthly readings for both October and November. Shelter costs, typically one of the stickiest inflation components, rose just 0.2% over the two-month period, slowing sharply from a 3.6% annual pace in September to 3.0% in November. Food prices increased 2.6% annually, down from 3.1% in September, while the energy index jumped 4.2% year-over-year, driven by a 6.9% surge in electricity costs.The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) rose 2.7% on an annual basis in November 2025, a notable deceleration from the 3.0% pace recorded in September. Core CPI, which strips out volatile food and energy costs, increased 2.6% year-over-year — its lowest reading since March 2021.

This article was written by Adam Button at investinglive.com.

💡 DMK Insight

CPI data just dropped, and it’s a mixed bag—here’s what it means for traders: The latest CPI figures show a m/m increase of 2.7%, slightly above expectations of 0.3%. While core inflation remains steady at 2.5% y/y, the real weekly earnings jumped 0.5%, indicating some wage growth. This could signal a potential shift in consumer spending patterns, which traders need to keep an eye on. If inflation persists or accelerates, the Fed might feel pressured to adjust interest rates sooner than anticipated, impacting both forex and crypto markets. Watch for how this data influences the USD; a stronger dollar could lead to bearish trends in commodities and crypto. Key levels to monitor are the 2.5% core inflation benchmark and the 0.3% core m/m figure. If inflation exceeds these levels in future reports, expect volatility in related assets, particularly in the forex market where currency pairs like EUR/USD could react sharply. Keep an eye on upcoming Fed statements for clues on their next moves.

📮 Takeaway

Traders should watch for inflation trends above 2.5% and potential Fed responses, as these could drive volatility in USD and related markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin