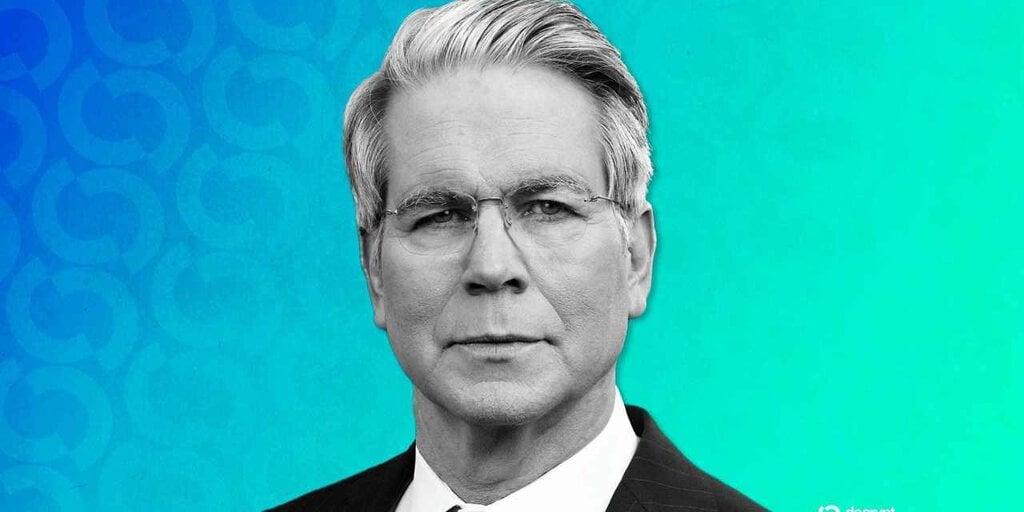

U.S. Treasury Secretary Scott Bessent suggested that the crypto market would be calmed by the passage of the Clarity Act. 🔗 Source 💡 DMK Insight The Clarity Act could be a game-changer for crypto traders, and here’s why: clearer regulations might stabilize a notoriously volatile market. Right now, uncertainty around regulatory frameworks is a major driver of price swings. If the Clarity Act passes, it could provide the much-needed framework that reassures institutional investors, potentially leading to increased capital inflow. This is especially crucial as we approach the end of the year, a time when many traders are looking to position themselves for 2024. Keep an eye on how major cryptocurrencies react to this news; a positive sentiment could push Bitcoin and Ethereum towards key resistance levels. But don’t overlook the flip side—if the Act faces delays or pushback, we could see a sharp sell-off as traders react to the uncertainty. Watch for any announcements or votes related to the Act in the coming weeks, as they could trigger significant market movements. 📮 Takeaway Monitor the progress of the Clarity Act closely; a positive outcome could lead to a rally in major cryptocurrencies, while delays might trigger sell-offs.

Trump Media Files to Launch Truth Social-Branded Bitcoin, Ethereum, Cronos ETFs

Truth Social Funds applied for ETFs that would give investors exposure to crypto—one focused on Bitcoin and Ethereum, the other on Cronos. 🔗 Source 💡 DMK Insight Truth Social’s ETF applications could shift crypto sentiment significantly. With ETH currently at $2,046.55, this move signals institutional interest, which often precedes price rallies. If these ETFs gain approval, expect increased trading volume and volatility, particularly for Bitcoin and Ethereum. Traders should monitor the $2,100 resistance level for ETH; a breakout could trigger a bullish trend. On the flip side, if the approval process stalls, it might lead to a pullback, so keep an eye on the market’s reaction to any news regarding the ETFs. This development could also impact related assets like Cronos, which may see speculative trading as investors look for potential upside. Watch for announcements in the coming weeks that could provide clarity on the ETF applications and influence market direction. 📮 Takeaway Keep an eye on ETH’s $2,100 resistance level; ETF approval could spark a bullish trend if broken.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin