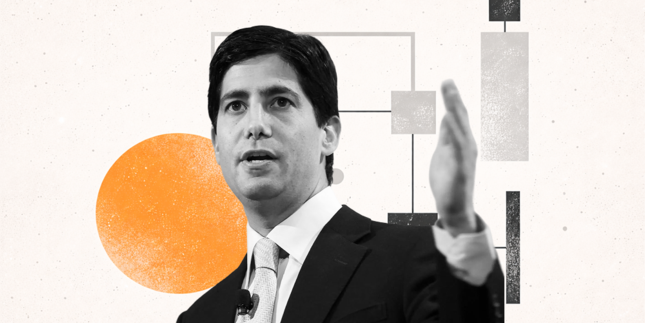

The Dollar is poised for a potential recovery following the expected nomination of Kevin Warsh as the new Federal Reserve Chair. This development is seen as a positive sign for the Dollar, which has been seeking a catalyst for recovery.

💡 DMK Insight

The Dollar’s potential recovery hinges on Kevin Warsh’s nomination as Fed Chair, and here’s why that matters: Warsh’s appointment could signal a shift towards a more hawkish monetary policy, which traders often view favorably for the Dollar. If the Fed leans towards tightening, we might see interest rates rise, boosting the Dollar’s appeal against other currencies. This could impact forex pairs like EUR/USD and GBP/USD, where traders should watch for resistance levels around 1.10 and 1.30 respectively. A stronger Dollar could also ripple through commodities, particularly gold, which often moves inversely to the Dollar’s strength. But let’s not get ahead of ourselves. The market’s reaction could be muted if Warsh’s policies lean towards gradualism rather than aggressive tightening. Traders should monitor upcoming economic data releases and Fed communications for clues on the actual direction of policy. The immediate timeframe is crucial—watch for price movements in the Dollar index over the next few weeks as the nomination unfolds and the market digests its implications.

📮 Takeaway

Keep an eye on the Dollar index; a strong reaction could signal a shift in forex dynamics, especially against EUR/USD and GBP/USD, in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether