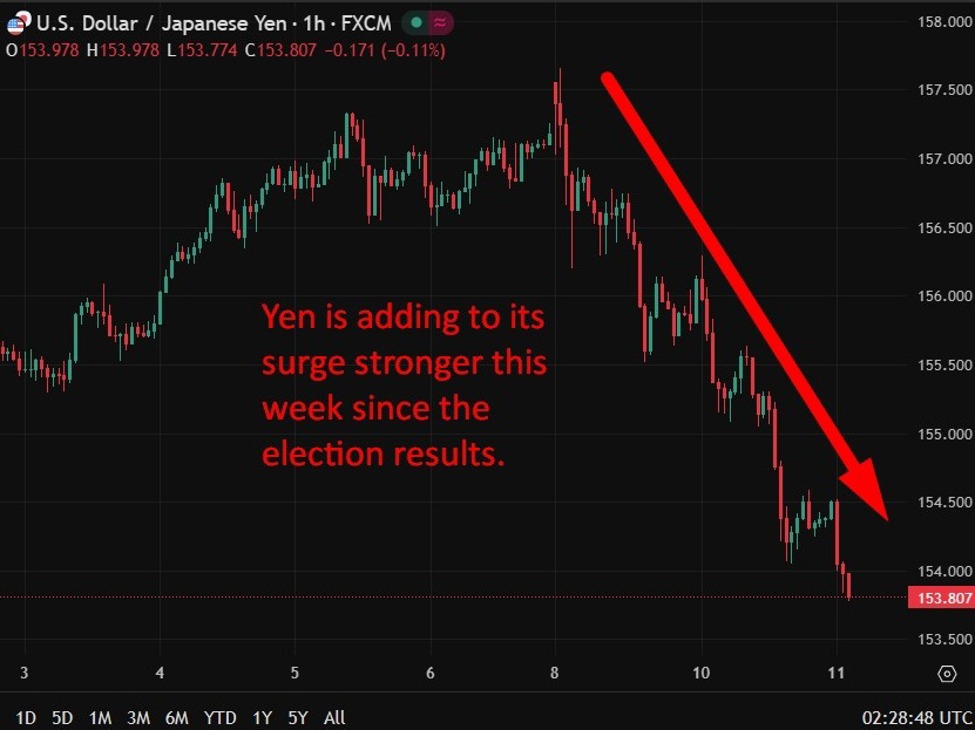

Japanese markets are closed for a holiday today. Of course, yen trade continues in other centres. but its thnnier than normal. There is no fresh news.NFP ahead:Preview: January non-farm payrolls by the numbers. The consensus is highGoldman flags substantial downside risk to January jobs report

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

With Japanese markets closed, yen trading is thinner, and here’s why that matters: The lack of fresh news means traders might be reacting to existing sentiment, which could amplify volatility. As we approach the January non-farm payrolls (NFP) report, expectations are elevated, but Goldman Sachs has flagged significant downside risks. This could lead to sharp market movements, especially if the actual figures deviate from the consensus. Traders should keep an eye on the USD/JPY pair, as any surprises in the NFP could trigger a breakout or breakdown around key technical levels. If the report shows weaker job growth, it might push the yen stronger against the dollar, while a strong report could lead to a sell-off in yen pairs. Here’s the flip side: if the NFP comes in as expected, we might see a continuation of current trends, but the thinner trading conditions could mean larger price swings. Watch for the NFP release and be prepared for potential volatility in the yen and related pairs, particularly in the hours following the announcement.

📮 Takeaway

Monitor the USD/JPY pair closely around the NFP release; any deviation from consensus could trigger significant volatility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether