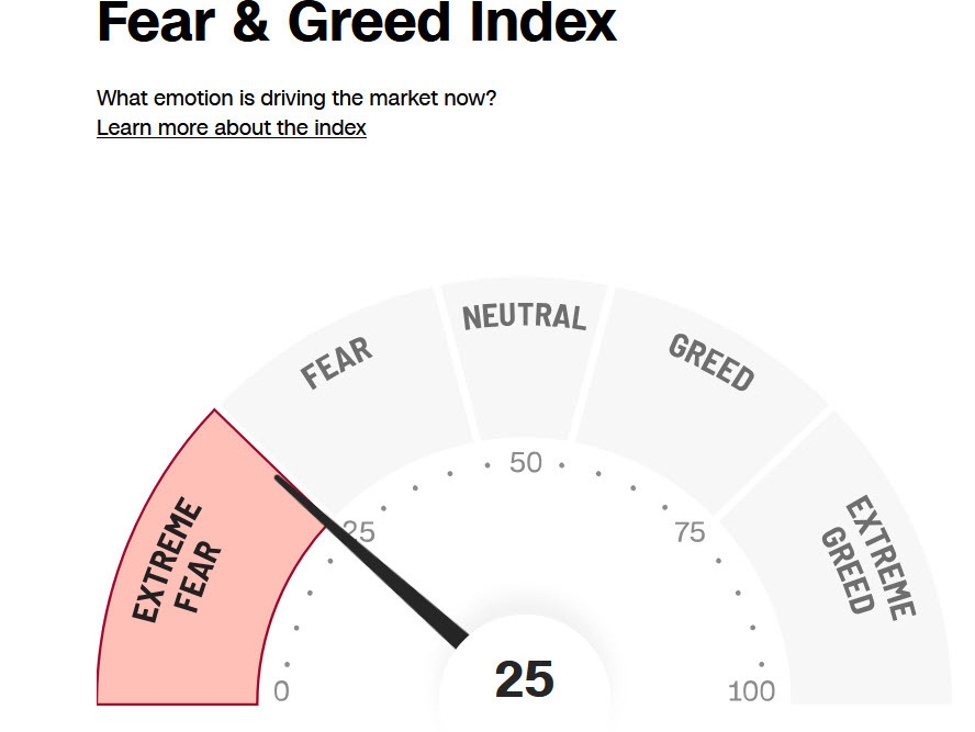

At times, the Fear & Greed index is a somewhat-useful indicator of market sentiment, particularly at extremes. But somehow it’s showing ‘extreme fear’ at the moment despite the S&P 500 being just 1.8% off the all-time high set just last week.On the face of it, that should be a strong buy signal for stock markets. What it’s picking up on is terrible breadth in the stock market, a swing in the put-call ratio, the FIX at 23.7, falling Treasury yields and junk bond demand. The problem is that these numbers are stochastic and we’re coming off a period of euphoric returns so they’re benchmarked against an impossible metric.

This article was written by Adam Button at investinglive.com.

💡 DMK Insight

The current 'extreme fear' reading from the Fear & Greed index, juxtaposed with the S&P 500's near-record highs, reveals a fascinating paradox in market psychology. Investors seem to be wrestling with uncertainty, perhaps haunted by past downturns or geopolitical tensions, even as the market dances on the edge of euphoria. This dissonance suggests that while the numbers may look rosy, the underlying sentiment is anything but stable. For traders, this could signal a ripe opportunity to gauge when to capitalize on fear or when to tread cautiously.

📮 Takeaway

Watch for shifts in sentiment; extreme fear could indicate a buying opportunity or a warning sign.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether