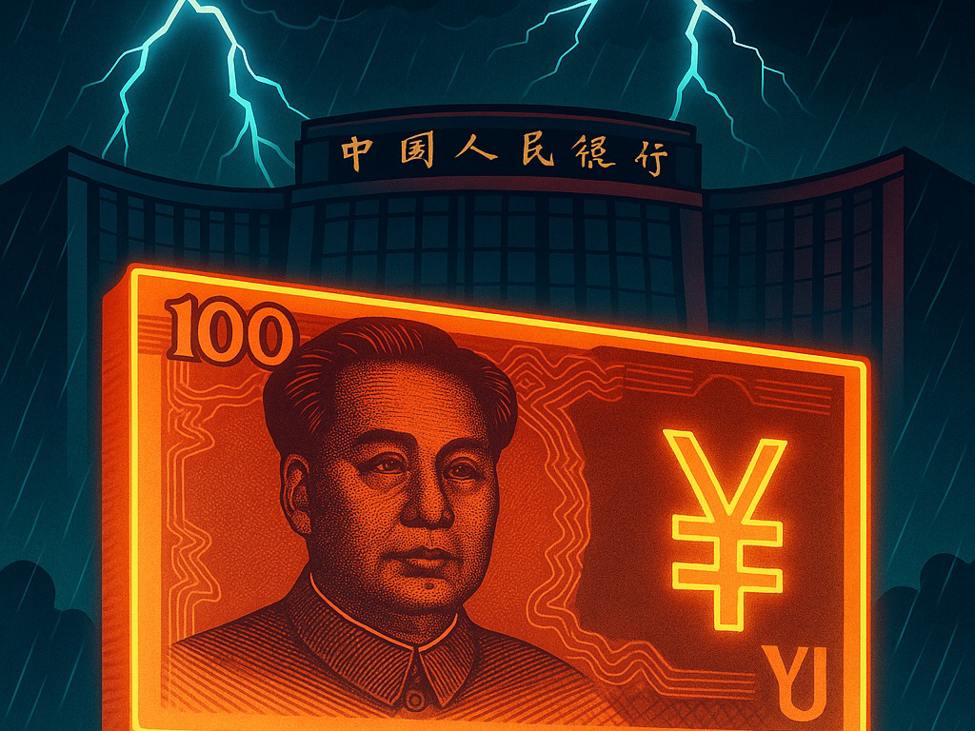

The PBOC allows the yuan to fluctuate within a +/- 2% range, around this reference rate.

Previous close 6.9033Injects CNY 145bln via 7-day reverse repos with the rate unchnaged at 1.40%

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

The PBOC’s latest move to inject CNY 145 billion via reverse repos is a clear signal of its intent to manage liquidity amid ongoing economic pressures. With the yuan’s reference rate set at 6.9033 and allowed to fluctuate within a 2% band, traders should keep an eye on how this affects the currency’s volatility. The unchanged reverse repo rate at 1.40% suggests the central bank is maintaining a cautious stance, likely to support economic stability while avoiding excessive depreciation of the yuan. This could impact forex pairs like USD/CNY, especially if traders start to position themselves based on anticipated fluctuations. However, there’s a flip side: if the yuan weakens beyond the 2% threshold, it could trigger further interventions from the PBOC, leading to increased volatility. Watch for any shifts in market sentiment around this reference rate, as it could provide trading opportunities in both the yuan and related assets like commodities that are priced in CNY.

📮 Takeaway

Monitor the USD/CNY pair closely; a breach of the 2% fluctuation range could signal significant volatility and trading opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin