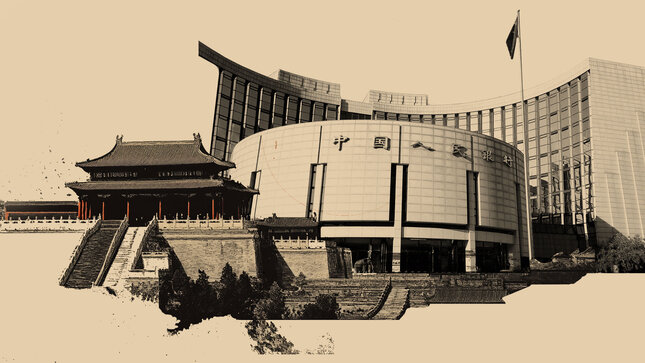

ING expects Chinese inflation dynamics to have limited impact on People’s Bank of China policy in 2026. Lynn Song argues that CPI will again undershoot an expected 2% target, but this shortfall should not constrain monetary decisions.

💡 DMK Insight

China’s inflation outlook is a mixed bag, and here’s why it matters for traders right now: With ING predicting that the Consumer Price Index (CPI) will fall short of the 2% target, traders should keep an eye on how this could influence the People’s Bank of China’s (PBoC) monetary policy. A lower CPI might suggest a sluggish economy, but if the PBoC remains unfazed, it could signal a commitment to maintaining liquidity, which is crucial for risk assets. This scenario could lead to a divergence in trading strategies, particularly for those focused on Chinese equities and commodities. If the PBoC doesn’t adjust rates, we might see a continued bullish trend in sectors reliant on cheap credit, while those expecting tightening could face losses. However, there’s a flip side: if inflation remains persistently low, it could raise concerns about economic stagnation, prompting shifts in investor sentiment. Traders should monitor key economic indicators, especially any unexpected shifts in CPI data or PBoC statements in the coming months. Watch for any significant price movements in the yuan and related assets, as these could provide early signals of market sentiment changes.

📮 Takeaway

Keep an eye on CPI trends and PBoC policy shifts; a persistent low CPI could impact Chinese equities and the yuan significantly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether