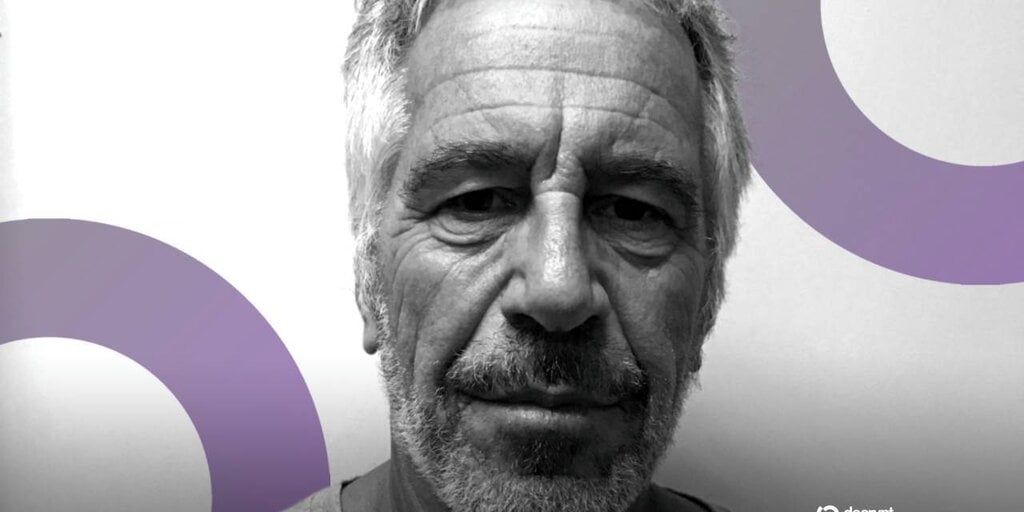

Coinbase co-founder Fred Ehrsam appears to have been personally aware and supportive of the convicted sex offender’s early investment in the company.

💡 DMK Insight

This revelation about Fred Ehrsam’s awareness of a convicted sex offender’s investment in Coinbase raises serious questions about the company’s governance and ethical standards. For traders, this could impact Coinbase’s reputation and stock performance, especially if it leads to regulatory scrutiny or a loss of consumer trust. The crypto market is already sensitive to negative news, and any fallout could result in increased volatility for Coinbase’s stock and the broader crypto sector. Watch for potential price reactions in Coinbase’s shares and related assets like Bitcoin and Ethereum, as sentiment shifts could trigger sell-offs. On the flip side, if Coinbase manages to navigate this situation without significant backlash, it could present a buying opportunity for those looking to capitalize on a dip. Keep an eye on trading volumes and market sentiment over the next few weeks to gauge how this news affects investor confidence.

📮 Takeaway

Monitor Coinbase’s stock closely for volatility; any significant drop could signal a buying opportunity if the fallout is contained.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether