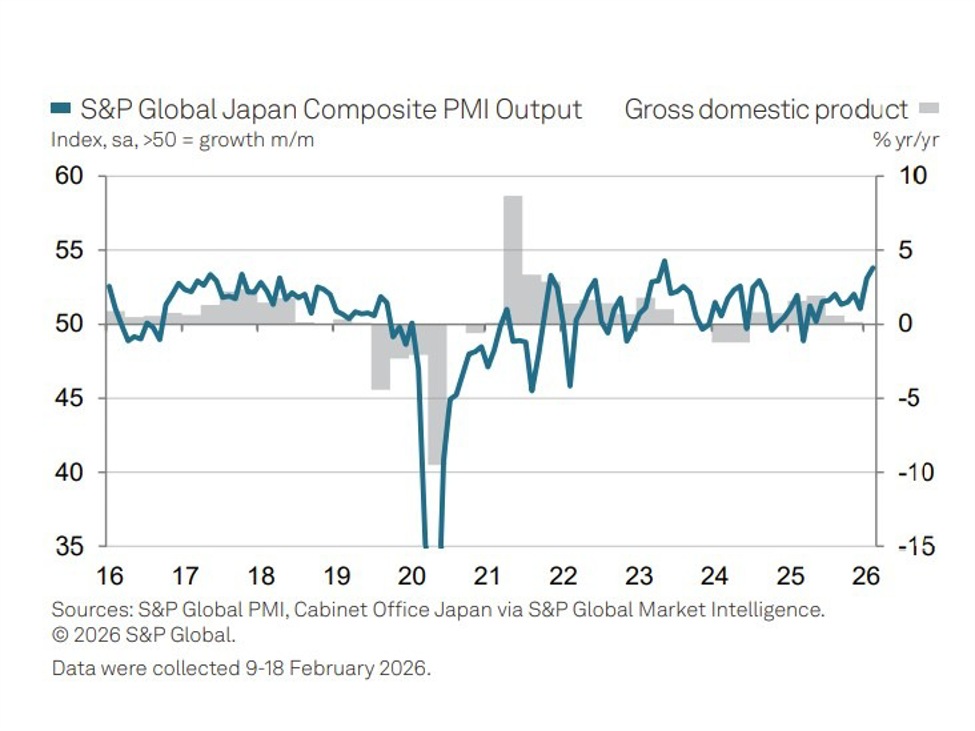

In wrapping up the 2025 year, foreign holdings of US Treasuries dropped slightly in December to $9.27 trillion. That compares with the peak seen in November at $9.36 trillion. The $88.4 billion drop might not seem much but it still represents the largest monthly decline since late 2022. But after hitting a record high in November, I think we can give that a pass.That especially if we put things more into context. The 2025 year-end figure still marks a massive year for US debt demand, with it being well above the $8.5 trillion at the end of 2024.So, what can we make of the trend and the data from the report yesterday?There are just a couple of things that stand out from the chart above.The first of course being the glaring and continued decline in China’s holdings of US Treasuries. The figure dropped to $683.5 billion by the end of 2025, which is the lowest since 2008. The total reduction in China’s holdings for the whole of last year was over $200 billion. So, it keeps up with the trend we’re seeing since the peak in 2013.That being said, the important detail when looking into this report is to not take the numbers at face value. It is best to remember that the numbers here are only a measure of each country’s holdings of Treasuries in US custodians. The thing about this is that some countries might still buying Treasures via non-US custodians. As such, China likely falls under this category.And these numbers tend to show up in the likes of Belgium and Luxembourg. That is not to say all of it are tied to proxy buying though. Both Belgium and Luxembourg also double as agents to facilitate demand for private financial institutions in Europe especially.As for the UK, it is more so a case of London acting as a global clearinghouse for private international investors. That especially after the Covid pandemic.In essence, the narrative there also highlights the continued shift in trend in terms of structural holdings of Treasuries and US debt.It is no longer central banks being the big players but instead private investors i.e. hedge funds, pension funds, asset managers who are now the dominant buyers. And they have been for quite a while now.As mentioned yesterday, this just means that US funding is now becoming more increasingly dependent on market-based capital and not so much so on reserve recycling. To put things more simply, it’s more about yield and financial demand rather than being a case of a geopolitical feature.And for all the negativity surrounding the dollar and US assets since last year, foreign demand for Treasuries remain strong. The total holdings by foreign investors last year even showed a staggering increase of $770 billion over the course of 2025.That’s good news for the US administration as they continue to balance on a very fine tightrope on the fiscal side of things. But even as foreign demand is holding up just enough to keep the engine running, the fiscal cost continues to put a stranglehold on the government.And now with the “financialisation” shift in who is demanding Treasuries, that creates a bigger risk especially since private investors are more price/yields sensitive. That in turn also creates the risk for more potential yield spikes on any major developments.

This article was written by Justin Low at investinglive.com.

💡 DMK Insight

Foreign holdings of US Treasuries just took a hit, and here’s why that matters: The drop to $9.27 trillion in December, down from November’s $9.36 trillion, signals a potential shift in investor sentiment. This is the largest monthly decline since late 2022, which could indicate that foreign investors are becoming more cautious about US debt. For traders, this could impact the USD and Treasury yields. If foreign demand continues to wane, we might see upward pressure on yields, making US debt less attractive. Keep an eye on the 10-year Treasury yield; any significant movement could affect broader market sentiment and risk appetite. On the flip side, this decline might also reflect a strategic repositioning by foreign investors, possibly favoring equities or other assets. If they’re reallocating towards riskier assets, it could lead to volatility in both the forex and equity markets. Watch for reactions in the forex market, especially with the USD, as shifts in Treasury holdings often correlate with currency strength. Traders should monitor the upcoming economic data releases and Fed commentary for clues on how this trend might evolve.

📮 Takeaway

Watch the 10-year Treasury yield closely; a rise could signal increased volatility in the USD and broader markets as foreign demand shifts.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin