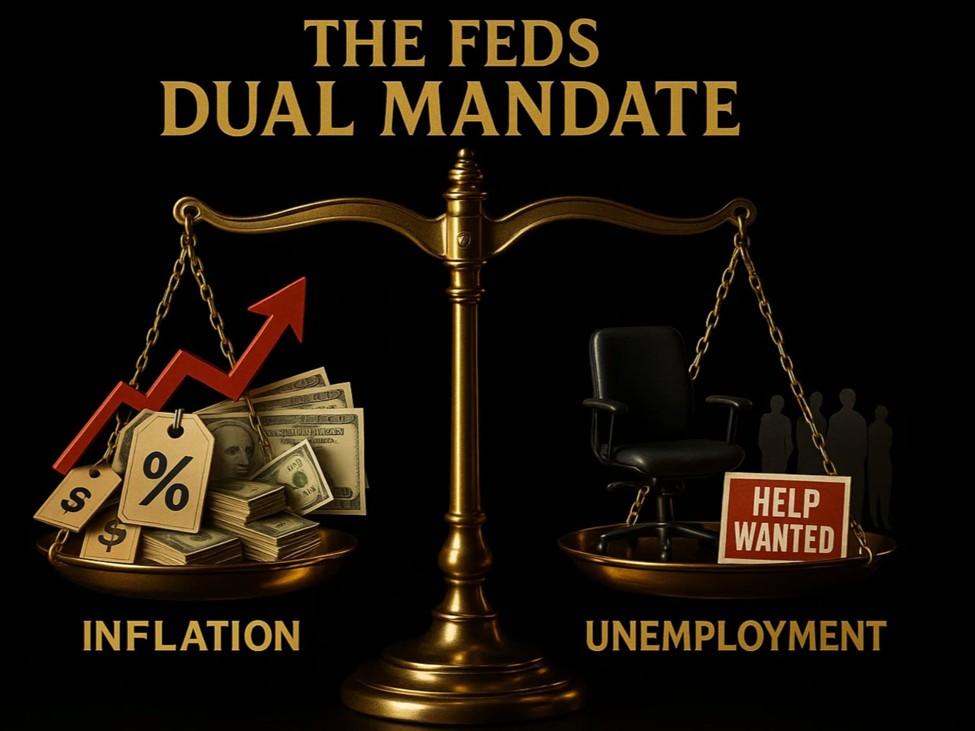

Fed Gov. Barr is also speaking and says:Progress has been made on inflation, but there is still work to do.Two-speed economy with wealthier households thriving Fed has to pay attention to ensuring the job market is solid Low hiring part of low-hire. Low fire environment may be showing some effect of AI adoption in some sectors.Big gap in economy right now between upper 40% and everyone else. Makes it harder for less well off to save, more at risk of shocksBarr is best characterised as a mild dove on interest-rate policy: he is willing to wait and monitor data rather than push for immediate cuts.However, he is struggling with concerns that inflation is not where it should be, but also weary of the employment market getting weaker.Barr is a permanent voting member on the FOMC board as a governor. He voted to cut rates at the last meeting.

This article was written by Greg Michalowski at investinglive.com.

💡 DMK Insight

Fed Gov. Barr’s comments on inflation and the job market are crucial for traders right now. With SOL currently at $155.90, the emphasis on a two-speed economy suggests that while wealthier households are thriving, the broader economic picture remains shaky. This could impact risk sentiment across crypto and equities, especially if the Fed signals a more cautious approach to interest rates. Traders should watch for potential volatility in SOL and related assets as market participants digest these comments. If inflation pressures persist, we might see a shift in monetary policy that could affect liquidity and risk appetite, especially in the crypto space. Keep an eye on SOL’s support around $150 and resistance near $160; these levels could dictate short-term trading strategies. If SOL breaks below $150, it could trigger further selling, while a move above $160 might attract bullish momentum. The real story here is how the job market’s health will influence Fed decisions and, in turn, crypto market dynamics.

📮 Takeaway

Watch SOL’s support at $150 and resistance at $160; Fed comments could drive volatility in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin