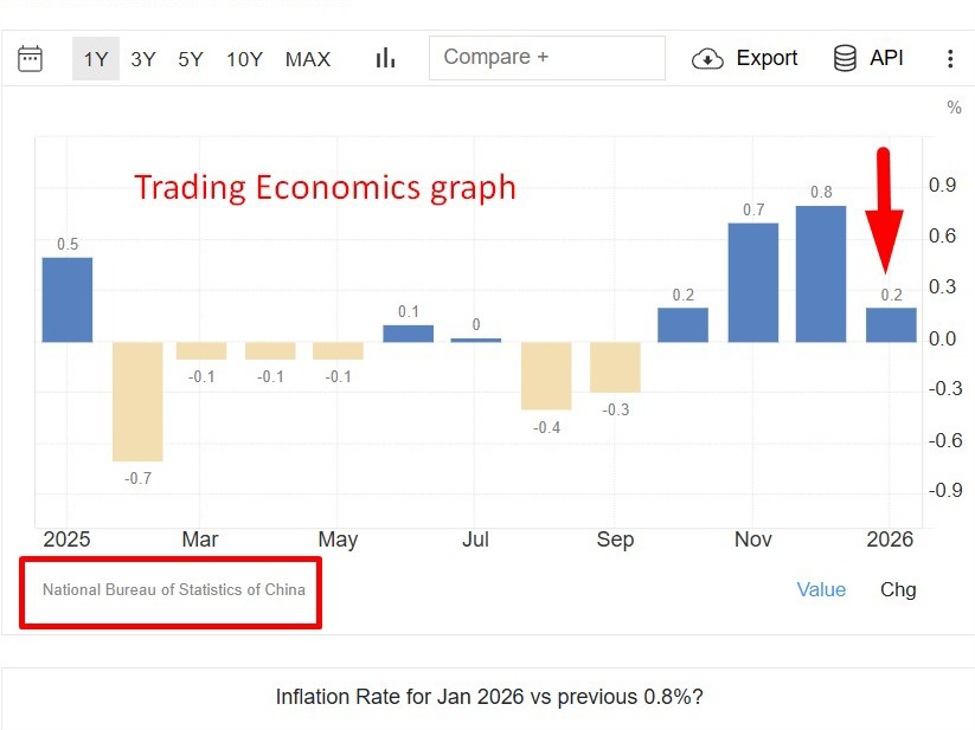

China’s January inflation data missed expectations and showed persistent producer-price deflation, reinforcing pressure for further policy support.Summary:January CPI +0.2% y/y, below expectationsCore inflation eased to 0.8%PPI -1.4% y/y, deflation persistsIndustrial profitability still pressuredPBOC maintains loose policy biasChina’s inflation data for January underscored persistent deflationary pressures in the world’s second-largest economy, with consumer prices rising less than expected and factory-gate prices remaining in contraction.Data from the National Bureau of Statistics of China showed the consumer price index (CPI) rose 0.2% y/y, below expectations for a 0.4% increase and down from December’s 0.8% gain. On a monthly basis, prices also rose 0.2%, undershooting forecasts.Core CPI, which excludes food and energy, increased 0.8% y/y, easing from 1.2% in December — a sign that underlying demand pressures remain soft.Meanwhile, producer price index (PPI) data pointed to ongoing weakness at the factory gate. PPI fell 1.4% y/y, slightly better than expectations but extending a deflationary run that has now lasted more than three years. The persistent decline in producer prices continues to squeeze industrial profitability amid subdued domestic demand and lingering excess capacity.China’s broader economic backdrop remains mixed. The economy expanded 5% in 2025, meeting the government’s target, supported by resilient exports to non-U.S. markets. However, authorities continue to grapple with property-sector weakness, fragile consumer confidence and overcapacity across key industries that has fuelled price competition.Policymakers have signalled further support may be forthcoming. In its latest quarterly report, the People’s Bank of China reiterated its commitment to maintaining an “appropriately loose” monetary stance and guiding prices toward a more sustainable recovery.With key annual policy meetings approaching next month, markets will watch closely for additional fiscal or monetary measures aimed at arresting deflationary pressures and stabilising growth.

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

China’s January inflation data is a wake-up call for traders: persistent deflation signals potential policy shifts. With CPI at +0.2% y/y and PPI down -1.4% y/y, the numbers clearly miss expectations and highlight ongoing economic struggles. This could prompt the People’s Bank of China (PBOC) to implement further monetary easing, which would likely impact the yuan and related assets. Traders should keep an eye on how this influences commodity prices, especially in sectors reliant on Chinese demand, like metals and energy. If the PBOC acts, it could lead to increased volatility in forex markets, particularly for USD/CNY. But here’s the flip side: while deflation can spur stimulus, it also raises concerns about economic health. If industrial profitability remains pressured, it might deter foreign investment, leading to a weaker yuan in the long run. Watch for any PBOC announcements in the coming weeks, as they could set the tone for market sentiment and trading strategies moving forward.

📮 Takeaway

Monitor PBOC actions closely; any stimulus could impact USD/CNY and commodities significantly in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether