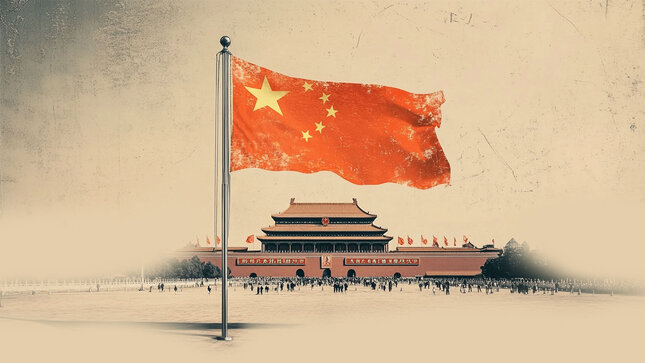

BNP Paribas analysts see Chinese GDP growth at 5.0% in 2025, easing moderately in 2026 as domestic demand weakens and property sector stress persists. Authorities are expected to maintain supportive but cautious fiscal and monetary policies, prioritizing private consumption.

💡 DMK Insight

China’s projected GDP growth of 5.0% in 2025 is a mixed bag for traders: On one hand, this growth forecast suggests a recovery, but the anticipated easing in 2026 due to weakening domestic demand and ongoing property sector issues raises red flags. Traders should keep an eye on how these economic indicators influence commodity prices, especially in sectors reliant on Chinese consumption, like metals and energy. If the property market continues to struggle, we could see a ripple effect impacting global supply chains and commodity markets. It’s also worth noting that the cautious fiscal and monetary policies may not provide the robust stimulus needed to spur significant growth. This could lead to volatility in related markets, particularly in currencies like the Australian dollar, which is sensitive to Chinese economic performance. Watch for any shifts in policy announcements or economic data releases that could signal changes in this trajectory, especially in the next quarterly reports.

📮 Takeaway

Monitor China’s economic indicators closely; a slowdown in domestic demand could impact commodities and related currencies, particularly the Australian dollar.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin