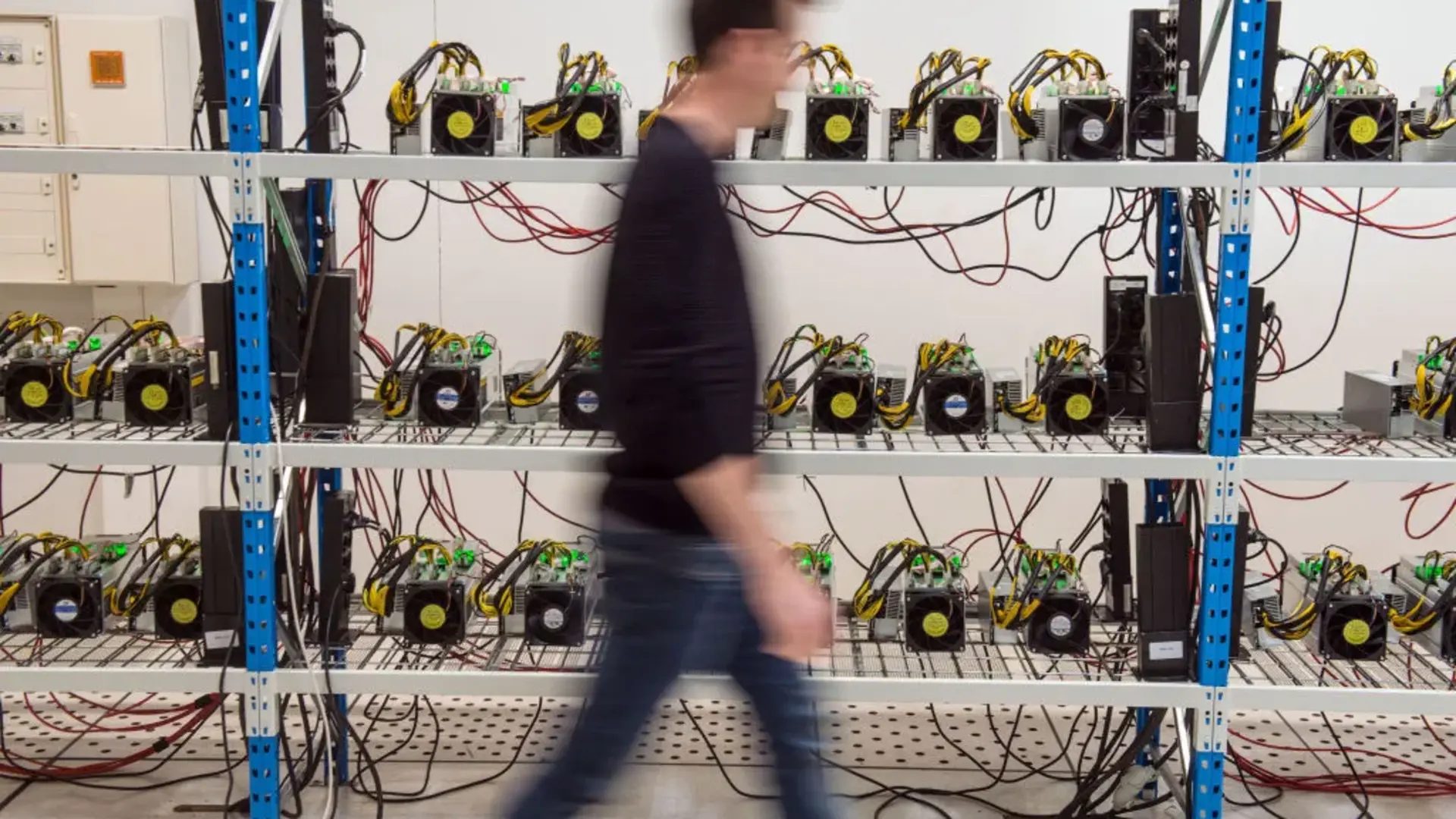

Bitfarms will wind down Bitcoin mining over the next two years. The announcement makes Bitfarms the newest member of a fast-growing group of miners pivoting …

💡 DMK Insight

Bitfarms winding down Bitcoin mining is a big deal for the sector right now. This move signals a broader trend among miners who are reevaluating their operations in the face of rising energy costs and fluctuating Bitcoin prices. As more miners step back, we could see a tightening of supply, which might eventually lead to upward pressure on prices if demand holds steady. Traders should keep an eye on how this affects hash rates and overall network security. If Bitfarms’ exit leads to a significant drop in hash rate, it could create a buying opportunity for those looking to accumulate Bitcoin at lower prices. But there’s a flip side: if more miners follow suit, it could signal a lack of confidence in the market, which might spook retail investors. Watch for Bitcoin’s price action around key support levels. If it holds above recent lows, it could indicate resilience despite miner exits. Conversely, a break below those levels might trigger further selling pressure. Keep an eye on the next quarterly earnings reports from other mining companies to gauge industry sentiment and potential ripple effects on Bitcoin’s price.

📮 Takeaway

Monitor Bitcoin’s support levels closely; a break below recent lows could signal further downside, while holding above may present a buying opportunity.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether