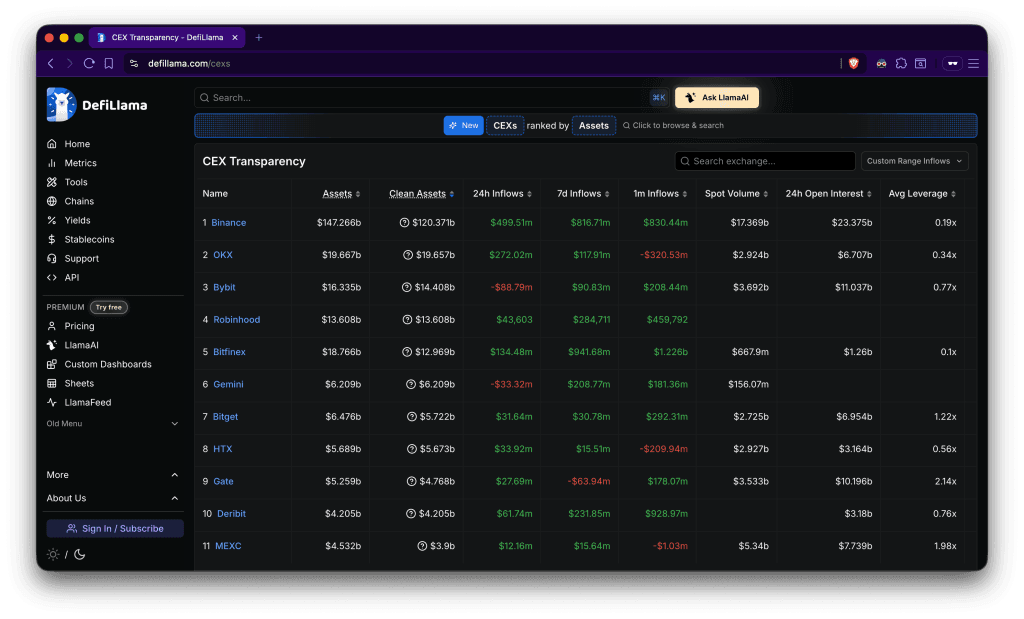

The cryptocurrency exchange landscape recently witnessed a significant milestone as Binance recorded nearly $700 million in net inflows within a single 24-hour period, according to DeFiLlama’s CEX Transparency data. This …

Read moreBinance Records $700M Net Inflow in 24 Hours: What This Means for Crypto Traders and Airdrop Farmers

Der Beitrag Binance Records $700M Net Inflow in 24 Hours: What This Means for Crypto Traders and Airdrop Farmers erschien zuerst auf airdrops.io.

💡 DMK Insight

Binance’s $700 million net inflow signals renewed confidence in crypto markets, and here’s why that matters: This surge in inflows could indicate a shift in trader sentiment, especially as we approach key resistance levels in Bitcoin and Ethereum. With institutional players possibly re-entering the market, day traders should watch for volatility spikes and potential breakout patterns. If Bitcoin can hold above its recent support level, we might see a rally that could push it toward higher targets. But don’t overlook the potential for profit-taking as traders react to these inflows. On the flip side, while this inflow is promising, it’s crucial to consider that such rapid inflows can lead to equally rapid outflows. Traders should keep an eye on Binance’s liquidity metrics and monitor for any signs of a reversal, especially if market sentiment shifts due to external factors like regulatory news or macroeconomic data. Watch for key levels around $30,000 for Bitcoin and $2,000 for Ethereum, as these could dictate the next moves in the market.

📮 Takeaway

Monitor Bitcoin’s ability to hold above $30,000 and Ethereum’s $2,000 level, as these will be crucial for potential upward momentum following Binance’s $700 million inflow.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin