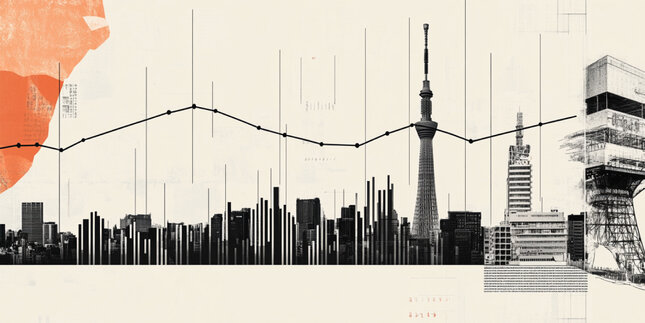

After both the Nikkei and KOSPI hit fresh highs early last week, the regional rally rolled over with four straight sessions of selling.

💡 DMK Insight

The recent pullback in the Nikkei and KOSPI after hitting fresh highs is a critical moment for traders. Four consecutive sessions of selling suggest a potential shift in market sentiment, which could indicate profit-taking or increased caution among investors. This downturn may be tied to broader economic concerns, such as inflation or geopolitical tensions, which often ripple through Asian markets. Traders should watch for key support levels on both indices; if the Nikkei breaks below its recent low, it could trigger further selling pressure. Conversely, a bounce back could signal a buying opportunity, especially if accompanied by strong volume. It’s also worth noting that this could affect correlated assets like the Japanese yen and South Korean won, as currency traders often react to shifts in equity market sentiment. Keep an eye on the upcoming economic data releases that could influence these markets, particularly any signs of economic slowdown or recovery in the region.

📮 Takeaway

Watch for key support levels in the Nikkei and KOSPI; a break below recent lows could signal further declines, while a bounce might present buying opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano