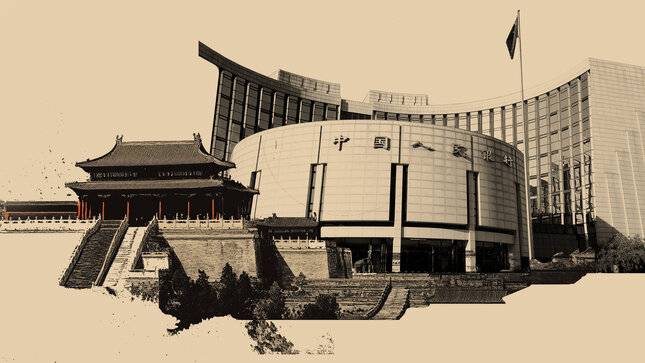

DBS Group Research economist Chua Han Teng expects the People’s Bank of China to keep the 1-year Loan Prime Rate at 3.00% on February 24, as January data are still unfolding.

💡 DMK Insight

The PBOC’s decision to maintain the 1-year Loan Prime Rate at 3.00% could signal stability in China’s economic outlook, but here’s why traders need to pay attention. Keeping rates steady suggests the central bank is cautious about economic recovery, especially with January data still coming in. This could impact the yuan’s strength against other currencies, particularly if traders perceive a lack of aggressive monetary easing. If the yuan weakens, it might lead to increased volatility in forex pairs involving the CNY, affecting commodities priced in dollars. Watch for reactions in the AUD/CNY and other related pairs, as they often reflect sentiment on Chinese economic health. Additionally, if the PBOC shifts its stance in the coming months, it could create ripple effects across global markets, especially in commodities and emerging market currencies. Traders should monitor the upcoming economic data releases closely, as any surprises could lead to rapid shifts in market sentiment. Keep an eye on the 3.00% level as a psychological barrier; a break below could indicate a shift in monetary policy expectations.

📮 Takeaway

Watch for January economic data; if it surprises, it could shift expectations around the PBOC’s rate policy and impact the yuan significantly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin