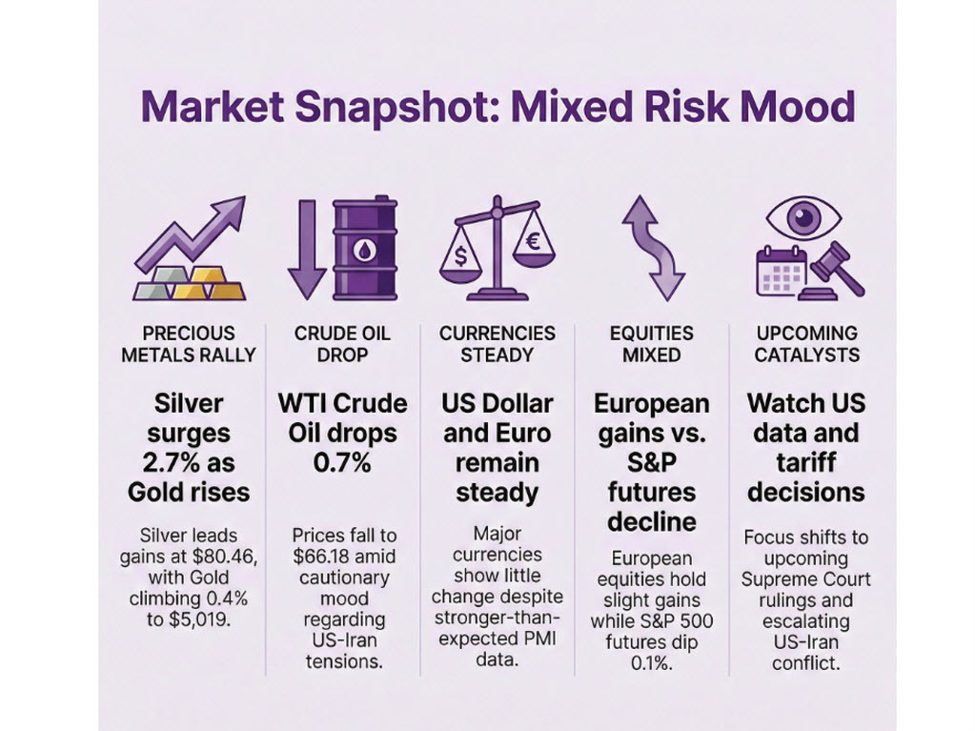

Headlines:USDJPY on track to revisit the intervention level as Japanese Yen lacks bullish catalystsSilver climbs back up to one-week highs but dip buyers still have work to doCrude Oil Breakout: What the Bull Flag Means for Oil Traders and UCO BuyersUS tariffs refund could top $175 billion if the Supreme Court rules against TrumpJapan prime minister Takaichi says will steadily restore fiscal sustainabilityGermany February flash manufacturing PMI 50.7 vs 49.5 expectedFrance February flash services PMI 49.6 vs 49.2 expectedEurozone February flash services PMI 51.8 vs 51.9 expectedUK February flash services PMI 53.9 vs 53.5 expectedUK January retail sales +1.8% vs +0.2% m/m expectedMarkets:US dollar steady across the boardGBP leads, NZD lags on the dayWTI crude oil down 0.7% to $66.18Gold up 0.4% to $5,019, silver up 2.7% to $80.46European equities hold slight gains, S&P 500 futures down 0.1%US 10-year yields down 0.8 bps to 4.067%Bitcoin up 0.8% to $67,417The market action in Europe today was a bit more mixed, with some key risk events still to watch before the weekend comes along.The major focus remains on US-Iran tensions, with traders and investors having to weigh up the risk of potential conflict ahead of the weekend break.That is keeping the overall risk mood on edge with a more mixed scene across broader markets. The dollar remains steady and is poised to wrap up a solid week of gains. EUR/USD is flattish around 1.1765 despite euro area PMI data beating on estimates. The most notable is German manufacturing perhaps turning the corner, posting its first growth in business activity in over three years.The UK also saw a similar PMI beat, allowing for GBP/USD to keep just marginally higher by 0.1% at 1.3475.Overall, the changes among major currencies are light with the dollar holding steadier mostly. USD/JPY is up 0.2% to 155.30 while AUD/USD is down 0.1% to 0.7050 on the day.In the equities space, it’s a mixed look with European indices posting slight gains on the session while US futures are down slightly. The DAX is seen up 0.2% with the CAC 40 up 0.8% on the day. Meanwhile, S&P 500 futures are down 0.1% currently amid some caution ahead of the Wall Street open.Looking to commodities, precious metals are staying underpinned in the second half of the week. Gold is up another 0.4% to $5,019 with silver up 2.7% to $80.46 on the day. However, there’s still much to be done in breaking free from the consolidative phase after the sharp retracement lower at the start of the month.As for the oil market, WTI crude is down slightly after touching its highest levels since August last year. We’re seeing price drop by 0.7% to $66.18 as traders are still weighing up US-Iran tensions ahead of the weekend.Coming up, we’ll have US PCE, GDP, and PMI data to work through alongside a potential Supreme Court decision on tariffs. Those will add to market anticipation of more US-Iran headlines in ending the week.

This article was written by Justin Low at investinglive.com.

💡 DMK Insight

The USDJPY is gearing up to test intervention levels again, and here’s why that matters: With the Japanese Yen struggling for bullish momentum, traders should keep a close eye on the Bank of Japan’s potential responses. If the USDJPY approaches key intervention levels, it could trigger significant volatility, especially for those holding long positions in the Yen. The broader context of rising U.S. interest rates continues to weigh on the Yen, making it less attractive for investors. Meanwhile, silver’s bounce back to one-week highs indicates some dip-buying interest, but the lack of strong bullish catalysts suggests that traders need to be cautious about overcommitting. In the crude oil market, the bull flag pattern is a positive sign for UCO buyers, but they should monitor for breakout confirmation to avoid false signals. Overall, the interplay between these markets could lead to cascading effects, particularly if the USDJPY intervention occurs, which might also impact commodities like oil and precious metals. Watch for USDJPY approaching intervention levels around 150, as this could trigger market reactions. Also, keep an eye on silver’s ability to maintain its gains and crude oil’s breakout confirmation in the coming days.

📮 Takeaway

Watch for USDJPY nearing intervention levels around 150, as this could spark volatility across related markets, especially commodities like oil and silver.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin