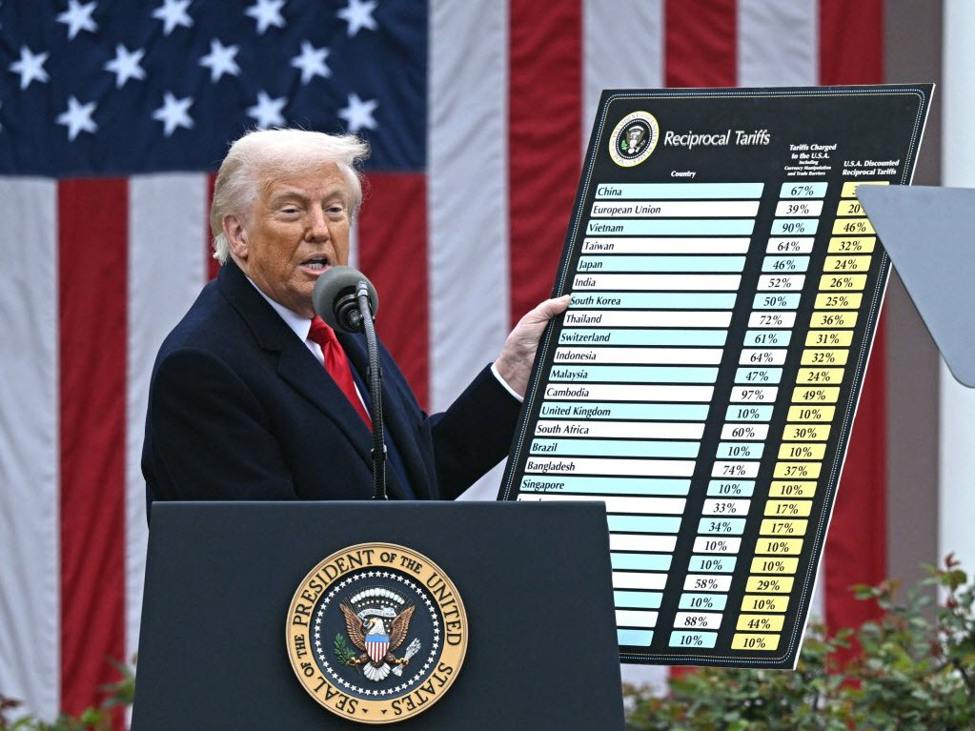

The NYT reports:President Trump is planning to invoke new trade authorities in response

to the Supreme Court’s ruling overturning his sweeping tariffs,

according to two people familiar with his plans, potentially including a

new, across-the-board tariff on U.S. trading partners.This is no surprise, many government officials have said this was coming.The report cities:Section 301 (requires an investigation)Section 122 (limited to 150 days and has never been used)Don’t be surprised if Trump pulls the trigger as soon as possible on Section 122, which would put on across the board 15% tariffs but has carve outs for exemptions for some countries.

This article was written by Adam Button at investinglive.com.

💡 DMK Insight

Trump’s potential tariffs could shake up markets, and here’s why you should care: If he moves forward with new trade authorities, it could lead to increased volatility in both forex and commodity markets. Traders should keep an eye on how this impacts the USD, as tariffs typically strengthen the dollar in the short term due to inflationary pressures. Additionally, commodities like steel and aluminum could see price spikes, affecting related sectors. Look for key technical levels in the USD index; a break above recent highs could signal a stronger dollar trend. On the flip side, if trading partners retaliate, we might see a swift reversal. This situation is fluid, and the market’s reaction could be immediate, so stay alert for news updates and adjust your positions accordingly. Watch for any announcements in the coming weeks that could clarify Trump’s intentions, especially around key economic indicators like inflation rates or employment data, which could further influence market sentiment.

📮 Takeaway

Keep an eye on the USD index and commodity prices as potential tariffs could trigger significant market volatility in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin