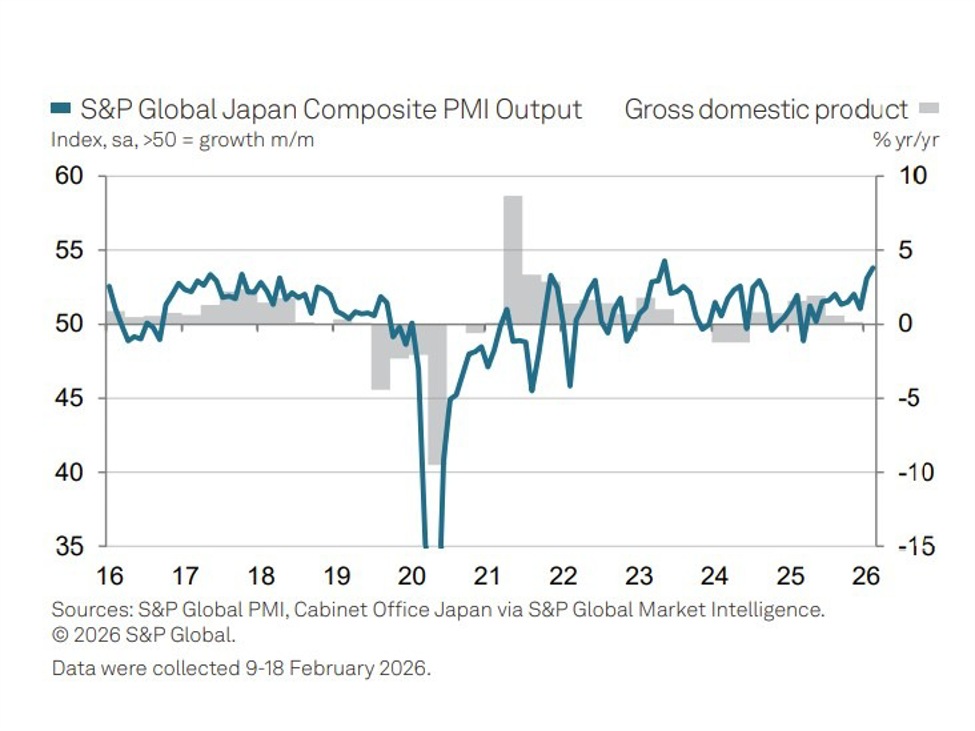

Japan’s February flash PMIs strengthened across the board, with composite output rising to 53.8 and manufacturing gaining momentum. Export demand surged, backlogs hit record highs and price pressures firmed, while business confidence improved.Summary:Composite PMI: 53.8 (Jan 53.1), fastest growth since May 2023.Services PMI: 53.8 (Jan 53.7), quickest pace since May 2024.Manufacturing PMI: 52.8 (Jan 51.5), strongest since January 2022.Composite new orders rose at the fastest rate since May 2023.Export orders surged at the quickest pace in eight years.Employment growth remained solid; factory hiring strongest in over four years.Backlogs rose at a record pace (series began September 2007).Input costs and selling prices both accelerated; output prices at 21-month high.Business confidence climbed to a 15-month high.Earlier from Japan: Japan inflation slows to 1.5% in January, core measures ease. What will the BoJ think?Japan’s private sector growth strengthened in February, with all three S&P Global flash PMI readings improving from January and signalling the fastest overall expansion in nearly three years.The S&P Global Flash Japan Composite PMI Output Index rose to 53.8 from 53.1 in January, marking the strongest pace of expansion since May 2023 and extending the current growth streak to 11 months.Momentum broadened across sectors. The Flash Japan Services PMI Business Activity Index edged up to 53.8 from 53.7, its fastest reading since May 2024. More notably, the Flash Japan Manufacturing PMI climbed sharply to 52.8 from 51.5, the strongest level since January 2022, pointing to a firmer and more balanced recovery.New business growth accelerated in line with output. Composite new orders rose at the fastest rate since May 2023, with services seeing the strongest increase in 22 months. Manufacturers reported their steepest rise in sales since early 2022, supported by stronger underlying demand and new product launches.External demand was a standout. Composite export orders expanded at the fastest pace in eight years, driven primarily by a rebound in goods exports.Employment continued to rise at a solid pace, although slightly softer than January’s multi-year record. Factory payrolls expanded at the quickest rate in just over four years, while services hiring moderated somewhat. Despite increased staffing, capacity pressures intensified: backlogs of work rose at the fastest pace since the composite series began in September 2007.Price pressures also ticked higher. Input costs increased at a slightly sharper rate overall, with stronger cost inflation in services offsetting softer pressures in manufacturing. Output charge inflation hit a 21-month high, with services firms showing greater pricing power than factories.Looking ahead, optimism improved. Business sentiment reached a 15-month high, with firms citing stronger domestic and overseas demand, semiconductor and AI-related investment, product innovation and supportive political conditions following Prime Minister Sanae Takaichi’s recent landslide election victory.The data reinforce a narrative of broadening growth momentum in Japan’s economy, even as inflation dynamics and Bank of Japan policy remain closely watched.

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

Japan’s February flash PMIs are signaling robust economic activity, and here’s why that matters: The composite PMI rising to 53.8 indicates a strengthening economy, which could lead to increased demand for Japanese exports. This uptick in manufacturing and services suggests that businesses are not only recovering but also expanding, which is crucial for traders focused on Japanese equities and the yen. With export demand surging and backlogs at record highs, we might see upward pressure on the Nikkei 225 and the USD/JPY pair. Traders should keep an eye on the 53.8 level in PMIs as a benchmark for future growth expectations. But let’s not overlook potential risks. While the data looks promising, price pressures firming could lead to inflation concerns, which might prompt the Bank of Japan to reconsider its ultra-loose monetary policy sooner than expected. This could create volatility in the forex market, especially for the yen. Watch for any comments from BOJ officials in the coming weeks that might hint at policy shifts. Overall, the immediate focus should be on how these PMIs influence market sentiment and trading strategies around Japanese assets.

📮 Takeaway

Monitor the 53.8 PMI level closely; a sustained rise could boost Japanese equities and the yen, but watch for inflation signals that might shift BOJ policy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin