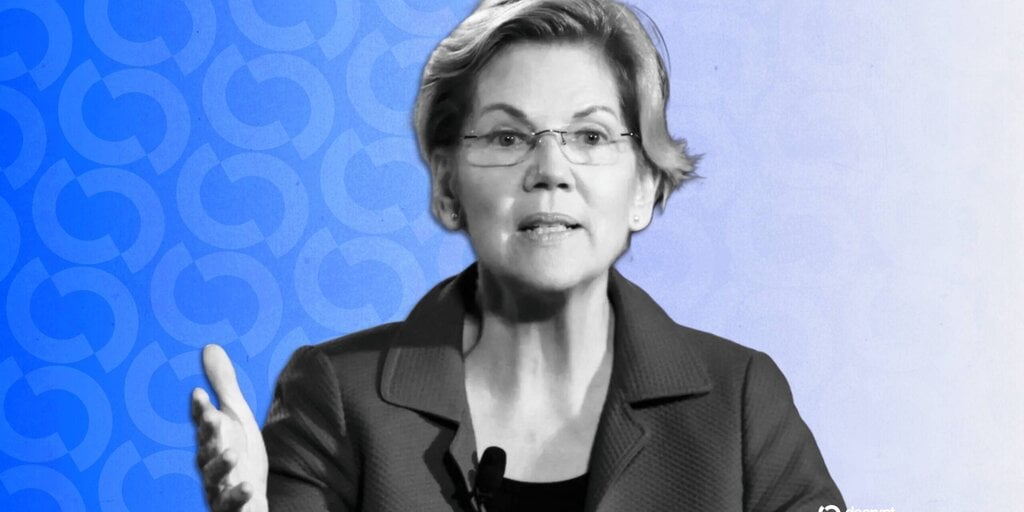

The longtime crypto critic warned against using taxpayer dollars to rescue investors and firms amid the current market slide.

💡 DMK Insight

Look, the warning against using taxpayer dollars to bail out crypto investors is a big deal right now. It highlights a growing sentiment that the crypto market needs to face its own consequences rather than relying on government intervention. This could lead to increased volatility as traders react to the uncertainty surrounding regulatory responses and potential bailouts. If the government does step in, it might create a false sense of security, encouraging reckless trading behavior. On the flip side, if no support comes, we could see a deeper market correction, especially in altcoins that are already feeling the pressure. Traders should keep an eye on key support levels across major cryptocurrencies, as breaking these could trigger further sell-offs. Watch for reactions from institutional players, as their strategies could shift dramatically based on how this situation unfolds. In the coming days, monitor the sentiment around regulatory discussions and any announcements regarding fiscal policies. These could be pivotal in shaping market direction and volatility.

📮 Takeaway

Traders should watch for key support levels in major cryptocurrencies and monitor regulatory discussions, as these could significantly impact market volatility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin