Posting this ICYMI from a Wednesday note from Morgan Stanley. Morgan Stanley says Nvidia is the most under-owned megacap as institutions lag tech benchmarks.Summary:Morgan Stanley says mega-cap tech is the most under-owned in 17 yearsNvidia is the most under-owned large-cap tech stockInstitutional ownership lags S&P 500 weightings across major megacapsInvestors show bias toward AI “picks and shovels” hardware namesSNDK stands out as the most over-owned large-cap tech stockMorgan Stanley’s latest analysis of fourth-quarter 13F filings highlights a striking positioning gap in US equities: mega-cap technology stocks are the most under-owned relative to the S&P 500 in 17 years.According to the bank, the ownership gap versus the benchmark widened to negative 155 basis points by the end of the quarter, underscoring how active institutional managers remain structurally underweight some of the largest names in the index despite their dominant market capitalisations.Among individual stocks, Nvidia stands out as the most under-owned large-cap technology name. Analyst Erik Woodring calculates a negative 2.57 percentage point gap between Nvidia’s S&P 500 weighting and active institutional ownership. Apple and Microsoft follow closely behind with gaps of negative 2.16% and negative 2.13%, respectively, while Amazon shows a negative 1.37% gap.The data suggest that even after a prolonged AI-driven rally, active managers have not fully caught up to benchmark allocations in these mega-cap leaders. Woodring notes that the modest widening in under-ownership from the prior quarter implies investors continue to lag index weightings rather than aggressively rotate back into the largest constituents.However, the positioning story is not uniform across the technology sector. Morgan Stanley sees a clear institutional bias toward AI “picks and shovels” names entering 2026. Semiconductor and hardware stocks such as SNDK, KLAC, WDC, LRCX and STX show elevated ownership levels, reflecting investor preference for infrastructure beneficiaries of AI spending. By contrast, institutional positioning in software names including IBM, ORCL, PANW, NOW and ADBE remains notably light.One standout is SNDK, whose institutional ownership has steadily increased since its re-listing in the first quarter of 2025. After joining the S&P 500 last quarter, it now shows the largest positive ownership gap among large-cap tech stocks at +1.58%.Overall, the note suggests active managers remain selective within technology, favouring hardware leverage to AI over broad megacap exposure — even as index concentration continues to climb. —Persistent under-ownership in megacaps could fuel catch-up buying if performance continues. Conversely, crowded positioning in AI hardware names raises the risk of sharper pullbacks if sentiment shifts.

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

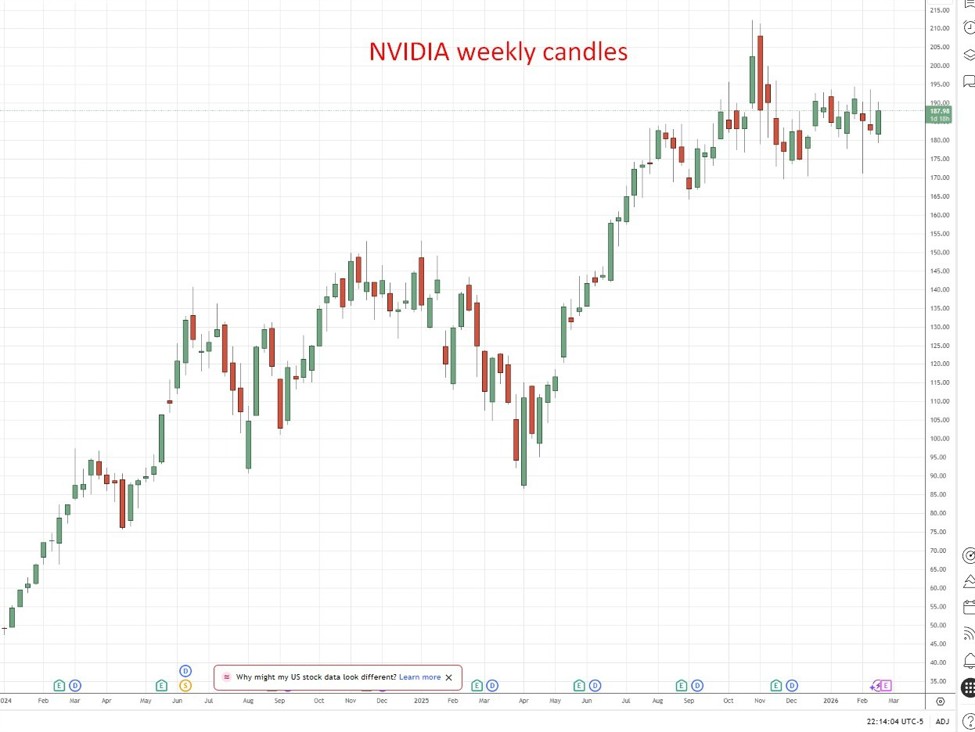

Nvidia’s under-ownership signals a potential buying opportunity for savvy traders right now. Morgan Stanley’s note highlights a significant disconnect between institutional ownership and the S&P 500 weightings, particularly for Nvidia. This could mean that as institutions catch up, we might see upward price pressure on Nvidia shares. With tech stocks generally gaining traction, especially in a market that’s been volatile, Nvidia stands out as a prime candidate for a rebound. If institutions start reallocating funds to align with tech benchmarks, we could see a surge in buying activity. Keep an eye on Nvidia’s price action; if it breaks above recent resistance levels, it could trigger a wave of institutional buying. However, it’s worth considering that the broader market sentiment can shift quickly. If macroeconomic indicators, like inflation or interest rates, take a turn for the worse, even strong fundamentals might not shield Nvidia from a pullback. Watch for key earnings reports and market reactions over the next few weeks, as these could provide critical insights into institutional behavior and overall market direction.

📮 Takeaway

Monitor Nvidia closely; a breakout above recent resistance could signal institutional buying, making it a key stock to watch in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin