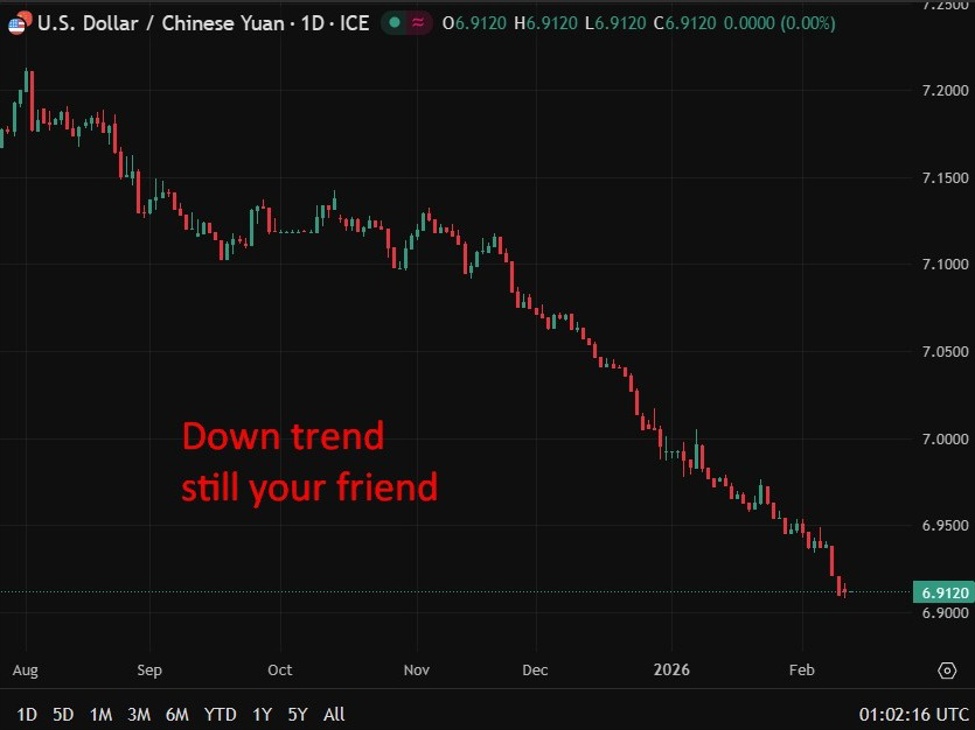

The PBOC allows the yuan to fluctuate within a +/- 2% range, around this reference rate.Previous close 6.9106PBOC inject 166.5bn yuan via 7-day RRs @1.4%

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

The PBOC’s recent move to inject 166.5 billion yuan into the market signals a proactive stance to stabilize the yuan, which closed at 6.9106. This liquidity boost comes as the yuan is allowed to fluctuate within a +/- 2% range, a strategy that aims to manage volatility amid ongoing economic pressures. Traders should pay attention to how this injection impacts the yuan’s performance against major currencies, especially the USD, as it could influence forex trading strategies. If the yuan strengthens, we might see a corresponding impact on commodities priced in yuan, like gold and oil. However, there’s a flip side: if the yuan continues to weaken despite these measures, it could raise concerns about the overall health of China’s economy, leading to increased volatility in related markets. Watch for any significant moves outside the established range, as that could trigger broader market reactions.

📮 Takeaway

Keep an eye on the yuan’s performance against the USD; a move beyond the +/- 2% range could signal increased volatility and trading opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin