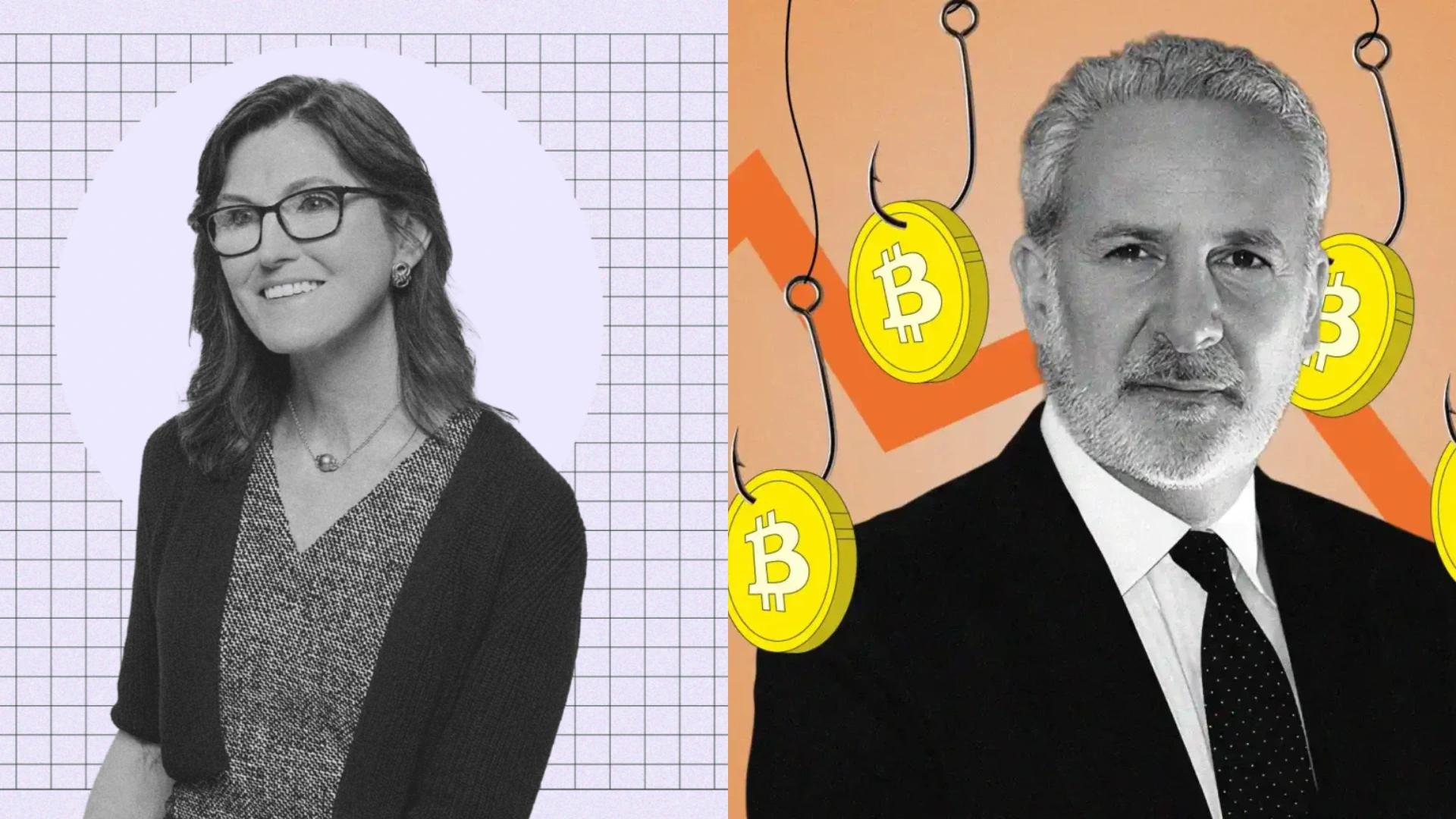

Cathie Wood said she would favor Bitcoin over gold. Peter Schiff has fired back at Wood on X. Wood reaffirmed ARK Invest’s long-term Bitcoin thesis. …

💡 DMK Insight

Cathie Wood’s preference for Bitcoin over gold is stirring the pot, and here’s why that matters right now: In a market where inflation fears and economic uncertainty are prevalent, Wood’s bullish stance on Bitcoin as a hedge against traditional assets like gold could sway institutional sentiment. This isn’t just a personal opinion; it reflects a broader trend where more investors are looking at Bitcoin as a digital store of value. If ARK Invest doubles down on its Bitcoin thesis, we might see increased buying pressure, particularly from retail and institutional investors who follow her lead. On the flip side, Peter Schiff’s rebuttal highlights the ongoing debate about Bitcoin’s viability compared to gold, which could create volatility in both assets. Traders should keep an eye on Bitcoin’s price action around key support and resistance levels, especially if it approaches recent highs or lows. Watch for Bitcoin’s performance in the coming weeks, particularly if it can maintain momentum above its recent support levels, as this could trigger further buying from both retail and institutional players.

📮 Takeaway

Monitor Bitcoin’s price action closely; a sustained move above recent resistance could attract significant buying interest from institutions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether