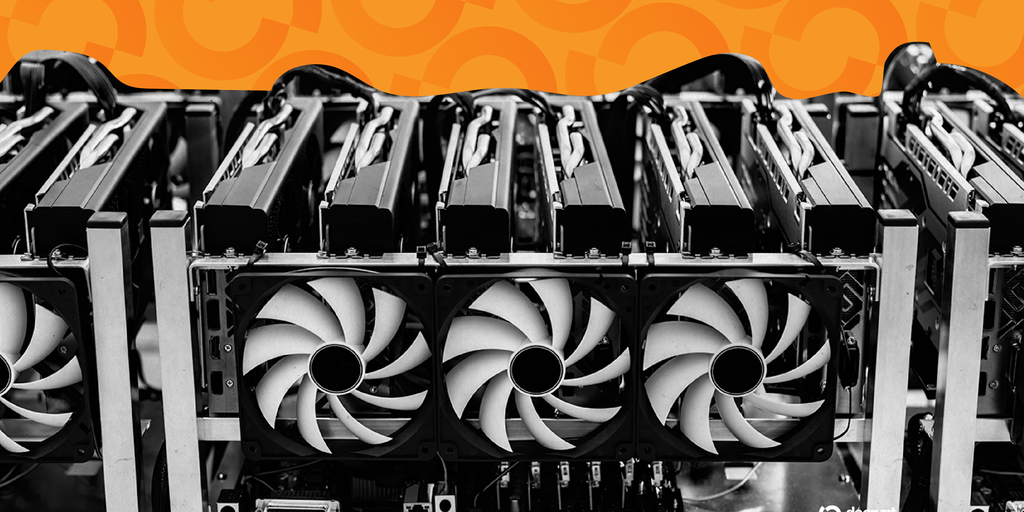

Publicly traded Bitcoin miner Bitfarms is planning a move to the United States and a name change as it transitions from crypto to AI compute.

💡 DMK Insight

Bitfarms is pivoting from crypto mining to AI compute, and here’s why that matters: This shift reflects a broader trend where crypto firms are reassessing their business models in light of regulatory pressures and market volatility. By moving to the U.S. and focusing on AI, Bitfarms is not just diversifying its revenue streams but also positioning itself in a rapidly growing sector. This could attract institutional investors who are increasingly interested in AI technologies, potentially boosting the stock’s appeal. However, this transition isn’t without risks; the mining sector is still reeling from low Bitcoin prices and high operational costs, which could impact their existing operations during the transition. Traders should keep an eye on how this move affects Bitfarms’ stock performance in the short term, particularly if they can successfully execute this transition without significant disruptions. Watch for any announcements regarding partnerships or contracts in the AI space, as these could serve as catalysts for price movement. Additionally, monitor Bitcoin’s price action; if it remains weak, it could further complicate Bitfarms’ transition and impact investor sentiment negatively.

📮 Takeaway

Watch for Bitfarms’ announcements on AI partnerships and monitor Bitcoin’s price; a successful pivot could attract new investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether