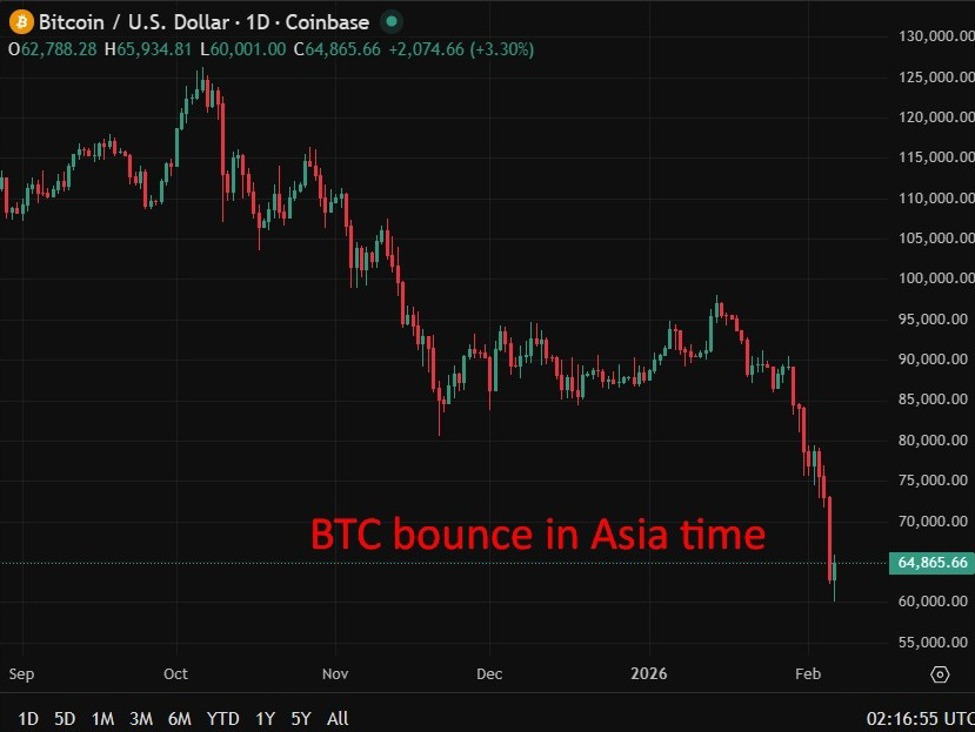

BTC up around 4% while ETH up just a little more that that. Crypto has seen epic selling. BTC was circa 125K in October 2025.

This article was written by Eamonn Sheridan at investinglive.com.

💡 DMK Insight

Bitcoin’s recent 4% surge is a breath of fresh air amid heavy selling pressure, but don’t get too comfortable. With BTC currently at $65,826, traders need to consider the broader context of its previous highs around $125K in October 2025. This recent uptick could signal a short-term recovery, but it’s crucial to watch for resistance levels that could cap further gains. If BTC can hold above $65,000, it might attract more buying interest, but any slip below could trigger additional selling. Ethereum’s modest rise to $1,922.22 suggests that while BTC is leading the charge, ETH isn’t far behind. Keep an eye on the BTC/ETH ratio; a strengthening BTC could weigh on ETH’s performance if it doesn’t catch up. Here’s the thing: while the current momentum is positive, the market’s volatility remains high. Traders should monitor for any significant pullbacks or news that could sway sentiment. Watch for key levels around $66,500 for resistance and $64,000 for support. If BTC breaks either of these, it could set the tone for the next trading session.

📮 Takeaway

Watch BTC closely around $66,500 resistance and $64,000 support; a break could dictate the next move in crypto markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether