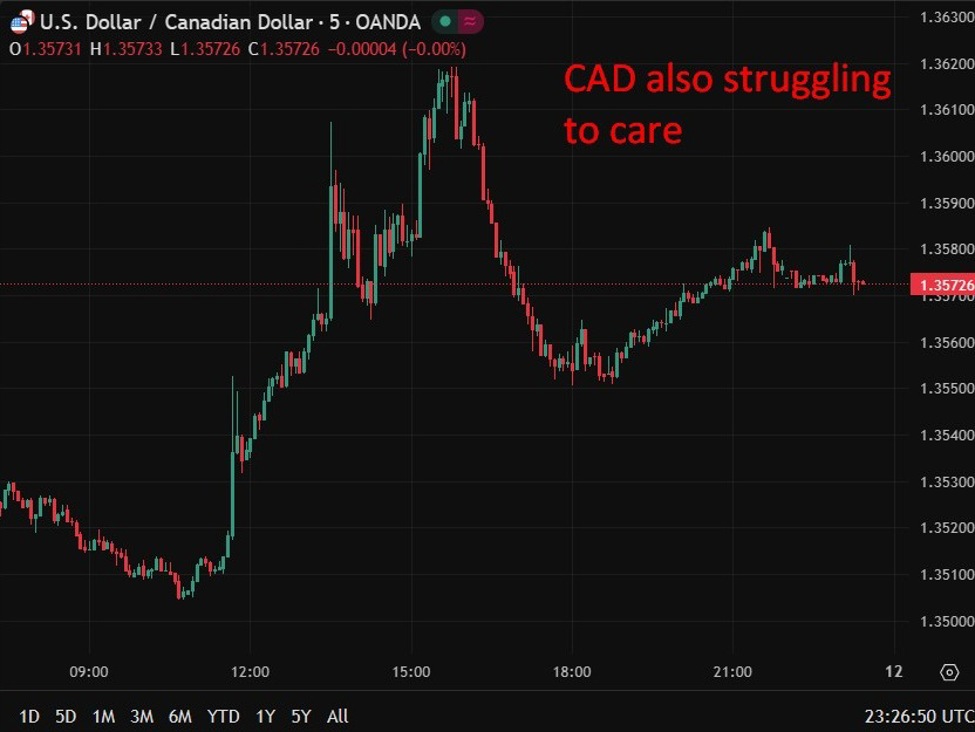

The European Central Bank (ECB) is holding its two-day meeting and will announce its monetary policy decision on Thursday.

💡 DMK Insight

The ECB’s upcoming monetary policy decision is crucial for traders, especially with inflation concerns lingering in the Eurozone. Market participants are closely watching for signals on interest rate adjustments, which could impact the euro’s strength against the dollar and other currencies. If the ECB hints at a more hawkish stance, we might see the euro gain traction, potentially breaking resistance levels. Conversely, a dovish tone could lead to a sell-off in the euro, affecting correlated assets like European equities. Traders should monitor the ECB’s language for clues on future rate hikes or cuts, as this will shape market sentiment in the coming weeks. Keep an eye on the euro’s performance around key technical levels, particularly if it approaches recent highs or lows post-announcement.

📮 Takeaway

Watch for the ECB’s interest rate decision on Thursday; a hawkish tone could strengthen the euro significantly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc