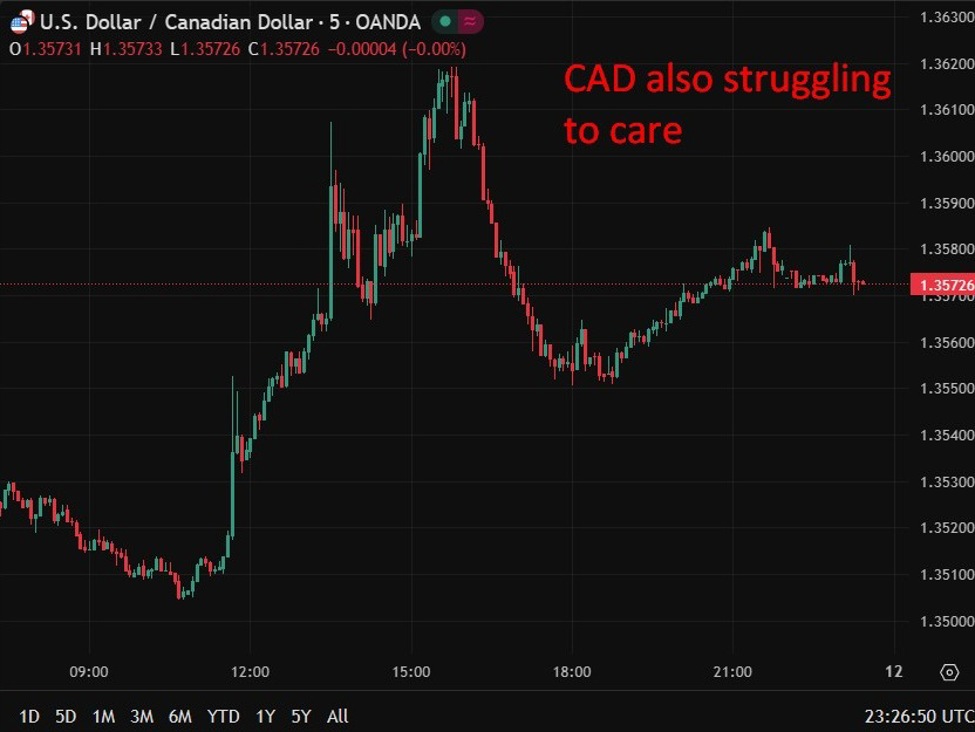

The Bank of England (BoE) will deliver its first monetary policy decision of 2026 on Thursday.

💡 DMK Insight

The upcoming Bank of England’s monetary policy decision is crucial for traders, especially with inflationary pressures still looming. Market participants are keenly watching how the BoE balances interest rates against economic growth, particularly as the UK grapples with persistent inflation. A shift in rates could signal a change in the broader economic landscape, impacting not just the GBP but also correlated assets like UK equities and bonds. If the BoE opts for a rate hike, it could strengthen the pound against major currencies, while a hold or cut might lead to a depreciation. Traders should keep an eye on the 1.30 level for GBP/USD as a potential pivot point, with volatility expected around the announcement. Here’s the thing: while many expect a cautious approach, any unexpected moves could create trading opportunities. Watch for the accompanying statement for clues on future policy direction, as this could set the tone for the next few months.

📮 Takeaway

Monitor the 1.30 level for GBP/USD around the BoE’s decision on Thursday; unexpected moves could create trading opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc