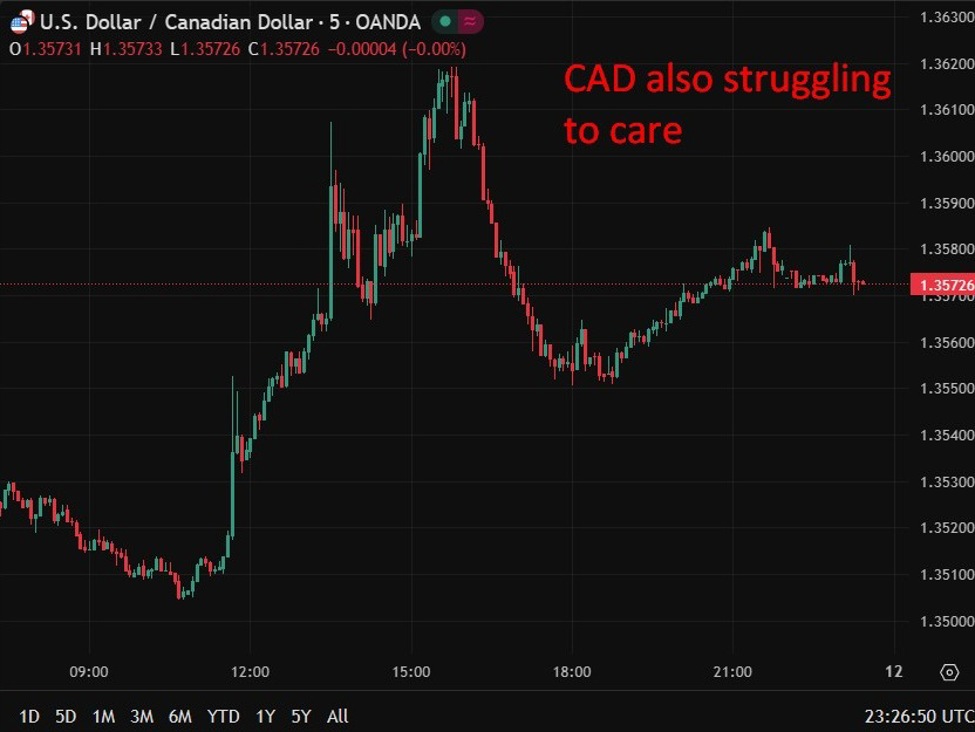

The British Pound and gilts have declined sharply due to political uncertainty surrounding Prime Minister Keir Starmer’s leadership.

💡 DMK Insight

Political uncertainty in the UK is shaking the British Pound and gilts, and here’s why that matters: With Prime Minister Keir Starmer’s leadership under scrutiny, traders should brace for volatility. The Pound’s decline signals a lack of confidence, which could lead to further sell-offs if the situation escalates. Watch for key support levels around recent lows; a break could trigger a cascade effect across forex markets. Gilt yields are likely to rise as investors demand higher returns for perceived risk, impacting bond markets and potentially leading to a broader risk-off sentiment. If you’re trading GBP pairs, keep an eye on economic indicators and sentiment shifts that could influence the Pound’s trajectory. On the flip side, this uncertainty might create buying opportunities for contrarian traders looking to capitalize on oversold conditions. If Starmer manages to stabilize his leadership, a rebound could be swift. Monitor the political landscape closely, as any signs of resolution could trigger a sharp reversal. Watch for key economic data releases that could provide insight into market sentiment and direction.

📮 Takeaway

Keep an eye on GBP support levels; a break could lead to increased volatility, while any stabilization in leadership might present buying opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc