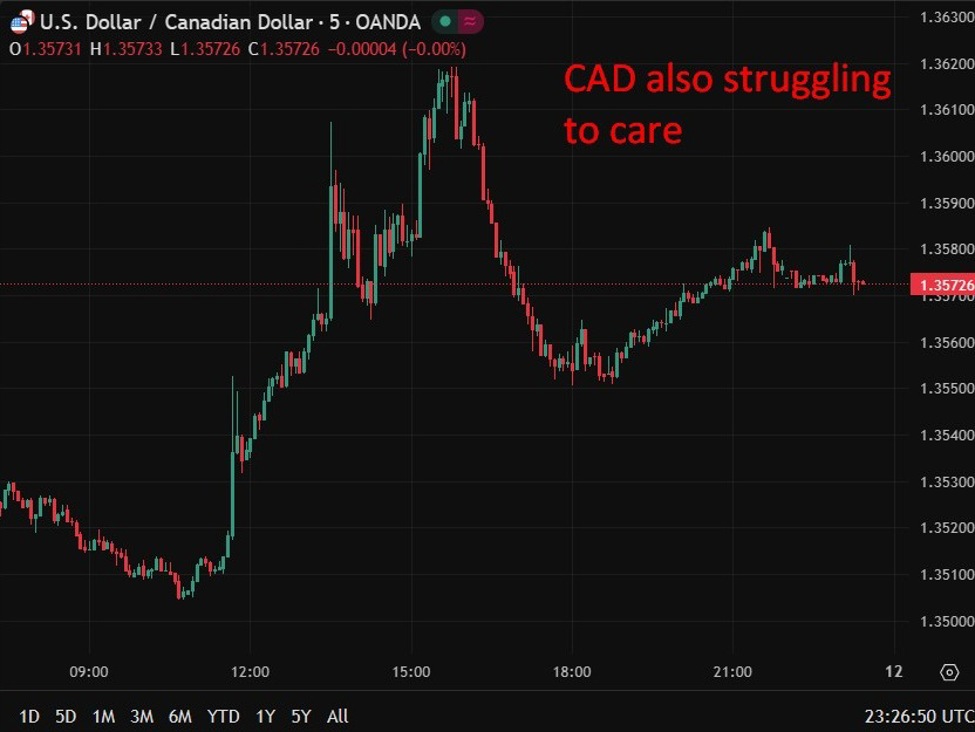

The Euro (EUR) depreciates for the second consecutive day against the US Dollar (USD) on Thursday, trading around 1.1790 at the time of writing, only a few pips above two-week lows, at 1.1777.

💡 DMK Insight

The Euro’s dip to around 1.1790 signals potential weakness against the Dollar, and here’s why that matters: With the EUR/USD pair hovering just above two-week lows, traders should be on alert for a possible breach of the 1.1777 support level. If this happens, it could trigger a wave of selling, pushing the Euro further down and potentially opening the door to a test of the 1.1700 mark. This depreciation comes amid ongoing concerns about the Eurozone’s economic recovery and contrasting strength in the U.S. economy, which is bolstered by recent positive data. Look for any shifts in sentiment or economic indicators that could influence this pair, especially as we approach key U.S. economic releases next week. On the flip side, if the Euro manages to hold above 1.1777, it could set the stage for a rebound, especially if European economic data surprises to the upside. Keep an eye on the RSI for signs of oversold conditions, which might indicate a potential reversal. Watch for volatility around these levels as market participants react to any new developments.

📮 Takeaway

Monitor the 1.1777 support level closely; a break could lead to further declines in the Euro against the Dollar.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc