Publicly traded Swiss bank UBS is working on plans to offer digital assets trading and tokenized service offerings for users, its CEO said.

💡 DMK Insight

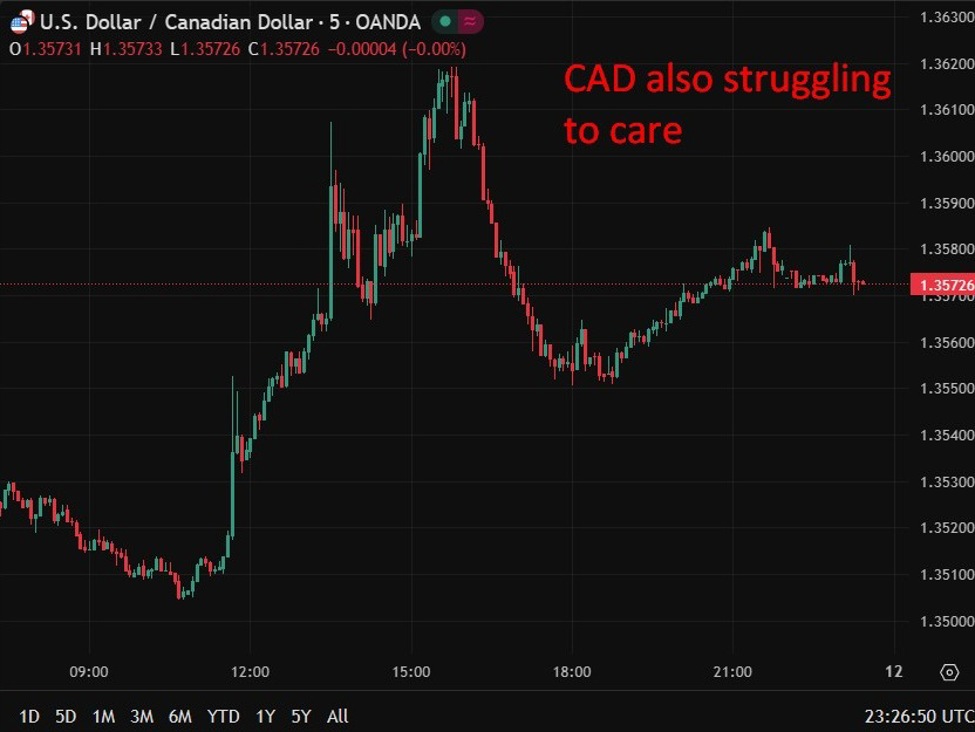

UBS’s move into digital assets could shake up the crypto trading landscape significantly. As a major player in traditional finance, UBS’s entry signals a growing acceptance of digital assets among institutional investors. This could lead to increased liquidity and potentially drive prices higher across the board. Traders should keep an eye on how this impacts Bitcoin and Ethereum, as these assets often react strongly to institutional interest. Additionally, watch for any regulatory developments that might accompany UBS’s offerings, as they could influence market sentiment. If UBS successfully integrates these services, it could set a precedent for other banks, further legitimizing crypto trading. However, there’s a flip side: increased competition could lead to tighter spreads and lower margins for existing crypto exchanges. Traders should monitor the market’s response over the next few weeks, particularly around any announcements or launches from UBS. Key levels to watch will be the support and resistance for major cryptocurrencies, as shifts in institutional sentiment could lead to volatility.

📮 Takeaway

Watch for UBS’s digital asset offerings to potentially drive liquidity and price movements in Bitcoin and Ethereum over the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc