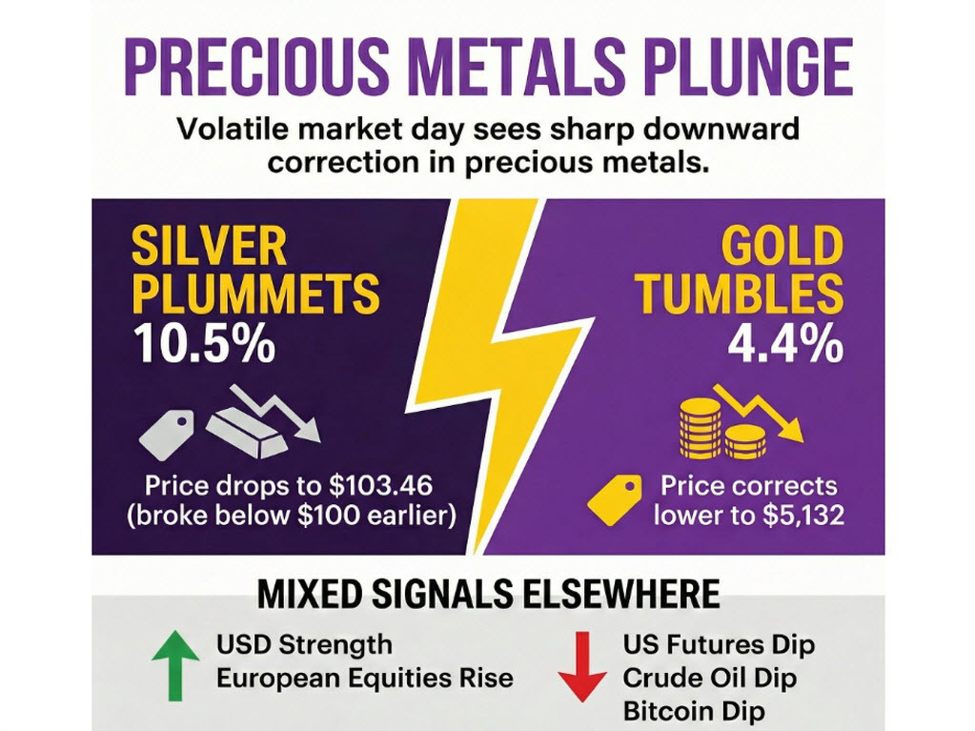

Headlines:Silver sinks below $100, gold tumbles below $5,000Precious metals continue to tumble as the heavy selling continuesSilver dropped by more than 20% in just two days amid massive profit-taking. What’s next?Have we reached a short-term top in gold after the sharp swing lower?US futures push lower as the risk mood holds more mixed todayTrump nominates Kevin Warsh to be the next chairman of the Federal ReserveHow have interest rate expectations changed after this week’s events?Bavaria January CPI +2.1% vs +1.7% y/y priorSpain January preliminary CPI +2.4% vs +2.3% y/y expectedGermany Q4 preliminary GDP +0.3% vs +0.2% q/q expectedFrance Q4 preliminary GDP +0.2% vs +0.2% q/q expectedSpain Q4 preliminary GDP +0.8% vs +0.6% q/q expectedItaly Q4 preliminary GDP +0.3% vs +0.2% q/q expectedEurozone consumer inflation expectations rise to the highest level since the survey beganMarkets:Precious metals in the spotlight as gold and silver tumble hard, correcting lowerGold down 4.4% to $5,132 with the low breaking under $5,000 earlierSilver down 10.5% to $103.46 with the low breaking below $100 earlierUSD leads, JPY lags on the dayDollar steadier amid selling in precious metals and traders digesting Kevin Warsh being Trump’s Fed chair pickEuropean equities higher across the board; S&P 500 futures down 0.3% but well off earlier lows of a decline of 0.9%WTI crude oil down 0.5% to $65.10Bitcoin down 2.0% to $82,724What a wild end to the week it’s all setting up to be. The showstoppers today are once again the same as it has been all through this month, that being precious metals. Gold and silver both tumbled hard today amid a further run of profit-taking after the warning from yesterday already.Gold dropped by over 7% at one point, poised for its worst day since April 2013 with the fall breaking under $5,000. That before a slight recovery now to be down 4.4% to $5,132 with volatile swings still persisting. Meanwhile, silver crashed hard by over 16% at the lows in a break below $100 before some light recovery again to around $103 levels now – still down over 10% on the day.The moves are coming at neck-breaking speeds, with extreme volatility kicking into gear for precious metals as January comes to an end.That’s having some reverberations elsewhere too with the dollar holding firmer across the board. However, the greenback is seeing gains trimmed during the session and also right as Trump announced Kevin Warsh as his pick for the next Fed chair.EUR/USD dipped down to around 1.1900 earlier before recovering to 1.1940 now, down 0.2% on the day. USD/JPY is seen up 0.5% to 153.85 but off earlier highs above 154.00 with yen-tervention risks still in play.Meanwhile, USD/CAD is seen up 0.1% to 1.3505 and AUD/USD down 0.3% to 0.7020 with the dollar seeing gains ease a little from earlier.In the equities space, things were also quite nervy amid all the chaos that is going on. European indices held calmer in rebounding from yesterday’s losses. But US futures were struggling earlier amid the unsettling mood in precious metals, with S&P 500 futures dropping by as low as 0.9% at one point. That before a slight recovery now to be down just 0.3% on the day.In terms of data releases, there were quite a handful in Europe but all overshadowed by other market happenings. Euro area Q4 GDP reaffirmed more resilience in the economy towards the end of last year while early indications from Germany and Spain suggest that inflation pressures are still keeping more stubborn to start the new year.It’s now back to gold and silver watch again in US trading later before the weekend.

This article was written by Justin Low at investinglive.com.

💡 DMK Insight

Silver’s plunge below $100 and gold’s drop below $5,000 signal a critical shift in precious metals. The recent 20% drop in silver over just two days is a stark reminder of how quickly sentiment can shift, especially amid profit-taking. Traders should be wary of the potential for further declines if selling pressure persists. This sharp sell-off could indicate that we’ve hit a short-term top for gold, especially if it fails to reclaim the $5,000 level. Watch for key support levels; if silver breaks below $80, it could trigger more selling as traders reassess their positions. On the flip side, this could present a buying opportunity for contrarian traders if they believe the long-term fundamentals for precious metals remain intact. Keep an eye on US futures as they could influence market sentiment further, especially if risk appetite continues to wane. The immediate focus should be on how these metals react in the coming days, particularly around the $5,000 mark for gold and $80 for silver.

📮 Takeaway

Watch for silver’s support at $80 and gold’s resistance at $5,000; a break below these levels could trigger further selling pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether