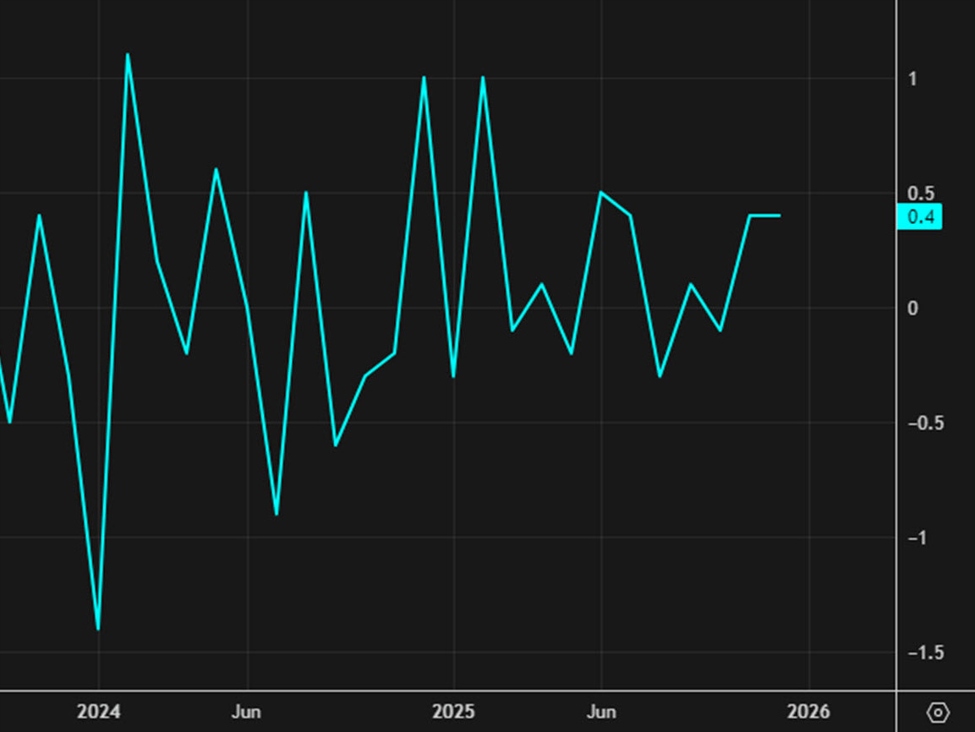

The good news continues to roll in for the US economy as December industrial production rose 0.4%, beating the 0.1% consensus. The November reading was also boosted to +0.4% from +0.2%.With that, capacity utilization rose to 76.3% from 76.0%. Manufacturing production rose by 0.2% compared to -0.2% expected. The November manufacturing number was also boosted to +0.3% from +0.2%.Those are signs that the US industrial strategy is beginning to bear fruit but when you scale out, it’s still a long way to go. Production rose at an annualized rate of just 0.7% in Q4 while capacity utilization is 3.2 percentage points below its long-term average.Breaking down the numbers, industrial production’s 0.4% December rise was primarily driven by a sharp 2.6% increase in utilities, largely influenced by a 12.0% surge in natural gas, something that’s unlikely to last. Manufacturing output also rose 0.2%, supported by a 0.3%increase in nondurables—specifically food, beverage, and petroleum products. Durable manufacturing edged up 0.1 percent, with significant gains in primary metals (2.4 percent) and aerospace equipment (1.5 percent) offsetting declines in motor vehicles and wood products.Among market groups, consumer goods climbed 0.7 percent, driven by nondurables, while business equipment rose 0.8 percent due to strength in transit and industrial equipment. These gains outweighed a 0.7 percent drop in mining output, allowing the total index to finish the year 2.0 percent above 2024 levels.If you zoom out even further, US production is flat over the past 20 years, despite a huge boom in oil production.

This article was written by Adam Button at investinglive.com.

💡 DMK Insight

US industrial production is showing unexpected strength, and here’s why that matters: The December rise of 0.4% in industrial production, surpassing the 0.1% consensus, signals a robust economic backdrop that could influence Fed policy. Capacity utilization climbing to 76.3% indicates that factories are operating closer to their limits, which often leads to increased investment and hiring. For traders, this could mean a bullish sentiment in sectors tied to manufacturing and industrials. If this trend continues, we might see upward pressure on commodities and related equities, particularly in sectors like materials and energy. But don’t overlook the flip side: if the Fed interprets this data as a sign to tighten monetary policy sooner, we could see volatility in equities and a stronger dollar. Keep an eye on the S&P 500 and industrial ETFs for potential breakouts or pullbacks. Watch for key resistance levels around recent highs, and monitor economic indicators closely for any shifts in sentiment. The next few weeks will be crucial as traders digest this data and its implications for future Fed actions.

📮 Takeaway

Watch for how the Fed reacts to this strong industrial data; key resistance levels in the S&P 500 could be tested if bullish sentiment continues.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether