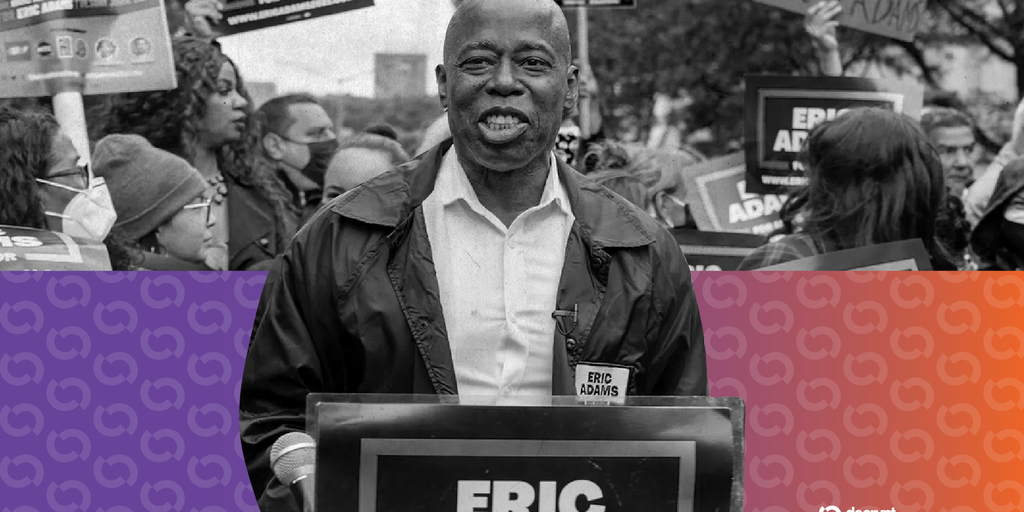

On-chain data shows unexplained liquidity withdrawals as Eric Adam’s NYC token’s market cap continues to bleed.

💡 DMK Insight

Liquidity withdrawals from ADA are raising eyebrows, and here’s why that matters: With ADA currently at $0.39, the unexplained outflows could signal underlying weakness in market sentiment. This isn’t just a blip; it reflects broader concerns about the token’s market cap erosion, which could be indicative of larger trends in the crypto space. If traders are pulling liquidity, it often leads to increased volatility, especially if it coincides with negative news or market shifts. Keep an eye on the $0.35 support level; a breach could trigger further selling pressure. On the flip side, this situation might present a buying opportunity for contrarian traders if they believe the fundamentals of ADA remain strong. However, the risk is palpable—if liquidity continues to drain, it could lead to a cascade effect, impacting related assets like ETH and BTC as traders seek safer havens. Watch for any news that could either stabilize or further destabilize ADA’s market position in the coming days.

📮 Takeaway

Monitor ADA closely around the $0.35 support level; further liquidity withdrawals could lead to increased volatility and selling pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether