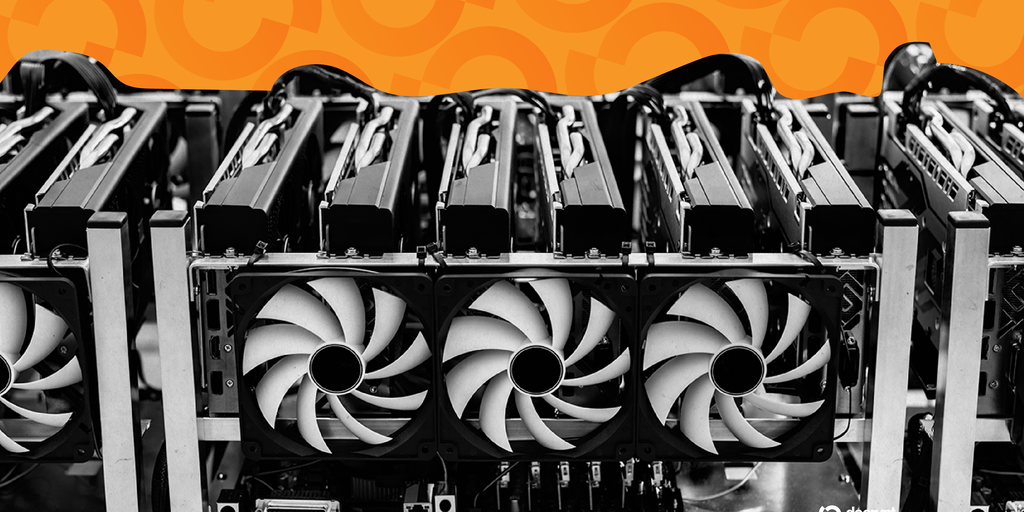

Canaan’s stock jumped Tuesday after the Bitcoin mining firm reported a revenue spike, though Bitcoin fell to a seven-month low overnight.

💡 DMK Insight

Canaan’s stock surge amidst Bitcoin’s decline highlights a disconnect in market sentiment. While Canaan reported a revenue spike, Bitcoin’s drop to a seven-month low signals underlying weakness in the crypto market. This divergence could indicate that investors are betting on the resilience of mining firms despite bearish trends in Bitcoin prices. Traders should watch for how this affects Canaan’s stock in the coming days, especially if Bitcoin continues to struggle. If Bitcoin breaks below key support levels, it could drag down related stocks, including Canaan, despite their recent performance. Keep an eye on Canaan’s price action around its recent highs and lows, as any significant pullback could present a buying opportunity for those looking to capitalize on mining stocks in a bearish crypto environment.

📮 Takeaway

Watch Canaan’s stock closely; if Bitcoin dips further, it may impact mining stocks despite their current strength.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether