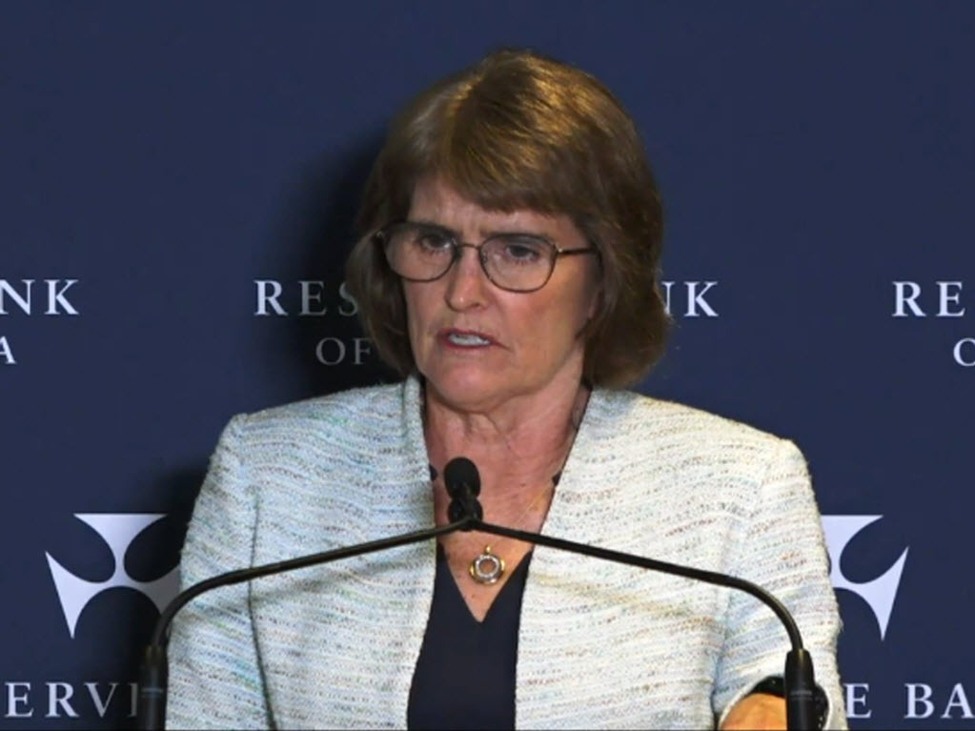

We’re alert to outside commentary on our policy settingThe board is not immune to outside commentary and will decide for themselves on policyPrevious rate cuts are still feeding through to the economyStill watching for the impact, it is a balancing actWe’ve already had three interest rate cuts, I know that mortgage holders want moreBut it’s also important to keep inflation under control, that’s also what impacts people’s living standardsPolicy is at the right spot at the momentI don’t think there’s anything else that would be too notable from her remarks. She has made it pretty clear that their current stance is to leave policy on hold and to weigh up economic data in the months ahead before deciding next year. AUD/USD is just holding marginally lower by 0.1% on the day at 0.6532, with the more negative risk mood likely to be the bigger driver today.

This article was written by Justin Low at investinglive.com.

💡 DMK Insight

The central bank’s cautious stance on interest rates is crucial for traders right now. With three rate cuts already in the pipeline, the board’s ongoing assessment of economic impacts suggests volatility in both forex and equity markets. Traders should be particularly mindful of how these cuts influence consumer spending and inflation metrics, as they can shift market sentiment rapidly. If the board signals further cuts or maintains the current rates, expect significant reactions in currency pairs, especially those tied to the economy’s performance. Look for the USD to react strongly against major pairs like the EUR and JPY, depending on the next policy announcement. On the flip side, while rate cuts can stimulate growth, they also raise concerns about inflation if the economy overheats. This duality means traders need to monitor inflation indicators closely, as unexpected spikes could lead to a hawkish shift in policy. Keep an eye on key economic reports in the coming weeks, as they could provide critical insights into the board’s next moves.

📮 Takeaway

Watch for the central bank’s next policy announcement; it could trigger volatility in major currency pairs, especially USD/EUR and USD/JPY.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin