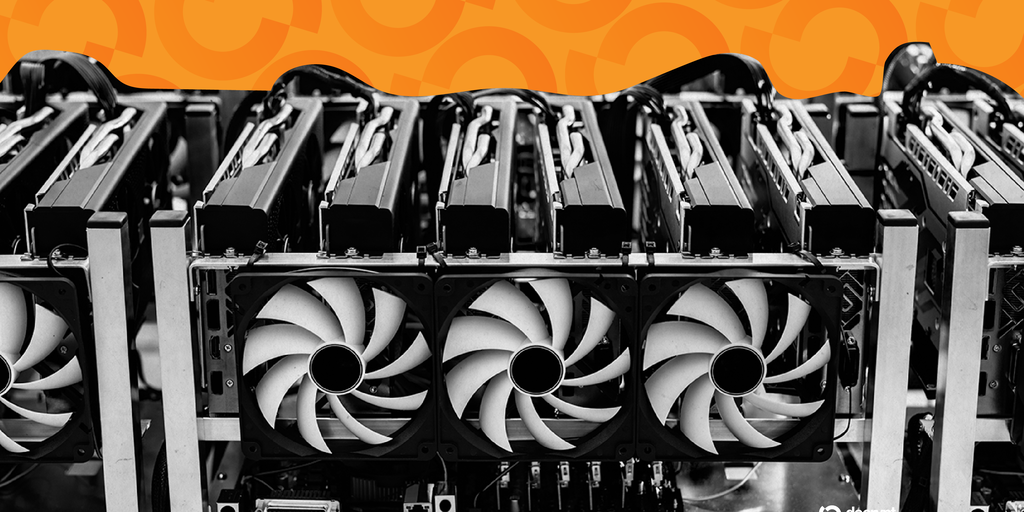

The transactions are the latest between Magnificent Seven companies and Bitcoin miner and data center firms.

💡 DMK Insight

The ongoing transactions between the Magnificent Seven companies and Bitcoin miners signal a potential shift in market dynamics. These partnerships could lead to increased demand for mining infrastructure, which might drive up operational costs and influence Bitcoin’s price trajectory. As these tech giants engage with miners, they’re likely looking to secure more control over the supply chain, which could create a ripple effect across the crypto market, impacting everything from mining profitability to Bitcoin’s market cap. Traders should keep an eye on how these collaborations evolve, especially in terms of technological advancements and energy consumption. If these companies invest heavily in sustainable mining practices, it could change the narrative around Bitcoin’s environmental impact, attracting more institutional investors. Conversely, if operational costs rise without a corresponding increase in Bitcoin’s price, we could see a squeeze on miners, leading to potential sell-offs. Watch for any announcements regarding specific partnerships or investments, as these could serve as catalysts for price movements. Key levels to monitor include Bitcoin’s support and resistance zones, which will be influenced by these developments.

📮 Takeaway

Keep an eye on partnerships between tech giants and Bitcoin miners; they could impact Bitcoin’s price and mining profitability significantly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin