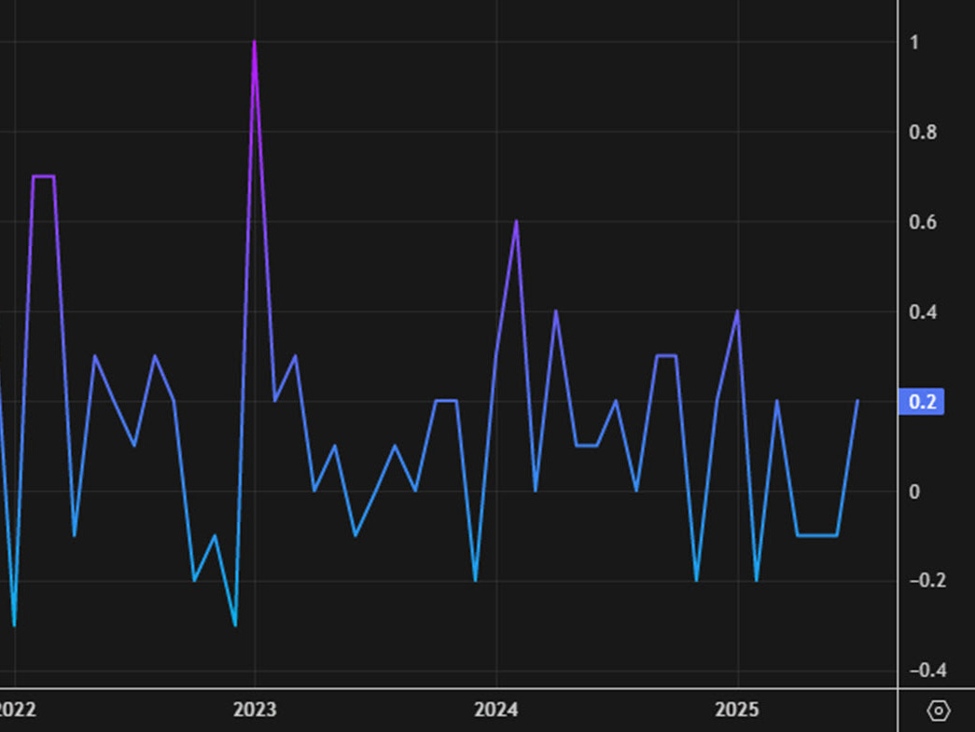

September advance estimate +0.1%Prior was +0.2% (revised to +0.3%)Goods-producing industries declined 0.6% in AugustServices-producing industries edged down 0.1%Flight attendant strike behind a 1.7% decline in transportation and warehousingWholesale trade sector declined 1.2% in AugustMining, quarrying, and oil and gas extraction contracted 0.7% in AugustThe utilities sector contracted 2.3% as worsening drought conditions hampered hydroelectric power generationRetail trade up 0.9%Full release

This article was written by Adam Button at investinglive.com.

💡 DMK Insight

The latest economic data shows a mixed bag, and here’s why that matters for traders: a mere 0.1% advance estimate for September signals potential stagnation in growth. With goods-producing industries down 0.6% in August and significant declines in sectors like transportation and warehousing, traders should be cautious. The 1.7% drop in transportation, largely due to the flight attendant strike, indicates labor issues could further disrupt supply chains. Additionally, the 1.2% decline in wholesale trade and contractions in mining and utilities suggest broader economic weakness. This could lead to volatility in related markets, particularly commodities and energy stocks, as traders reassess demand forecasts. Keep an eye on the upcoming economic indicators and any potential revisions to these estimates, as they could shift market sentiment. Watch for key support levels in commodities that might react to these trends, especially if the economic outlook worsens further.

📮 Takeaway

Traders should monitor upcoming economic indicators closely, especially in commodities, as current data suggests potential economic weakness and volatility ahead.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano