Shareholders on Thursday rejected the deal, which was first announced in July.

💡 DMK Insight

Shareholders rejecting the deal is a significant red flag for market sentiment. This kind of pushback often indicates deeper issues within the company, potentially affecting its stock price and overall stability. Traders should be wary, as this rejection could lead to increased volatility in the short term, especially if the deal was expected to bolster the company’s financials or market position. Look at the broader context: if this rejection is part of a trend where shareholders are increasingly skeptical of management decisions, it could signal a shift in investor confidence. This might not only impact the company in question but could also ripple through related sectors or competitors facing similar scrutiny. For those trading this stock, key levels to watch would be any support or resistance points that emerge in the wake of this news, particularly on the daily charts. If the stock breaks below a significant support level, it could trigger further selling pressure. Keep an eye on upcoming earnings reports or management commentary, as these could provide more insight into the company’s direction and shareholder sentiment.

📮 Takeaway

Watch for key support levels in the stock following the shareholder rejection; a break below could signal increased selling pressure.

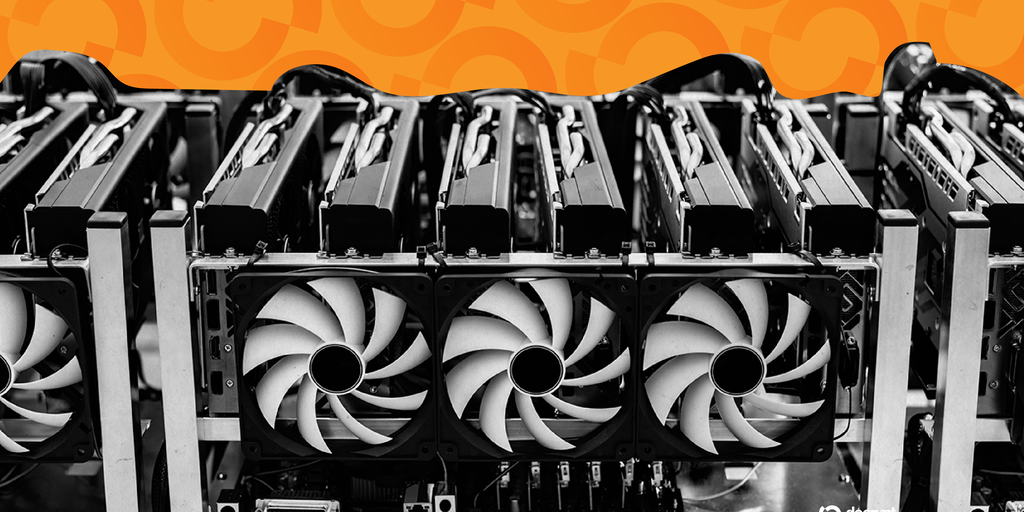

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano