Cleveland Fed President Beth Hammack is crossing the wires. She said that the Unemployment Rate is stabilizing, following the release of the strong January Nonfarm Payrolls report in the US. 🔗 Source

AUD/JPY Price Forecast: Slides over 1%, yet it remains bullish biased

The Aussie Dollar depreciates against the Japanese Yen on Wednesday, down by more than 1%, courtesy of broad Yen’s strength, courtesy of the landslide victory of Prime Minister Takaichi over the weekend. At the time of writing the AUD/JPY trades at 109.23. 🔗 Source 💡 DMK Insight The Aussie Dollar’s drop against the Yen signals a shift in market sentiment following Takaichi’s victory. With the AUD/JPY trading at 109.23, this decline reflects broader trends in risk appetite and currency strength. Traders should note that the Yen’s recent strength is likely tied to expectations of more aggressive monetary policy from Japan, which could further pressure the AUD. This situation is critical for day traders and swing traders alike, as the 109.00 level could act as a psychological support. If breached, it may open the door for further downside. On the flip side, if the AUD finds support and rebounds, it could indicate a potential reversal, especially if commodity prices strengthen. Keep an eye on the upcoming economic data releases from both Australia and Japan, as they could provide additional volatility. Monitoring the 109.00 and 110.00 levels will be key in determining the next moves in this pair. 📮 Takeaway Watch the AUD/JPY closely around the 109.00 support level; a break could lead to further declines, while a rebound may signal a reversal.

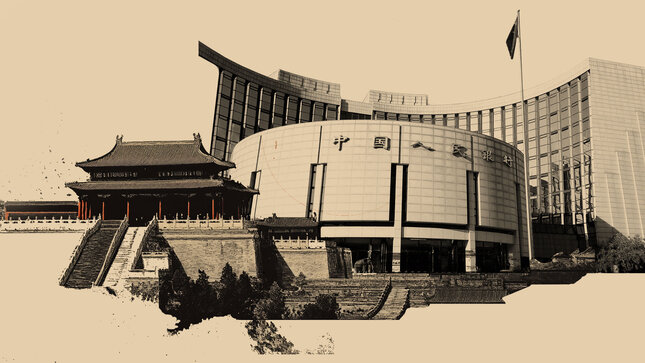

PBOC: Limited inflation constraint, easing likely – ING

ING expects Chinese inflation dynamics to have limited impact on People’s Bank of China policy in 2026. Lynn Song argues that CPI will again undershoot an expected 2% target, but this shortfall should not constrain monetary decisions. 🔗 Source 💡 DMK Insight China’s inflation outlook is a mixed bag, and here’s why it matters for traders right now: With ING predicting that the Consumer Price Index (CPI) will fall short of the 2% target, traders should keep an eye on how this could influence the People’s Bank of China’s (PBoC) monetary policy. A lower CPI might suggest a sluggish economy, but if the PBoC remains unfazed, it could signal a commitment to maintaining liquidity, which is crucial for risk assets. This scenario could lead to a divergence in trading strategies, particularly for those focused on Chinese equities and commodities. If the PBoC doesn’t adjust rates, we might see a continued bullish trend in sectors reliant on cheap credit, while those expecting tightening could face losses. However, there’s a flip side: if inflation remains persistently low, it could raise concerns about economic stagnation, prompting shifts in investor sentiment. Traders should monitor key economic indicators, especially any unexpected shifts in CPI data or PBoC statements in the coming months. Watch for any significant price movements in the yuan and related assets, as these could provide early signals of market sentiment changes. 📮 Takeaway Keep an eye on CPI trends and PBoC policy shifts; a persistent low CPI could impact Chinese equities and the yuan significantly.

USD/MYR: Range trade near multi‑year lows – Commerzbank

Commerzbank’s Moses Lim highlights stronger-than-expected Malaysian industrial production, driven by electronics and export-oriented manufacturing, with mining weakness seen as temporary. 🔗 Source 💡 DMK Insight Malaysian industrial production is outperforming expectations, and here’s why that matters for traders: The uptick in production, particularly in electronics and export-oriented sectors, signals a potential rebound in Malaysia’s economic health. This could lead to increased demand for the Malaysian Ringgit (MYR) as foreign investment flows in, especially if the trend continues. Traders should keep an eye on the MYR against major pairs, particularly USD/MYR, as a strengthening currency could indicate broader market confidence. However, the noted weakness in mining suggests that not all sectors are thriving, which could temper bullish sentiment if it persists. Watch for any updates on mining performance in the coming weeks, as this could shift the narrative. On a technical level, if USD/MYR breaks below recent support levels, it could trigger further buying in the MYR. Conversely, if mining issues linger, it might create volatility. Keep an eye on the upcoming economic data releases for further insights into Malaysia’s industrial landscape, as these will be crucial for positioning in both forex and related equities. 📮 Takeaway Monitor USD/MYR closely; a break below support could signal a stronger MYR, while mining sector updates will be key for volatility.

UK GDP expected to show weak economic growth in Q4

Markets will be watching closely on Thursday, when the United Kingdom’s (UK) Office for National Statistics (ONS) will release the advance estimate of Q4 Gross Domestic Product (GDP). 🔗 Source 💡 DMK Insight The upcoming UK GDP estimate could shake up market sentiment significantly. Traders should be prepared for volatility, especially if the figures deviate from expectations. A stronger-than-expected GDP could bolster the British pound, impacting forex pairs like GBP/USD and potentially lifting UK equities. Conversely, a disappointing number might trigger a sell-off, not just in the pound but across related markets. Keep an eye on the 1.30 level for GBP/USD; a break below could signal further weakness. Given the current economic climate, where inflation and interest rates are in focus, this GDP release is more than just a number—it’s a potential catalyst for broader market movements. Watch how institutional players react, as their positioning could set the tone for the rest of the week. 📮 Takeaway Watch for the UK GDP estimate on Thursday; deviations from expectations could lead to significant moves in GBP/USD and related markets.

AUD/USD lurches into highs after NFP beats expectations

The Australian Dollar surged to its highest level since August 2022 on Wednesday after the delayed US Non-Farm Payrolls (NFP) report came in stronger than expected at 130K, well above the 70K consensus, though massive downward revisions to 2025 payroll data (898K lower for March 2025 alone) painted 🔗 Source 💡 DMK Insight The Aussie Dollar’s rise signals a potential shift in market sentiment, and here’s why that matters: With the US NFP report exceeding expectations, traders might see this as a sign of economic resilience, which could bolster the AUD further. However, the significant downward revisions to past payroll data raise questions about the sustainability of this growth. If the market starts to doubt the strength of the US economy, we could see a reversal in the AUD’s gains. Keep an eye on the 0.65 level for the AUD/USD pair; a break above could lead to further bullish momentum, while a failure to hold could trigger profit-taking. Additionally, monitor how this affects commodities, especially if the AUD continues to strengthen—historically, a stronger Aussie can weigh on commodity prices, impacting related assets like gold and oil. In the short term, watch for any comments from the Reserve Bank of Australia that could influence the AUD’s trajectory. The market’s reaction to upcoming economic data releases will be crucial in determining whether this surge is a sustainable trend or just a temporary spike. 📮 Takeaway Watch the AUD/USD pair closely; a break above 0.65 could signal further gains, but downward revisions in US payroll data may create volatility.

Japanese Yen strengthens above 153.00 despite stronger US jobs data

The USD/JPY pair attracts some sellers to around 153.20 during the early Asian session on Thursday. The Japanese Yen (JPY) strengthens against the US Dollar (USD) in the aftermath of Prime Minister Sanae Takaichi’s landslide election victory. 🔗 Source 💡 DMK Insight The USD/JPY’s dip to 153.20 signals a shift in market sentiment following Takaichi’s election win. This political development is crucial for traders as it suggests a potential shift in Japan’s monetary policy stance, which could lead to further JPY strength. If the pair continues to hold below 153.50, it may indicate a bearish trend, prompting sellers to capitalize on this momentum. Watch for any comments from Takaichi regarding economic reforms or monetary policy, as they could provide further direction. Additionally, keep an eye on the broader market context; if U.S. economic data comes in weaker than expected, it could exacerbate the JPY’s gains against the dollar. Conversely, if USD strength returns, we might see a rebound in the USD/JPY pair. Traders should monitor the 153.00 support level closely, as a break below could trigger more selling pressure, while resistance at 154.00 remains a key level to watch for potential reversals. 📮 Takeaway Watch the 153.00 support level in USD/JPY; a break could lead to increased selling pressure amid JPY strength post-election.

NZD/USD spun in a tight circle on Wednesday

The New Zealand Dollar is holding near multi-month highs against the US Dollar following Wednesday’s US Non-Farm Payrolls (NFP) report, which showed 130K jobs added in January, above the 70K forecast, but was overshadowed by an 898K downward benchmark revision to 2025 payroll data that reinforced th 🔗 Source 💡 DMK Insight The New Zealand Dollar’s strength against the US Dollar is a key signal for traders right now. With the US NFP report showing 130K jobs added, the initial reaction might suggest a robust labor market. However, the staggering 898K downward revision to previous payroll data raises questions about the sustainability of this growth. For traders, this could mean increased volatility in USD pairs, particularly if the market starts to digest the implications of the revised data. The NZD/USD pair is currently near multi-month highs, and a break above recent resistance levels could trigger further bullish momentum. Keep an eye on the 0.65 level; if it holds, we might see a push towards 0.66 or higher. Conversely, if the USD strengthens unexpectedly due to other economic indicators, the NZD could face significant pullback risks. Watch for any shifts in sentiment from institutional players, as they often lead the charge in these scenarios. The real story is how traders react to this mixed bag of employment data—will they buy the dip or sell the rally? That’s the question to ponder as we move forward. 📮 Takeaway Monitor the NZD/USD pair closely; a break above 0.65 could signal further gains, while any USD strength may reverse recent highs.

GBP/USD slips heading into the Thursday trading window

The Pound Sterling pulled back from four-year highs on Wednesday, weighed down by a combination of Bank of England (BoE) dovishness and UK political uncertainty, even as the US Dollar weakened on soft labor market revisions. 🔗 Source 💡 DMK Insight The Pound’s retreat from four-year highs signals a critical moment for traders: The Bank of England’s dovish stance is clashing with a weakening US Dollar, creating a complex trading environment. Political uncertainty in the UK is adding to the volatility, making it essential for traders to reassess their positions. If the Pound continues to falter, watch for key support levels that could trigger further selling pressure. The recent soft labor market revisions in the US might provide a temporary boost to the Dollar, but the overall sentiment remains fragile. Traders should keep an eye on the upcoming economic data releases from the UK, as any signs of improvement could reignite bullish momentum for the Pound. Conversely, if political instability escalates, it could lead to a more pronounced decline. The real story is how these factors interplay; a dovish BoE might keep the Pound under pressure, while a weaker Dollar could offer a temporary reprieve. Watch for the Pound’s performance around key technical levels, especially if it approaches recent lows, as this could indicate a shift in market sentiment. 📮 Takeaway Monitor the Pound’s support levels closely; a break below recent lows could signal further declines amid UK political uncertainty.

RBA’s Bullock: Bringing inflation down may or may not require further rate hikes

Reserve Bank of Australia (RBA) Governor Michele Bullock said on Thursday that bringing inflation down may or may not require further rate hikes. Bullock further stated that central bank will continue to look at data and will act if inflation seems entrenched. 🔗 Source 💡 DMK Insight RBA’s mixed signals on rate hikes are crucial for traders right now. Bullock’s comments suggest a cautious approach, indicating that the central bank is data-dependent. If inflation shows signs of being entrenched, we could see a shift in monetary policy that impacts the Australian dollar and related forex pairs. Traders should keep an eye on upcoming inflation data releases, as these will likely dictate the RBA’s next moves. If inflation remains stubbornly high, expect increased volatility in AUD pairs, particularly against the USD and NZD. The market’s current pricing of rate expectations could shift dramatically based on these data points, so being nimble is key. On the flip side, if inflation eases, the RBA might hold off on hikes, which could strengthen the AUD in the short term. Watch for key resistance levels around recent highs; a break above could signal bullish momentum. Conversely, if inflation data disappoints, we might see a quick pullback. Keep your charts ready and monitor the economic calendar closely for any surprises. 📮 Takeaway Watch upcoming inflation data closely; a surprise could shift RBA’s rate stance and impact AUD significantly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether