Coinbase returned with a playful ad, its first Super Bowl appearance since 2022. Crypto kept a low profile as AI dominated the 2026 ad lineup. … 🔗 Source 💡 DMK Insight Coinbase’s return to the Super Bowl ad space signals a strategic pivot, especially as crypto’s visibility wanes in favor of AI. This move could be a calculated effort to rekindle interest in crypto amidst a market that’s seen a dip in retail engagement. With AI taking center stage, Coinbase might be trying to capture the attention of a broader audience, potentially reigniting trading activity. Traders should consider how this ad might influence sentiment and trading volumes in the coming weeks. If Coinbase’s campaign resonates, we could see increased activity in major cryptocurrencies, particularly Bitcoin and Ethereum, which often react to shifts in market sentiment. However, there’s a flip side: if the ad fails to generate buzz, it could further entrench the perception that crypto is losing its appeal. Watch for any spikes in trading volume or price movements in the days following the ad’s airing, as these could indicate whether Coinbase’s gamble pays off or falls flat. 📮 Takeaway Keep an eye on trading volumes and price movements for Bitcoin and Ethereum after Coinbase’s Super Bowl ad—this could signal a shift in market sentiment.

Vitalik Calls Algorithmic Stablecoins ‘True DeFi’ as Rules Tighten for Stablecoins

Vitalik said in X post “USDC savings interest” is not DeFi and framed algorithmic stablecoins as the “true DeFi”. Brazil passed a bill requiring stablecoins … 🔗 Source 💡 DMK Insight Vitalik’s take on USDC highlights a growing divide in the crypto community: what’s truly decentralized? His comments could shift sentiment around algorithmic stablecoins, especially as Brazil’s new bill mandates stablecoin regulations. Traders should watch how this impacts liquidity and adoption rates in the coming weeks. If algorithmic stablecoins gain traction, we might see a ripple effect on related assets, particularly those tied to DeFi protocols. On the flip side, USDC’s perceived centralization could lead to reduced demand, especially among those prioritizing decentralization. Keep an eye on the daily trading volumes of both USDC and algorithmic alternatives to gauge market sentiment and potential shifts in capital flows. 📮 Takeaway Watch for changes in trading volumes of USDC and algorithmic stablecoins over the next few weeks to gauge market sentiment shifts.

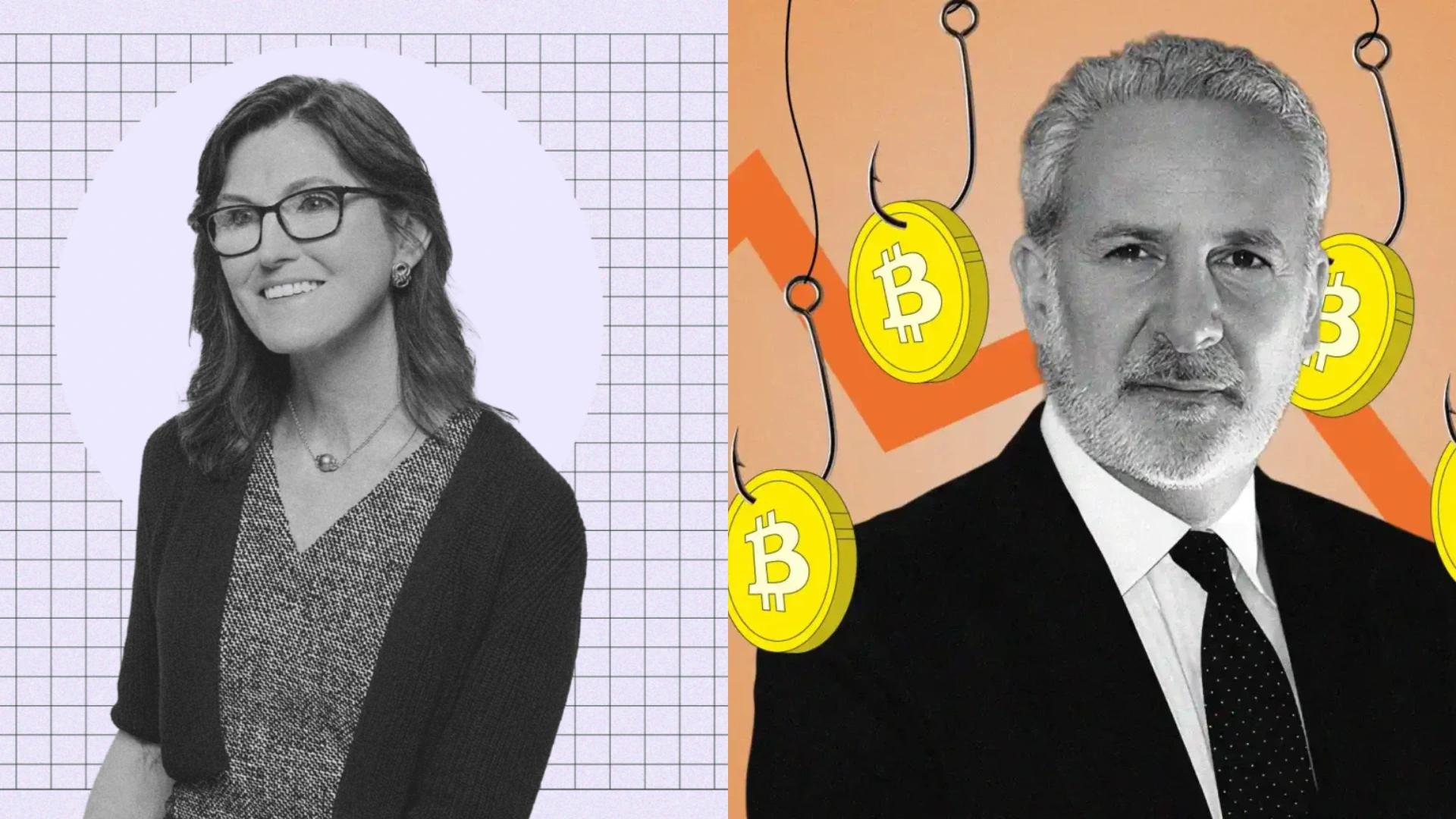

Traders Should Sell Gold For Bitcoin, Says Cathie Wood, as Peter Schiff Claims It Will Make Traders ‘Go Broke’

Cathie Wood said she would favor Bitcoin over gold. Peter Schiff has fired back at Wood on X. Wood reaffirmed ARK Invest’s long-term Bitcoin thesis. … 🔗 Source 💡 DMK Insight Cathie Wood’s preference for Bitcoin over gold is stirring the pot, and here’s why that matters right now: In a market where inflation fears and economic uncertainty are prevalent, Wood’s bullish stance on Bitcoin as a hedge against traditional assets like gold could sway institutional sentiment. This isn’t just a personal opinion; it reflects a broader trend where more investors are looking at Bitcoin as a digital store of value. If ARK Invest doubles down on its Bitcoin thesis, we might see increased buying pressure, particularly from retail and institutional investors who follow her lead. On the flip side, Peter Schiff’s rebuttal highlights the ongoing debate about Bitcoin’s viability compared to gold, which could create volatility in both assets. Traders should keep an eye on Bitcoin’s price action around key support and resistance levels, especially if it approaches recent highs or lows. Watch for Bitcoin’s performance in the coming weeks, particularly if it can maintain momentum above its recent support levels, as this could trigger further buying from both retail and institutional players. 📮 Takeaway Monitor Bitcoin’s price action closely; a sustained move above recent resistance could attract significant buying interest from institutions.

Binance Adds $300M in Bitcoin to SAFU Fund as Crypto’s Safety Reserves Shift

Binance’s SAFU fund purchased $300 million in Bitcoin, increasing its total holdings to 10,455 BTC. The purchase is part of a planned $1 billion conversion … 🔗 Source 💡 DMK Insight Binance’s SAFU fund just bought $300 million in Bitcoin, and here’s why that matters: This significant purchase boosts their holdings to 10,455 BTC, signaling strong institutional confidence in Bitcoin at a price of $68,763. With the SAFU fund’s total planned conversion reaching $1 billion, traders should watch for potential upward pressure on BTC as institutional demand ramps up. This could create a bullish sentiment in the market, especially if other institutions follow suit. However, it’s worth noting that such large purchases can also lead to increased volatility. If Bitcoin’s price reacts positively, we might see resistance around $70,000, which traders should monitor closely. Conversely, if the market doesn’t respond favorably, a pullback could test support levels below $65,000. Keep an eye on trading volumes and sentiment indicators to gauge market reactions in the coming days, as they could provide insights into the sustainability of this bullish trend. 📮 Takeaway Watch for Bitcoin’s reaction around $70,000; increased institutional buying could drive prices higher, but volatility is likely.

Hashbitcoin Predicts: Bitcoin and Dogecoin Hardware-Free Mining in 2026

By 2026, cloud mining has transformed from a niche experiment into a widely accessible investment method. Ordinary users no longer need to purchase expensive mining hardware or acquire complex technical The post Hashbitcoin Predicts: Bitcoin and Dogecoin Hardware-Free Mining in 2026 appeared first on NFT Evening. 🔗 Source 💡 DMK Insight Cloud mining’s rise could reshape how traders approach Bitcoin and Dogecoin investments. As we look towards 2026, the shift from hardware-dependent mining to cloud-based solutions means that accessibility will skyrocket. This could lead to increased participation in the crypto market, particularly for retail investors who previously felt excluded. For day traders and swing traders, this trend might create volatility as new participants enter the market, potentially driving prices up or down based on sentiment and speculation. With ETH currently at $2,033.17 and DOGE at $0.09, the implications for these assets are significant. If cloud mining becomes mainstream, it could lead to a surge in demand for both Bitcoin and Dogecoin, impacting their price dynamics. However, there’s a flip side: increased supply from cloud mining could also lead to downward pressure on prices if demand doesn’t keep pace. Traders should keep an eye on key levels—watch for DOGE to maintain support around $0.09 and ETH to hold above $2,000. Monitoring trading volumes and sentiment indicators will be crucial as this trend develops. 📮 Takeaway Watch for DOGE to hold above $0.09 and ETH to stay above $2,000 as cloud mining evolves—these levels will signal market sentiment and potential volatility.

Crypto and banks spar in comments on Fed’s ‘skinny master account’ idea

Crypto companies have backed a Federal Reserve proposal to give them limited access to the central bank, while banking associations have urged caution. 🔗 Source 💡 DMK Insight Crypto firms pushing for Fed access could reshape market dynamics significantly. This proposal indicates a potential shift in regulatory sentiment, which could lead to increased legitimacy for the crypto sector. If the Fed allows limited access, it might pave the way for more institutional participation, potentially driving up demand and prices. However, banking associations are raising red flags, suggesting that the traditional banking sector remains wary of crypto’s volatility and risks. Traders should keep an eye on how this plays out, as any positive movement could trigger bullish sentiment across the crypto market, particularly for assets like Bitcoin and Ethereum. On the flip side, if the Fed’s proposal gets bogged down in regulatory hurdles, it could dampen enthusiasm and lead to a sell-off. Watch for any statements from the Fed or banking associations in the coming weeks, as these could provide critical insights into market direction. Key levels to monitor are the support and resistance zones around recent price movements in major cryptocurrencies, as they may react sharply to news on this front. 📮 Takeaway Keep an eye on Fed developments regarding crypto access; positive news could boost Bitcoin and Ethereum, while regulatory delays might trigger sell-offs.

Bessent suggests Warsh nomination hearings alongside Powell probe

The Fed chair confirmation faces a key hurdle as a senator vows to block the process until a DOJ investigation into Jerome Powell is resolved. 🔗 Source 💡 DMK Insight The Fed chair confirmation drama is more than just political theater—it’s a potential market mover. With SOL currently at $83.32, uncertainty around Jerome Powell’s position could shake investor confidence, particularly in riskier assets like cryptocurrencies. If the confirmation process stalls, expect volatility in the crypto markets as traders react to the implications for monetary policy. A prolonged investigation could signal a shift in the Fed’s approach to interest rates, impacting liquidity and risk appetite across the board. Keep an eye on SOL’s support levels; a drop below $80 could trigger further selling pressure, while a bounce back above $85 might indicate renewed bullish sentiment. On the flip side, if Powell’s confirmation is expedited, it could stabilize markets and lead to a short-term rally in crypto assets. Traders should monitor the political landscape closely, as any developments could lead to rapid shifts in sentiment. Watch for key announcements or statements from the Fed that could provide clarity on future monetary policy, especially in the coming weeks. 📮 Takeaway Watch SOL closely; a drop below $80 could signal increased selling pressure, while a rise above $85 may indicate bullish sentiment returning.

South Korea expands crypto market probes after Bithumb Bitcoin blunder

South Korea’s financial watchdog detailed planned investigations into high-risk trading tactics as it prepares the next phase of crypto regulation, Yonhap News Agency reported. 🔗 Source 💡 DMK Insight South Korea’s move to investigate high-risk trading tactics is a game changer for crypto traders. Regulatory scrutiny often leads to increased volatility, and this could trigger a sell-off as traders reassess their positions. If the watchdog implements stricter rules, we might see a shift in market sentiment, particularly among retail investors who are more sensitive to regulatory news. Keep an eye on how major exchanges in South Korea react; they could face liquidity issues or increased withdrawal requests. This also raises questions about the future of crypto derivatives in the region, which could impact related markets like forex and traditional equities. On the flip side, this could create buying opportunities if the market overreacts. Traders should monitor key price levels in major cryptocurrencies to gauge potential support or resistance zones. Watch for any announcements from the Financial Services Commission in the coming weeks, as they could provide clearer insights into the regulatory landscape and its implications for trading strategies. 📮 Takeaway Watch for South Korean regulatory updates; a sell-off could present buying opportunities if prices dip significantly.

Kiwi dollar steadies as softer NZ data clashes with hawkish RBA

The kiwi stabilised after early losses, but softer NZ data and Australia’s hawkish shift leave NZD consolidating rather than trending higher.Summary:NZD eased last week as softer labour data pushed out expectations for RBNZ tighteningRisk-off tone supported the USD, keeping the kiwi under pressure earlyNZD/USD stabilised above 0.60 as equities rebounded into the weekendNZD/AUD weakened on Australia’s surprise RBA hike and widening rate differentialsAnalysts see near-term consolidation for NZD, with risks still tilted modestly lowerThe New Zealand dollar ended last week on a steadier footing after early pressure from softer domestic data and a broadly firmer US dollar, with markets reassessing the outlook for interest rates and regional policy divergence.According to Kiwibank analysts, a return to more “normal” market transmission saw a global risk-off tone support the US dollar, while New Zealand’s fourth-quarter labour market report dampened expectations for any near-term tightening by the Reserve Bank of New Zealand. That combination weighed on the kiwi, as traders pushed out the expected timing of future policy moves.NZD/USD traded in a relatively wide 0.5928–0.6063 range over the week, before finding some stability late as global equity markets rebounded. The pair opened the new week back above the 0.60 handle, sitting comfortably within last week’s range as investors turned their attention to delayed US payrolls data later in the week. Kiwibank’s FX team characterised the near-term outlook as neutral, noting the currency is consolidating after a recent run higher rather than breaking into a fresh trend.The pressure was more evident on the crosses, particularly against the Australian dollar. NZD/AUD slid back toward its mid-January lows near 0.8550, reflecting a sharp divergence in policy signals between Wellington and Canberra. The Reserve Bank of Australia surprised markets by hiking rates for the first time in more than two years, adopting a distinctly hawkish tone as inflation climbed well above target. In contrast, New Zealand data reinforced the view that the RBNZ has no urgency to follow.Kiwibank’s economists highlighted that New Zealand’s economy continues to operate with meaningful spare capacity. The unemployment rate rose to a decade high of 5.4%, underutilisation remains elevated, and wage growth has cooled sharply. Those dynamics, they argue, sharply reduce domestic inflation pressure and justify a patient policy stance from the RBNZ.In FX markets, that divergence has widened interest rate differentials decisively in Australia’s favour. Speculative positioning has amplified the move: futures data show hedge funds extending Australian dollar longs to their strongest levels since 2017, while trimming New Zealand dollar shorts only modestly. The imbalance underlines how one-sided positioning has become.Even so, Kiwibank notes that NZD/AUD has so far avoided a clean technical break lower. Demand for the kiwi has emerged repeatedly around well-worn support levels, suggesting some investors see value at current levels. While the balance of risks still favours further Australian dollar strength, analysts say the resilience above the mid-0.85 area shows NZD buyers are not capitulating.For now, the kiwi’s outlook hinges on offshore data and risk sentiment rather than domestic policy momentum. With the RBNZ comfortably on hold and global events driving direction, NZD is likely to remain range-bound in the near term, vulnerable to renewed downside if global risk appetite deteriorates again. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The NZD’s recent stabilization at 0.60 is a sign of cautious optimism, but underlying pressures remain. With softer labor data from New Zealand pushing back expectations for RBNZ tightening, traders should be wary of potential volatility. The hawkish stance from Australia could further complicate the NZD’s trajectory, especially if risk-off sentiment persists in global markets. This dynamic leaves the kiwi vulnerable, particularly if the USD continues to strengthen. Watch for key resistance around 0.6050; a break above could signal a shift in momentum. Conversely, if the NZD/USD slips below 0.5950, it might trigger further selling pressure, leading to a deeper consolidation phase. Keep an eye on upcoming economic releases from both New Zealand and Australia, as they could provide critical insights into the RBNZ’s future policy direction and impact the broader AUD/NZD cross. 📮 Takeaway Monitor NZD/USD closely; a break below 0.5950 could lead to increased selling pressure, while resistance at 0.6050 is key for potential upside.

PBOC sets USD/ CNY reference rate for today at 6.9523 (vs. estimate at 6.9334)

The PBOC allows the yuan to fluctuate within a +/- 2% range, around this reference rate.Previous close 6.9354OMOs: PBOC inject 113bn yuan via 7-day RRs @1.4%Earlier:China gold reserves climb further, buying continues for a 15th straight month This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The PBOC’s yuan fluctuation policy and ongoing gold purchases signal deeper economic strategies at play. With the yuan closing at 6.9354, the +/- 2% fluctuation range indicates a controlled approach to currency stability, which could impact forex traders looking for volatility. The PBOC’s injection of 113 billion yuan via 7-day RRs at 1.4% suggests a liquidity boost aimed at supporting economic activity. This could lead to short-term opportunities in yuan pairs, especially if traders anticipate a shift in the PBOC’s stance. Additionally, China’s continuous gold accumulation for 15 months hints at a strategic pivot towards asset-backed stability, which may influence gold prices and related commodities. Traders should keep an eye on the yuan’s movement within its range and any changes in gold prices, as these could create ripple effects across the forex and commodities markets. Watch for any statements from the PBOC that might indicate future policy shifts, especially as we approach the end of the month, which could set the tone for trading strategies going forward. 📮 Takeaway Monitor the yuan’s movement around 6.9354 and watch for PBOC announcements that could signal shifts in monetary policy or liquidity measures.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether