Coinbase customers faced losses in fresh ways through the exchange’s crypto-backed lending product as Bitcoin and Ethereum tumbled this week. 🔗 Source 💡 DMK Insight Ethereum’s drop to $2,051.69 is more than just a number—it’s a wake-up call for traders. With Coinbase’s crypto-backed lending product causing ripple effects, many investors are feeling the pinch. The recent downturn in Bitcoin and Ethereum highlights the fragility of leveraged positions, especially in a volatile market. Traders need to be cautious about over-leveraging, as this can amplify losses significantly. If ETH continues to slide, watch for support around the $2,000 mark; a break below could trigger further selling pressure. Conversely, if it holds, it might present a buying opportunity for those looking to capitalize on potential rebounds. But here’s the flip side: while some may see this as a chance to buy the dip, the broader market sentiment remains shaky. Institutional players could be waiting for clearer signals before re-entering, which means retail traders should be prepared for choppy waters ahead. Keep an eye on Bitcoin’s performance as well, since its movements often dictate Ethereum’s trajectory. Overall, monitor the $2,000 level closely as it could define the next short-term trend. 📮 Takeaway Watch for Ethereum’s $2,000 support level; a break could lead to increased selling pressure, while holding may offer a buying opportunity.

Bitfarms Stock Pumps as It Dumps Bitcoin Mining for AI With Name Change, Move to US

Publicly traded Bitcoin miner Bitfarms is planning a move to the United States and a name change as it transitions from crypto to AI compute. 🔗 Source 💡 DMK Insight Bitfarms is pivoting from crypto mining to AI compute, and here’s why that matters: This shift reflects a broader trend where crypto firms are reassessing their business models in light of regulatory pressures and market volatility. By moving to the U.S. and focusing on AI, Bitfarms is not just diversifying its revenue streams but also positioning itself in a rapidly growing sector. This could attract institutional investors who are increasingly interested in AI technologies, potentially boosting the stock’s appeal. However, this transition isn’t without risks; the mining sector is still reeling from low Bitcoin prices and high operational costs, which could impact their existing operations during the transition. Traders should keep an eye on how this move affects Bitfarms’ stock performance in the short term, particularly if they can successfully execute this transition without significant disruptions. Watch for any announcements regarding partnerships or contracts in the AI space, as these could serve as catalysts for price movement. Additionally, monitor Bitcoin’s price action; if it remains weak, it could further complicate Bitfarms’ transition and impact investor sentiment negatively. 📮 Takeaway Watch for Bitfarms’ announcements on AI partnerships and monitor Bitcoin’s price; a successful pivot could attract new investors.

President Trump Launches TrumpRx, Promising Lower Drug Prices: Is It Legit?

The White House is betting that a new cash-pay platform—built around blockbuster GLP-1 drugs—can pressure Big Pharma and bypass the middlemen who keep U.S. prices high. 🔗 Source 💡 DMK Insight The White House’s push for a cash-pay platform around GLP-1 drugs could shake up the pharma market significantly. By targeting high prices and middlemen, this initiative might create a ripple effect, impacting not just pharmaceutical stocks but also related sectors like healthcare and insurance. Traders should keep an eye on how Big Pharma reacts; if major companies start to feel pressure, we could see volatility in their stock prices. Additionally, this could set a precedent for future healthcare reforms, influencing investor sentiment across the board. Watch for any announcements or pilot programs in the coming weeks that could provide insight into the platform’s effectiveness and adoption rates. 📮 Takeaway Monitor Big Pharma stock reactions closely; any significant price drops could signal broader market shifts in healthcare policy.

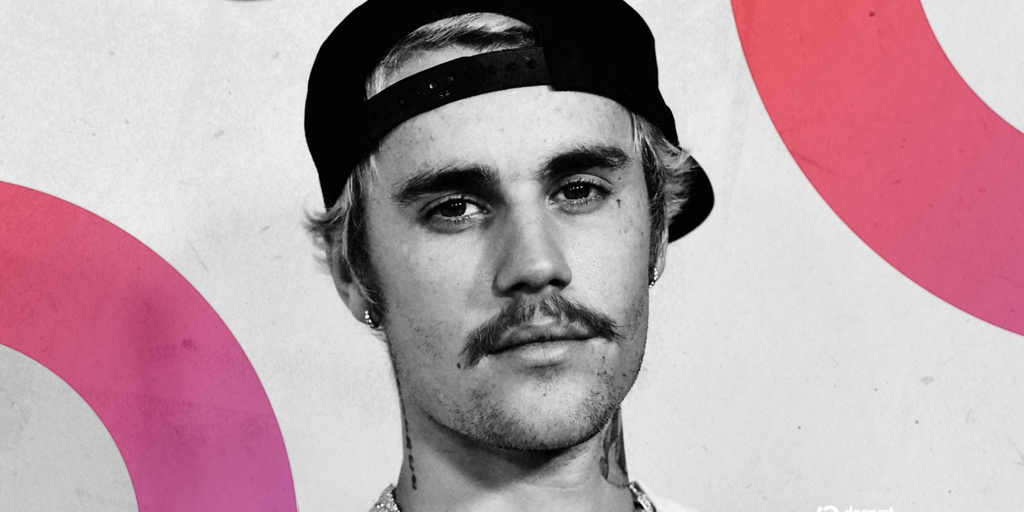

Justin Bieber Paid $1.3 Million for a Bored Ape NFT. It's Now Worth $12K

Back when NFTs were hot, Justin Bieber dropped $1.3 million to join the Bored Ape Yacht Club. The Ethereum NFTs now start at just $12K. 🔗 Source 💡 DMK Insight Ethereum’s NFT market is in a steep decline, and here’s why that matters: The drastic drop in Bored Ape Yacht Club NFTs from $1.3 million to a starting price of $12K signals a significant shift in market sentiment. This isn’t just about NFTs; it reflects broader concerns about Ethereum’s utility and value as a platform. Traders should be wary of the potential for further declines, especially if this trend continues. The current ETH price at $2,051.69 could face pressure if NFT sales don’t recover, impacting overall market confidence. Look for key support levels around $2,000; a breach could trigger more selling. On the flip side, this could present a buying opportunity for those looking to accumulate ETH at lower levels, especially if you believe in its long-term potential. Keep an eye on trading volumes and sentiment indicators; a spike in activity could signal a reversal. Watch for any news or developments in the NFT space that could catalyze a rebound, as they often influence ETH’s price directly. 📮 Takeaway Monitor ETH closely around the $2,000 support level; a break could lead to further declines, while a rebound might signal a buying opportunity.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether