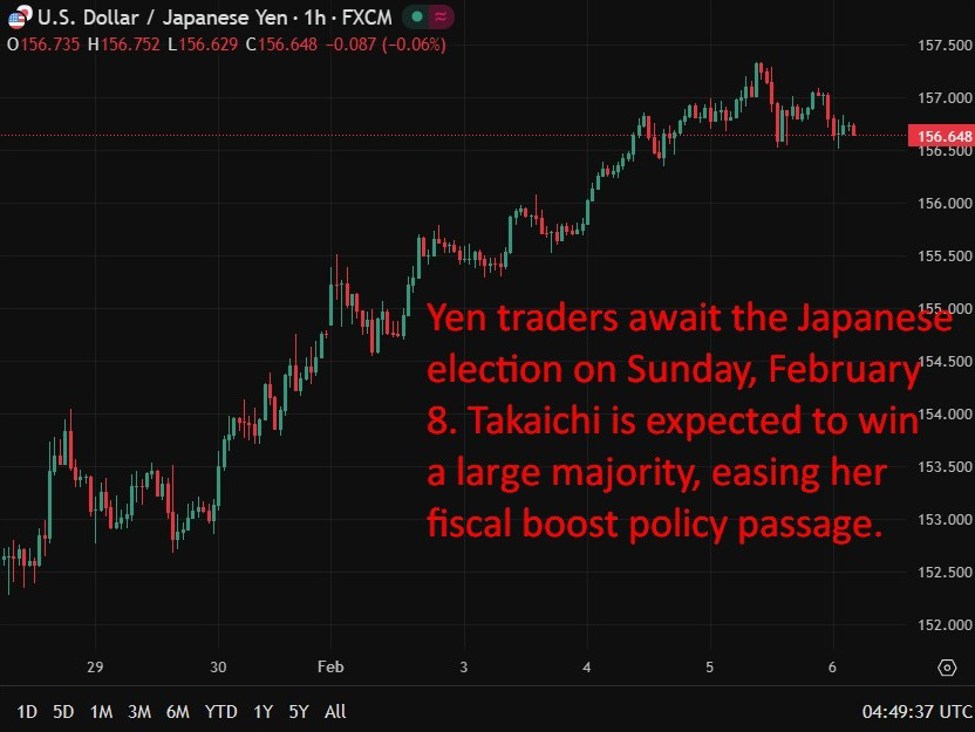

Japan markets are watching whether Takaichi’s likely election win delivers political stability without reigniting fiscal fears that pressure the yen and JGBs.Summary:Japan heads into a national election with polls pointing to a strong mandate for Prime Minister Sanae Takaichi, potentially reshaping the policy and market backdrop.A decisive win could stabilise politics, but fiscal risks remain front and centre, especially around her proposed food sales tax suspension.Markets are sensitive to funding questions, with the yen and JGBs already reacting sharply to fiscal uncertainty.A weaker mandate — or policy missteps — could limit the Bank of Japan’s room to smooth market stress.Geopolitical tensions with China add another layer of risk for Japan assets and currency sentiment.Japan’s election on Sunday is shaping up as a pivotal test for Prime Minister Sanae Takaichi, with polls suggesting her conservative bloc could secure a commanding majority, an outcome that would carry significant implications for Japanese markets, the yen and fiscal policy.Surveys indicate Takaichi’s Liberal Democratic Party and coalition partner Japan Innovation Party could win close to 300 seats in the 465-seat lower house, well above the threshold needed for a stable majority. Such an outcome would give the government firm control of parliamentary committees, easing the passage of budgets and legislation and reducing near-term political uncertainty, typically a supportive backdrop for Japanese assets.For markets, however, the election is about more than seat counts. Investors remain wary of Takaichi’s pledge to suspend the 8% sales tax on food to cushion households from rising prices. The proposal triggered a sharp sell-off in Japanese government bonds last month and pushed the yen lower, as markets questioned how an economy with the heaviest public debt burden in the developed world would absorb an estimated 5 trillion yen annual revenue shortfall. Any post-election clarification on funding or duration will be closely scrutinised by FX and rates markets.The fiscal debate also intersects with monetary policy. Analysts note that if renewed fiscal concerns unsettle markets, the BoJ may be less willing, or able, to step in to stabilise bonds or the currency, particularly as it continues to normalise policy. That dynamic leaves the yen sensitive to both political messaging and global yield moves.Beyond economics, a strong electoral mandate could embolden Takaichi on foreign policy, particularly in relations with China. Her hawkish stance on regional security and Taiwan has already heightened tensions with Beijing, raising the prospect of increased defence spending. While this may support certain equity sectors, it also adds a geopolitical risk premium that can weigh on the yen during periods of stress. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Japan’s political landscape is shifting, and here’s why that matters for traders: a Takaichi win could stabilize the yen and impact ETH. With ETH currently at $1,922.10, any political stability in Japan could ease fiscal fears, which have been pressuring the yen and Japanese Government Bonds (JGBs). A strong mandate for Takaichi might lead to more predictable economic policies, potentially boosting investor confidence in the region. This could strengthen the yen, which often has a correlated effect on crypto markets, including ETH. Traders should keep an eye on how this political shift influences market sentiment, especially if the yen strengthens against the dollar. But don’t overlook the flip side: if Takaichi’s policies are perceived as too aggressive or inflationary, it could lead to volatility in both the yen and crypto markets. Watch for key resistance levels in ETH around $2,000, as a break above could signal bullish momentum. Conversely, if the yen weakens further, ETH might face downward pressure. Keep an eye on the election results and their immediate impact on market sentiment over the next few days. 📮 Takeaway Monitor ETH’s reaction to Japan’s election results; a decisive Takaichi win could push ETH past $2,000 or trigger volatility if fiscal fears resurface.

Japan megabanks signal return to JGB buying as yields rise and markets stabilise

Japan’s megabanks see higher yields restoring the appeal of JGBs, even as near-term losses and policy risks argue for a cautious rebuild.In brief, via Reuters report. Summary:Japan’s biggest banks say they are ready to rebuild JGB holdings as higher yields improve returns, despite rising unrealised losses.MUFG and SMFG see long-term yields stabilising, opening the door to cautious re-entry after years of shrinking bond exposure.Recent calm in JGB markets, including resilient auction demand and lower long-end yields, has eased immediate stress.Banks remain wary of further BoJ rate hikes and fiscal risks linked to Prime Minister Takaichi’s policy agenda.Analysts say higher yields and a weaker yen should lift bank earnings momentum over coming years.Japan’s largest banks are preparing to increase their holdings of government bonds as rising interest rates restore the appeal of yields, even as valuation losses on existing portfolios have mounted.Executives at Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group said they expect to rebuild Japanese government bond exposure after years of cutting holdings during the era of ultra-low rates. Over the past decade, returns on JGBs were compressed by aggressive monetary easing from the Bank of Japan, prompting banks to shorten duration or shift assets elsewhere.That dynamic is now changing. A sharp rise in JGB yields since November, triggered in part by fiscal concerns tied to Prime Minister Sanae Takaichi’s spending proposals, hit bond valuations, pushing unrealised losses higher. However, recent weeks have brought signs of stabilisation. Demand at recent debt auctions has been resilient, while 30-year JGB yields have retreated around 32 basis points from January’s record highs.MUFG said it would cautiously rebuild its JGB position as long-term rates show signs of peaking. The bank reported unrealised bond losses of roughly ¥200bn at year-end, up sharply from earlier in the year, but noted that earlier sales of longer-dated bonds helped limit the damage. SMFG echoed that stance, acknowledging valuation losses while signalling plans to gradually increase JGB exposure as market conditions allow.Banks have so far remained focused on short-duration bonds. Mizuho, Japan’s third-largest lender, reported an average remaining maturity of just 1.8 years on its JGB holdings at end-December, underscoring sector-wide caution.Some investors expect banks to wait before adding significant long-dated exposure, given the risk of further BoJ tightening and concerns over Japan’s heavy debt load. Still, analysts argue that higher yields should support earnings over time, especially as net interest margins improve. The rally in bank shares since the BoJ began raising rates in 2024 reflects that optimism, with analysts now revising profit forecasts higher across the sector. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Japan’s megabanks are eyeing JGBs again, and here’s why that matters: higher yields could shift market dynamics. With MUFG and SMFG signaling a readiness to rebuild their JGB holdings, traders should pay attention to how this could influence both domestic and global bond markets. The rising yields on Japanese Government Bonds (JGBs) suggest a potential shift in investor sentiment, especially as these banks navigate unrealized losses. This could lead to a broader trend where institutional investors reassess their fixed-income strategies, impacting related assets like U.S. Treasuries and corporate bonds. If JGB yields continue to rise, we might see a ripple effect that could pressure yields elsewhere, especially if investors start reallocating funds. But there’s a flip side: the policy risks and near-term losses could keep some traders on the sidelines. Watch for key resistance levels in JGB yields and any comments from the Bank of Japan that could signal a shift in monetary policy. For now, keep an eye on how these banks’ actions unfold over the next few weeks, as they could set the tone for the bond market in Q4. 📮 Takeaway Monitor JGB yields closely; a sustained rise could shift investor sentiment and impact global bond markets significantly in the coming weeks.

India eyes up to $80bn in Boeing orders after US trade deal, CNBC reports

A potential $70–80bn Boeing order pipeline would be a headline boost for US aerospace, but markets still need detail on timing, funding and how much of the wider US–India trade package is binding.Summary:India is ready to place up to US$80bn of Boeing aircraft orders as part of a broader push to expand US–India trade after the announced deal, CNBC reported. Trade minister Piyush Goyal indicated aircraft demand alone is $70–80bn, and could top $100bn once engines and spares are included. A joint statement is expected within 4–5 days, with a formal agreement targeted for March, according to Goyal in separate reporting. The trade package’s scale (including claims around $500bn of US goods purchases) is drawing scrutiny in India and scepticism from market watchers on feasibility. For markets, a Boeing-heavy tranche is a near-term positive for US aerospace, while the broader deal has cross-currents for energy flows and crude pricing if it shifts India’s crude sourcing mix.Info via CNBC and other sources. India is preparing to place aircraft orders of up to US$80 billion with Boeing following the announcement of a new US–India trade deal, according to a CNBC report citing comments from India’s commerce and industry minister Piyush Goyal.CNBC reported that Goyal described India’s aircraft demand as “ready” to be placed, putting the value near $80bn for Boeing jets, and suggesting the total could exceed $100bn once engines and spare parts are included. The figures broadly align with separate reporting that India expects to buy $70–80bn of Boeing aircraft and that aviation-related purchases could total roughly $100bn when engines and parts are counted. The aircraft push sits within a wider trade narrative that has been light on official detail and heavy on headline numbers. Goyal has flagged that India and the US expect a joint statement within days to finalise the first tranche, with a formal agreement in March. The broader package includes claims that India could procure at least $500bn of US goods over five years, though analysts and opposition figures in India have demanded clarity on what is committed versus aspirational. For Boeing, any large incremental India order flow would reinforce a longer-run growth story tied to India’s expanding aviation market, but the timing and certainty of “yet-to-be-placed” demand will matter. The policy and reputational backdrop also remains sensitive: Boeing has faced ongoing scrutiny tied to Air India’s Dreamliner fleet and litigation from some families connected to a fatal June 2025 crash, which has kept safety and governance questions in the foreground. Macro-wise, markets will also watch the energy angle. The trade deal has been linked in public commentary to India potentially shifting crude sourcing toward US (and possibly Venezuela), which would have implications for regional crude differentials and freight flows, even if New Delhi has been careful to frame energy imports as a commercial decision. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Boeing’s potential $70–80bn order from India could shift market sentiment, but details matter more than hype. Traders should focus on the timing and funding specifics of this deal, as uncertainty can lead to volatility in Boeing’s stock and related aerospace sectors. If the order materializes, it could bolster Boeing’s financial outlook and potentially lift the entire US aerospace industry, impacting stocks like Lockheed Martin and Northrop Grumman. However, without clarity on how much of this order is guaranteed, traders might want to exercise caution. The broader US-India trade package’s binding nature will also play a crucial role in determining the sustainability of this order. Watch for any announcements regarding the deal’s specifics in the coming weeks, as they could provide key insights into Boeing’s stock trajectory. If the order is confirmed with solid funding, it could push Boeing’s stock above recent resistance levels, making it a potential buy opportunity for short-term traders. 📮 Takeaway Keep an eye on Boeing’s stock for potential movement if the $70–80bn order is confirmed, especially regarding funding details and timing.

Recap: BoJ policymaker flags need for further hikes as inflation nears target

Masu’s comments reinforce a more hawkish tilt at the BoJ, keeping April hike expectations alive as yen weakness sharpens inflation risks.Summary:BoJ board member Kazuyuki Masu called for timely rate hikes to prevent underlying inflation from overshooting the 2% target.Masu said underlying inflation is still below target but “drawing very close”, with deflationary behaviour fading.He highlighted the weak yen as a key inflation risk, warning of spillovers into expectations and prices.The comments underscore growing hawkishness within the BoJ board, following dissent and recent votes for higher rates.Markets continue to price a meaningful chance of an April hike, keeping yen and JGB sensitivity elevated.A Bank of Japan policymaker struck a notably hawkish tone on Friday, calling for further interest rate increases to prevent inflation from overshooting target and reinforcing market expectations for a near-term policy move.BoJ board member Kazuyuki Masu said Japan’s underlying inflation remains below the central bank’s 2% target but is “drawing very close” as firms and households move away from deeply entrenched deflationary behaviour. Speaking to business leaders in western Japan, Masu argued that additional rate hikes will be required to complete the normalisation of monetary policy after decades of ultra-easy settings.The remarks highlight a shift within the BoJ toward greater vigilance on inflation risks, driven by sustained wage growth, persistently high food prices and a weak yen. Masu warned that currency depreciation could amplify import costs and feed into inflation expectations, a channel policymakers are watching closely as the yen remains under pressure.Masu said particular attention should be paid to processed food prices, noting that sharp rises in rice prices may have made households more accepting of broader food price increases. That dynamic, he suggested, could play a decisive role in determining whether underlying inflation stays contained or drifts higher.The BoJ raised its short-term policy rate to 0.75% in December. At its January ‘on hold’ meeting one member voted for a further hike, to 1%. Masu’s comments add to evidence of a growing hawkish bloc within the nine-member board.At the same time, Masu stressed the need for caution. While Japan has clearly entered an inflationary phase, he said excessive tightening risks undermining the nascent virtuous cycle between wages and prices. That balancing act remains central to the BoJ’s strategy.Governor Kazuo Ueda has echoed the need for care, arguing that underlying inflation driven by domestic demand and wages has not yet firmly reached 2%. Markets, however, are increasingly focused on the risk that yen weakness accelerates import-driven inflation, with pricing reflecting roughly a 60% chance of another rate hike as early as April. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The BoJ’s hawkish shift could shake up forex markets, especially for the yen. Masu’s comments about timely rate hikes signal that the Bank of Japan is seriously considering tightening monetary policy to combat inflation risks. With underlying inflation nearing the 2% target, traders should keep an eye on the yen’s performance against major currencies. A rate hike in April could lead to a stronger yen, impacting pairs like USD/JPY and EUR/JPY. If the yen strengthens, it could also affect commodity prices, particularly those priced in yen, like gold. But here’s the flip side: if the BoJ hesitates or if inflation data disappoints, we could see a quick reversal. Watch for the upcoming inflation reports and any further comments from BoJ officials. Key levels to monitor include the 130 level for USD/JPY; a break below could signal a stronger yen trend. Overall, this is a pivotal moment for yen traders, with potential volatility on the horizon. 📮 Takeaway Watch for inflation data and BoJ comments; a rate hike could strengthen the yen, especially if USD/JPY breaks below 130.

Reserve Bank India monetary policy decision due 10am local (0430 GMT/2330 US Eastern time)

Summary:The RBI is expected to hold rates steady at its 10:00 a.m. IST decision, with inflation pressures contained and tariff risks easing.Recent budget measures to support manufacturing and exports, alongside a trade deal with the US, have improved the policy backdrop.Attention is shifting from rates to liquidity conditions, with banks pushing for looser LCR rules.State-owned banks face a credit–deposit mismatch, as loan growth outpaces deposits under pressure to lend.Analysts warn easing LCR requirements could flatten or pressure the yield curve, leaving the RBI in a policy bind.–The Reserve Bank of India is set to announce its policy decision at 10:00 a.m. IST, with expectations firmly centred on the central bank leaving interest rates unchanged. The outlook is supported by relatively benign inflation conditions and easing concerns around potential US tariffs, following recent budget measures aimed at boosting manufacturing and exports, as well as a trade deal with Washington.While a pause in rates is widely anticipated, pressure is building elsewhere in the system. Banks are increasingly lobbying for an easing of liquidity coverage ratio (LCR) requirements, according to analysts. Suresh Ganapathy, managing director and head of financial services research at Macquarie Capital, said state-owned banks face ongoing pressure to deliver stronger credit growth even as deposit growth lags, creating structural strain.Relaxing LCR rules could help ease that imbalance, but Ganapathy warned it would likely put pressure on the yield curve. As a result, the RBI finds itself in a difficult position, balancing financial stability concerns against the need to support bank lending and economic growth.Stay tuned for the policy announcement due on just a few minutes time.The rupee strengthened in the previous session, taking its weekly advance, sparked by the U.S.-India trade deal This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The RBI’s decision to hold rates steady is a pivotal moment for traders, especially with inflation pressures easing. With recent budget measures aimed at bolstering manufacturing and exports, alongside a trade deal with the US, the economic landscape is shifting. This could lead to improved liquidity conditions, which might influence currency pairs and equities tied to these sectors. Traders should keep an eye on how this decision impacts the Indian Rupee against major currencies, particularly if liquidity improves. However, there’s a flip side: if the RBI signals a more hawkish stance in future meetings, it could lead to volatility in the forex market. Watch for any comments on liquidity management post-decision, as this could provide clues on the central bank’s future direction. Key levels to monitor include the USD/INR pair, especially if it approaches recent support or resistance zones. 📮 Takeaway Watch the USD/INR pair closely for volatility as the RBI’s liquidity management signals unfold in the coming days.

Reserve Bank of India unchanged, as widely expected

RBI leaves repo rate at 5.25%, and SDF (standing facility rate) rate, which is the floor of the monetary policy corridor, at 5.00% This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight RBI’s decision to maintain the repo rate at 5.25% signals a cautious approach amid economic uncertainty. For traders, this means the Indian rupee might remain under pressure as the central bank balances inflation control with growth support. With the SDF rate at 5.00%, liquidity conditions are likely to stay tight, impacting forex pairs involving the INR. Traders should keep an eye on inflation data and GDP growth figures, as any shifts could prompt a change in monetary policy. Additionally, if global markets react negatively to this decision, we could see increased volatility in the rupee, especially against major currencies like the USD. Watch for key support around recent lows in the INR/USD pair, as breaking those levels could trigger further selling pressure. On the flip side, if inflation eases in the coming months, the RBI might be able to pivot towards a more accommodative stance, which could strengthen the rupee. So, it’s crucial to monitor upcoming economic indicators closely. 📮 Takeaway Keep an eye on inflation and GDP data; a shift in these could impact the INR significantly, especially against the USD.

RBI holds rates at 5.25% as inflation stays low and growth outlook remains steady

The RBI held rates and its neutral stance as expected, signalling confidence in domestic growth while flagging rising external headwinds.The Reserve Bank of India held policy steady as expected, with the MPC unanimously keeping the repo rate at 5.25%.SDF (standing facility rate) rate, which is the floor of the monetary policy corridor, unchanged at 5.00%The RBI retained a neutral policy stance, signalling comfort with current settings after aggressive easing.Officials said underlying inflation remains low, while near-term growth and inflation outlooks stay positive.External headwinds have intensified since the last meeting, but domestic fundamentals are seen as resilient.The Indian rupee was little changed after the decision, reflecting a well-telegraphed outcome.The Reserve Bank of India kept monetary policy unchanged on Friday, striking a steady tone on growth and inflation while acknowledging rising external risks.The RBI’s monetary policy committee voted unanimously to hold the repo rate at 5.25%, with the central bank also leaving the marginal standing facility rate at 5.50% and the standing deposit facility rate at 5.0%. The MPC retained its neutral policy stance, signalling that current settings remain appropriate after a prolonged easing cycle.In his remarks, the RBI governor said the Indian economy remains on a steadily improving trajectory, with domestic growth momentum intact despite a more challenging global backdrop. Underlying inflation was described as continuing to run low, giving policymakers room to stay on hold even as uncertainty abroad has picked up.The central bank acknowledged that external headwinds have intensified since the last policy meeting, reflecting global financial conditions and lingering geopolitical and trade-related risks. Even so, officials said the near-term outlook for domestic inflation and growth remains positive, underpinned by solid demand and favourable inflation dynamics.Markets took the decision in stride. The Indian rupee traded near unchanged against the US dollar following the announcement, reflecting broad consensus around the rate hold and limited surprises in the policy message. Bond markets also showed little reaction, with investors focused more on the RBI’s forward guidance than the headline decision.With inflation expected to stay around or below the RBI’s 4% target and growth holding up, the policy signal suggests an extended pause ahead. Attention now shifts to how persistent external pressures become, and whether global financial conditions eventually force a reassessment of the RBI’s neutral stance later in the year. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The RBI’s decision to hold the repo rate at 5.25% signals stability, but external pressures could shake things up. By maintaining its neutral stance, the RBI is projecting confidence in India’s domestic growth, which is crucial for traders focused on the INR and related assets. However, the mention of rising external headwinds suggests that geopolitical tensions or global economic shifts could impact this outlook. Traders should keep an eye on how these external factors might influence the INR’s performance against major currencies. If external pressures escalate, we could see volatility in forex pairs involving the INR, particularly against the USD. It’s also worth noting that while the RBI’s current stance may seem reassuring, the market could react sharply if inflation or global economic conditions change. Watch for any shifts in the MPC’s language in upcoming statements, as that could signal a pivot in monetary policy. For now, traders should monitor the INR closely, especially around key economic releases or geopolitical events that could sway market sentiment. 📮 Takeaway Keep an eye on the INR’s performance against the USD; external pressures could lead to volatility, especially if inflation concerns rise.

investingLive Asia-Pacific FX news wrap: Amazon shares trashed

RBI holds rates at 5.25% as inflation stays low and growth outlook remains steadyReserve Bank of India unchanged, as widely expectedReserve Bank India monetary policy decision due 10am local (0430 GMT/2330 US Eastern time)Recap: BoJ policymaker flags need for further hikes as inflation nears targetIndia eyes up to $80bn in Boeing orders after US trade deal, CNBC reportsJapan megabanks signal return to JGB buying as yields rise and markets stabiliseJapan election Sunday puts yen and bond markets on alert as Takaichi seeks strong mandateBitcoin, Ether bounce in Asia, swings continueUS “leave Iran now” warning resurfaces, but advisory dates back to JanuaryBoJ’s Masu says Japan has shifted into inflation as policy normalisation continuesGold ETF inflows hit record in January as holdings and AUM reach new highs, WGC saysPBOC sets USD/ CNY reference rate for today at 6.9590 (vs. estimate at 6.9517)South Korea sells $3bn FX stabilisation bonds to bolster reserves as won pressure persistsJapan household spending slumps in December as inflation squeezes consumers (more)Gold is seeing selling in early AsiaJapan December household spending falls m/m and y/y, poor numbersRussian oil discounts to China hit record as India demand risks mountBullock says RBA needs tighter policy as capacity constraints lift inflation risksGold fundamentals remain supportive despite recent correction, analysts sayMore on CME raises margins on COMEX gold and silver futures after extreme volatilityCME raises margins on Comex gold (again)investingLive Americas market news: Bitcoin cut in half in four months, down 13% todayAmazon Q4 2026 Earnings: Revenue Tops Estimates, AWS Drives Strong Growth, Small EPS MissAt a glance:Amazon shares slumped after earnings, as a heavy capex outlook overshadowed solid operating performance and strong AWS growth.CME raised margin requirements for gold and silver futures following extreme volatility, triggering early Asia weakness before a partial rebound.RBA Governor Bullock defended this week’s rate hike, flagging capacity constraints and persistent inflation risks.BoJ board member Masu struck a cautious-hawkish tone, keeping further tightening on the table while warning about yen-driven inflation.India’s RBI held rates at 5.25%, with the rupee little changed, while Japan’s election looms as a fresh risk for yen and JGBs.Amazon’s Q4 2026 earnings were mixed but solid, with a slight EPS miss offset by a clear top-line beat. Operating income of $24.98bn and an 11.7% margin were effectively in line with expectations, signalling continued cost discipline. AWS was the standout, delivering $35.58bn in revenue and 24% ex-FX growth, well above the 21% expected.However, the capex outlook dominated the reaction. Amazon flagged around $200bn of capex for 2026, far above the $146bn consensus, reigniting concerns around cash flow and near-term returns. The initial reaction was brutal, with chatter that the stock would be “slaughtered”, and Amazon shares were down more than 10% in after-hours trade at last check. US equity index futures also slid on Globex, though they later recovered off the lows.In commodities, the CME again lifted margin requirements for key precious metals contracts. Initial margin on COMEX 100 gold futures rises to 9% from 8%, while COMEX 5000 silver margins increase to 18% from 15%. The move follows violent recent price swings and forced deleveraging across metals. Gold and silver fell in early Asia trade before stabilising.In Australia, RBA Governor Bullock told parliament the board lifted the cash rate because the economy is more capacity constrained than previously judged, requiring tighter policy. She said demand growth must slow unless supply-side capacity and productivity improve, adding that the labour market remains strong, inflation is still elevated, and risks are skewed toward inflation persistence. The Australian dollar traded in a narrow range, briefly dipping below 0.6910 before edging back toward 0.6950, mirroring subdued moves across major FX.In Japan, BoJ board member Masu said the central bank has exited extraordinary easing and will continue to raise rates if the January outlook is realised, but cautiously, to avoid disrupting the wage–price cycle. He described yen weakness as a double-edged sword, supporting profits but adding to imported inflation, and stressed that excessive or disorderly currency moves are undesirable.Elsewhere, India’s RBI held the repo rate at 5.25% in a unanimous vote, retaining a neutral stance amid low underlying inflation and steady growth. The rupee was little changed.Finally, Japan heads into a national election on Sunday, with polls pointing to a strong mandate for Prime Minister Sanae Takaichi. While a decisive win could stabilise politics, markets remain focused on fiscal risks, particularly her proposed food sales tax suspension, with implications for JGBs and the yen firmly in view. Asia-Pac stocks: Japan (Nikkei 225) +0.29%Hong Kong (Hang Seng) -1.13% Shanghai Composite +0.11%Australia (S&P/ASX 200) -2.26% This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The RBI’s decision to hold rates at 5.25% signals stability, but here’s why traders should pay attention: With inflation remaining low and growth outlook steady, the RBI is prioritizing a balanced approach. This decision aligns with broader trends in emerging markets where central banks are cautious amid global economic uncertainties. For forex traders, the INR may see some stability against major currencies, but any shifts in global risk sentiment could lead to volatility. Keep an eye on the USD/INR pair, especially if the US economic data releases show unexpected strength, which could pressure the RBI to reconsider its stance sooner than anticipated. On the flip side, the Bank of Japan’s hints at further hikes could create a divergence in monetary policy that impacts cross-currency pairs. If the BoJ moves ahead with tightening while the RBI maintains its position, we might see increased volatility in the JPY/INR pair. Traders should monitor key levels around 82.00 for USD/INR and 55.00 for JPY/INR, as these could dictate short-term trading strategies. Watch for any significant economic data releases that could sway the RBI’s future decisions. 📮 Takeaway Watch the USD/INR around 82.00 and JPY/INR near 55.00 for potential volatility as global monetary policies diverge.

Markets hold more nervous ahead of European trading today

With the absence of the US jobs report today, it is leaving markets to fend for themselves in closing out the week. And so far, the more nervous and jittery mood all around is still permeating as we look to the session ahead. In particular, risk trades are being shaken up hard amid a combination of a selloff in tech shares and cryptocurrencies falling apart.The sharp pullback in precious metals also extended in early Asia trading, before a modest bounce back seen in the past few hours. Silver dipped to as low as $64.06 before recovering some poise to sit just a little over 3% higher on the day at $73 levels now. At the lows, it marked another potential 13% decline in silver earlier as dip buyers got flushed once more.Interestingly though, the chart shows the rebound coming just as price was close to testing the 100-day moving average (red line). That’s a key line in the sand with silver having not traded below the key level since April 2025. And even then, it was only for a brief period in navigating through Trump’s tariffs threat.If dip buyers can hold that line, it bodes well for a more solid rebound as we establish a consolidative phase for the precious metal. Some technical buying will be a key sentiment indicator in keeping the bullish run going for precious metals this year.The other good news for silver is that we’re seeing the gold-to-silver ratio jump back up to around the 65 to 70 range. The ratio narrowed considerably to below 50 at one point at the end of last month, which suggested that any major correction will punish silver more than it will gold.The more balanced ratio would suggest that the flush in silver might be meeting its end, allowing for a healthy correction to complete its course. We’ll then move on to defining the underlying factors driving precious metals again and focus on the case for a continued push higher later in the year. After all, February has always proved to be a tough seasonal month for silver in any case.Besides the volatile selling in precious metals, risk trades are also taking a big knock in trading this week. In particular, tech shares have been hit hard as the AI trade begins to crack. High valuations, souring investor sentiment, and Anthropic making waves are key factors dampening the status quo that market players have been used to over the past two years or so.Adding to that is the technical breakdown seen above, with the Nasdaq cracking under its 100-day moving average (red line) this week. That’s the first run below the key technical level since May 2025, with the previous break from above coming back in February 2025. The break at the time brought about a roughly 19% drop after, so just be wary that it is a big momentum shift for tech shares in general.And lastly, there’s the whole pain trade with cryptocurrencies happening as well this week. Bitcoin tumbled hard in breaking below the lows from March to April 2025, then taking out the $70,000 mark yesterday. That’s leading to a sharper drop with the low earlier today coming within a whisker of cracking the $60,000 level. As mentioned yesterday here, it is hard to pick at key support levels for Bitcoin currently.At most, we can point to the $60,000 mark as being a psychological support barrier alongside the 200-week moving average (blue line) now at around $58,065. Those will be key lines in the sand in keeping risk sentiment afloat as we look to end the week.For the time being, it looks like markets could use a bit of a breather before the weekend comes along. Precious metals are holding a modest rebound after the heavy drop, with S&P 500 futures down by just 0.1% even as Amazon shares are sent to the cleaners. Then, we’re seeing Bitcoin also bounce back to around $66,000 levels so far.The more nervous mood is easing a little but it doesn’t mean that the pressure valve is off. All it takes is just one small trigger to stir up the negative animal spirits in markets once again, considering the more fragile sentiment in play. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight With no US jobs report today, traders are left to navigate a jittery market environment. The absence of key economic data often leads to increased volatility, and that’s exactly what we’re seeing. Risk trades are particularly vulnerable right now, as uncertainty looms over market sentiment. Traders should be cautious, especially if they’re holding positions in equities or crypto, as these markets tend to react sharply to shifts in sentiment. Keep an eye on correlated assets like gold or the US dollar, which often serve as safe havens during turbulent times. Here’s the thing: while some might see this as a buying opportunity, it’s crucial to assess the broader context. If risk aversion continues, we could see a further pullback in risk assets. Watch for any sudden shifts in sentiment or unexpected news that could trigger a market reaction. The next few sessions could be pivotal, so stay alert for signs of stabilization or further declines. 📮 Takeaway Monitor risk sentiment closely; a shift could lead to significant moves in equities and crypto over the coming sessions.

BOJ policymaker Masu says not thinking of a particular pace in hiking interest rates

BOJ is not behind the curve in dealing with inflationIt is obvious that we should not raise rates too quickly in a way that derails the economic recoveryI’m not saying that food prices are rising in a way that warrants immediate policy actionNot thinking of a particular pace in raising ratesDon’t have a specific timeframe in mind on how soon the BOJ should raise rates nextIt would be wrong to have a preset idea on that decisionIf there is sufficient data that convinces us to act, then we will do so without hesitationThe previous pace of rate hikes are not any guide on the future pace of rate hikesUnderlying inflation remains on track to hit the 2% target; the pace hasn’t been too fast or too slowHe’s saying a lot without saying anything really. The comments are mostly to reaffirm the central bank’s existing policy stance more than anything else. The BOJ remains sidelined awaiting further developments from the spring wage negotiations in March. That will be the earliest in which we could see a bit of a narrative shift from the BOJ, depending on the wage numbers.But amid the pressure from the government in wanting the central bank to keep rates unchanged, that will make things tougher in challenging the convention by taking an outright hawkish stance. As such, expect much of the BOJ commentary to reflect the kind of two-sided thinking like what Masu is saying above. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight The BOJ’s cautious stance on rate hikes is a key signal for traders: they’re prioritizing economic recovery over aggressive inflation measures. This approach suggests that the central bank is aware of the delicate balance between controlling inflation and supporting growth. For forex traders, this could mean a more stable yen in the short term, as sudden rate changes are off the table. However, if inflation indicators start to rise significantly, the BOJ may need to pivot, which could create volatility. Keep an eye on inflation data releases and any shifts in BOJ commentary, as these could impact the USD/JPY pair significantly. On the flip side, if other central banks, like the Fed, continue their tightening paths, the yen could weaken against the dollar. So, watch for divergence in monetary policy, especially if the Fed signals more aggressive rate hikes while the BOJ remains steady. The key levels to monitor are the recent highs and lows in the USD/JPY, as they could indicate potential breakout or reversal points. 📮 Takeaway Traders should watch inflation data closely; a shift in BOJ policy could impact USD/JPY volatility significantly in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether