The prediction market has filed trademark applications for POLY and $POLY tied to a digital token and crypto trading services. 🔗 Source 💡 DMK Insight The trademark applications for POLY and $POLY signal a potential shift in the prediction market landscape, and here’s why that matters now: As the crypto space evolves, the introduction of new tokens can create volatility and trading opportunities. Traders should keep an eye on how these developments might influence existing tokens and platforms. If POLY gains traction, it could attract liquidity away from competitors, impacting their price dynamics. Additionally, the broader market context shows a growing interest in decentralized finance (DeFi) and prediction markets, which could amplify trading volume in the short term. Watch for any announcements regarding partnerships or integrations that could further validate the token’s utility. But there’s a flip side: trademark filings don’t guarantee success. Traders should be cautious about overreacting to news without understanding the underlying fundamentals. Monitoring sentiment and trading volumes around POLY will be crucial in assessing its potential impact on related assets. Keep an eye on key price levels and market reactions as this story unfolds. 📮 Takeaway Watch for trading volume and sentiment around POLY; any significant movement could indicate broader market shifts in prediction markets.

US equities look to recover a little after a rough few days

It’s been a day of mixed fortunes for US futures so far today. Tech shares were battered in Wall Street yesterday and that continued after Amazon faced a backlash on their earnings reporting. Big tech continues to try and justify their increased AI infrastructure spending but investors are slowly but surely moving on to the “show me the money” mood. And Amazon is being punished, with shares down over 8% in pre-market.Despite that, we are seeing a solid recovery in US futures after some losses early in Asia trading. S&P 500 futures were down by as much as 1% at the lows earlier today but are now seen up 0.5% instead. Tech shares are leading the rebound with Nasdaq futures seen up 0.7% as well currently.Of note, Microsoft shares are up 1.6% in pre-market while Palantir shares are up over 5% in pre-market. Both were beaten down heavily in trading yesterday and for the better part of this week. Meanwhile, Oracle shares are also up close to 2% after dropping by roughly 7% yesterday.The latest bounce offers just a bit of relief with the S&P 500 nudging down yesterday to test its 100-day moving average. The last time we got to this juncture was back in November last year and dip buyers prevailed. But if the Nasdaq is any indication, we could see tech shares fall off again in reaffirming the break under its own 100-day moving average (red line) this week:If so, that will definitely cascade to the S&P 500 and arguably broader risk sentiment in Wall Street.So far today, the mood music is also helped by a modest rebound in the likes of precious metals and Bitcoin too. Silver fell off hard to near $64 at the lows in early Asia trading but is now trading near 5% higher at around $74.61. Meanwhile, Bitcoin dipped down to come within a whisker of the $60,000 level before finding bids to be up to $66,000 levels now.Overall, the backdrop is still one filled with much nervousness and jitters. The slight bounce here offers investors to catch a breath for a bit. But make no mistake, risk sentiment is still in a fragile state as we look to close out the week. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight Tech stocks are under pressure, and here’s why that matters for traders right now: The recent backlash against Amazon’s earnings highlights a growing skepticism among investors regarding the sustainability of big tech’s AI spending. This isn’t just a one-off; it reflects broader concerns about profitability in a sector that has been a market darling. As tech shares struggle, day traders should keep an eye on correlated sectors, particularly those tied to consumer spending and discretionary income. If tech continues to falter, we might see a spillover effect into related markets, like consumer goods or even crypto, where sentiment can shift rapidly based on equity performance. Look for key technical levels in major tech indices. If the NASDAQ breaks below recent support levels, it could trigger further selling pressure. Conversely, a bounce back could present a short-term buying opportunity. Watch for earnings reports from other tech giants in the coming weeks, as they could either reinforce or alleviate current fears. The real story is how these earnings will shape market sentiment moving forward, especially as we approach the end of the quarter. 📮 Takeaway Monitor NASDAQ support levels closely; a break could signal further declines in tech stocks, impacting related markets.

What is Zama? How it Works, Features, and Use Cases

If you’re wondering what Zama is and why it’s being described as one of the most important privacy projects in crypto today, you’re in the right place. Zama is a The post What is Zama? How it Works, Features, and Use Cases appeared first on NFT Evening. 🔗 Source 💡 DMK Insight Zama’s emergence as a key player in the privacy sector of crypto is significant for traders focused on security and anonymity. As regulatory scrutiny intensifies, projects like Zama that prioritize privacy could see increased demand, especially among institutional investors looking to safeguard their transactions. This trend aligns with a broader market shift towards privacy-centric solutions, which could impact the valuation of other privacy coins like Monero and Zcash. Traders should keep an eye on Zama’s adoption rates and any partnerships it forms, as these could serve as catalysts for price movements. Additionally, monitoring technical levels in related assets will be crucial; for instance, if privacy coins start to rally, it might indicate a shift in market sentiment towards privacy-focused investments. Watch for any announcements or updates from Zama that could influence its market position, particularly in the coming weeks as the crypto landscape evolves. 📮 Takeaway Keep an eye on Zama’s developments and related privacy coins; a rally could signal a shift in market sentiment towards privacy-focused investments.

Trump-linked WLFI faces probe over $500M UAE crypto deal

House Democrats probe $500 million UAE investment in Trump-linked WLFI, highlighting questions over dealings with the country’s national security adviser. 🔗 Source 💡 DMK Insight The House Democrats’ investigation into the $500 million UAE investment in Trump-linked WLFI raises significant concerns for traders, especially in sectors tied to geopolitical stability. This scrutiny could lead to increased volatility in markets sensitive to U.S.-UAE relations, particularly in defense and energy sectors. Traders should monitor how this unfolds, as any negative developments could impact stocks associated with these industries. Additionally, if the investigation reveals deeper ties or conflicts, it could spark broader market reactions, affecting not just U.S. equities but also foreign investments and currency pairs involving the UAE dirham. The real story here is the potential ripple effect on investor sentiment, which could lead to a flight to safety in more stable assets. Keep an eye on the daily trading volumes and price movements of related stocks, as well as any statements from lawmakers or market analysts that could signal shifts in sentiment. This situation is fluid, and the implications could stretch beyond just the immediate parties involved. 📮 Takeaway Watch for shifts in U.S.-UAE relations and their impact on defense and energy stocks, as this investigation could trigger significant market volatility.

EU tokenization companies push for DLT pilot changes amid US momentum

European tokenization companies urged EU lawmakers to quickly amend the DLT Pilot Regime, warning that current limits risk pushing onchain markets to the US. 🔗 Source 💡 DMK Insight The push for amending the DLT Pilot Regime is crucial for European tokenization firms, and here’s why: If lawmakers delay, we could see a significant capital flight to the US, where regulations are more favorable. This isn’t just about compliance; it’s about creating a competitive landscape for innovation. European firms are already feeling the pressure, and if they can’t operate effectively on-chain, they’ll either relocate or scale down operations. Traders should keep an eye on how this regulatory environment evolves, as it could impact the valuation of European tokens versus their US counterparts. Look for any announcements or shifts in sentiment from EU lawmakers in the coming weeks. If amendments are made, we could see a resurgence in European token prices, while a lack of action might lead to further declines. Monitoring the performance of related assets, particularly those linked to tokenization and blockchain technology, will be key in gauging market reactions. 📮 Takeaway Watch for EU regulatory updates on the DLT Pilot Regime; delays could trigger a sell-off in European tokens as firms consider relocating.

Banks and crypto could offer similar products in time: Bessent

US Treasury Secretary Scott Bessent says banks and crypto may begin to offer similar products, and pledged to prevent deposit flight concerns that are stalling a key crypto bill. 🔗 Source 💡 DMK Insight Bessent’s comments hint at a potential convergence between traditional banking and crypto, and here’s why that’s crucial for traders right now: If banks start offering crypto-like products, it could legitimize the sector and attract institutional money, which has been hesitant due to regulatory uncertainty. This shift might also lead to increased competition, pushing crypto platforms to innovate or lower fees. Traders should keep an eye on how this regulatory landscape evolves, especially with the key crypto bill hanging in the balance. If it passes, we could see a bullish sentiment across major cryptocurrencies, particularly Bitcoin and Ethereum, which often react strongly to regulatory news. Watch for any price movements around significant support levels—like Bitcoin at $30,000 and Ethereum at $2,000—as these could signal broader market trends. But there’s a flip side: if banks fail to deliver on these promises or if regulations tighten further, we could see a sharp pullback in crypto prices. So, stay alert for any updates on the bill’s progress and how banks are positioning themselves in the crypto space. 📮 Takeaway Monitor Bitcoin around $30,000 and Ethereum at $2,000 for potential volatility as regulatory news unfolds.

Gold ETF inflows hit record in January as holdings and AUM reach new highs, WGC says

WGC data show January delivered record gold ETF inflows, pushing holdings and AUM to new highs even as dip-buying emerged after a late-month pullback.The World Gold Council (an industry-backed lobby group) says global gold ETFs pulled in a record US$19bn in January, taking holdings and AUM to fresh highs. WGC puts global gold ETF AUM at US$669bn and holdings at 4,145t after +120t in January. North America and Asia led inflows, with Europe also positive as geopolitical and trade risks stayed elevated. Trading activity surged, with WGC estimating gold market volumes at a record US$623bn/day through January. WGC says dip-buying showed up even as prices pulled back late-month, with most regions still seeing inflows on key late-January/early-February dayGlobal physically backed gold ETFs attracted a record wave of inflows in January, according to data compiled by the World Gold Council, as investors increased allocations even as prices pulled back late in the month. The WGC, an industry-backed lobby group, said gold ETFs drew US$19bn in net inflows in January, the strongest monthly intake on record. The January buying coincided with a sharp rise in gold prices earlier in the month, helping push global gold ETF assets under management to a fresh high of US$669bn, up around 20% on the month, while collective holdings rose 120 tonnes to a record 4,145 tonnes, the WGC said. The report also highlighted a surge in trading activity, with gold market volumes ending January at a record US$623bn/day, underlining how active the market has become during periods of fast-moving macro and geopolitical headlines. Regionally, WGC said North American and Asian investors did the heavy lifting, while Europe also recorded notable inflows as geopolitical and trade tensions kept hedging demand elevated. Importantly for market tone, the WGC said that even after a late-month price decline, inflows largely continued outside Europe on 30 January and 2 February, suggesting some investors used the dip to add exposure rather than de-risk. For markets, the message is that ETFs remain a powerful transmission channel for investor appetite. Sustained ETF demand can tighten effective supply in the physical market, reinforce bullish momentum and amplify moves when prices are already trending. The risk is that flows can also reverse quickly if real yields rise, the US dollar strengthens, or volatility forces deleveraging — making ETF data a key near-term signal alongside central bank buying and futures positioning. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Record gold ETF inflows in January signal strong investor confidence, but here’s why it matters now: With global gold ETFs attracting a staggering US$19 billion, we’re seeing a robust shift in market sentiment towards safe-haven assets. This influx comes despite a late-month pullback, indicating that dip-buying is gaining traction among traders. For those in the gold market, this could mean a bullish trend in the short to medium term, especially if the momentum continues. Watch for key resistance levels around recent highs, as breaking through could trigger further buying. However, it’s worth noting that this surge in inflows could also lead to increased volatility. If profit-taking occurs after such a rapid rise, it could create a sharp correction. Keep an eye on related markets, like silver and mining stocks, as they often react to gold’s movements. Traders should monitor ETF flows closely; a sustained increase could solidify gold’s position as a go-to asset amid economic uncertainty. 📮 Takeaway Watch for gold ETF inflows to maintain momentum; a break above recent highs could signal further bullish action.

BoJ’s Masu says Japan has shifted into inflation as policy normalisation continues

Masu said Japan is firmly in an inflationary phase and policy will keep normalising if the outlook holds, but the boj will move cautiously to protect the wage–price cycle while continuing balance-sheet tapering. Full text can be read here:Economic Activity, Prices, and Monetary Policy in JapanSpeech at a Meeting with Local Leaders in EhimeSummaryBoJ board member Masu said Japan’s economy has so far weathered the US tariff shock better than feared, with tariffs “winding down” and little visible disruption to domestic activity. He argued Japan has “fully transitioned into inflation”, but expects CPI to slow below 2% in H1 2026 as food-price effects fade and government measures bite. Masu flagged food, especially rice and spillovers into broader processed food, as the key inflation risk to watch, more so than services inflation. On policy, he said the BoJ has exited extraordinary easing, delivered four rate hikes since March 2024, held steady in January 2026, and will keep raising rates if the January outlook is realised, but cautiously to avoid breaking the wage–price cycle. He also addressed balance-sheet normalisation: ETF disposal guidelines were set in September 2025, while JGB purchases are being tapered sharply and holdings reduced, with purchases seen falling to under JPY30trn by FY2027.-Bank of Japan board member Kazuyuki Masu struck a cautiously hawkish tone in a speech in Ehime, arguing Japan has moved decisively out of deflation while warning policymakers must navigate the final stage of normalisation carefully to avoid damaging a nascent wage–price cycle. Masu opened by flagging two key risks the BoJ is monitoring: the global spillovers from US tariff policy and the durability of Japan’s inflation dynamics. On trade, he said the tariff issue that has weighed on global sentiment since 2025 appears to be “winding down” without causing significant disruption to Japan, aided in part by yen depreciation supporting exporters’ earnings even as auto tariffs rose. He pointed to firm US consumption and labour-market conditions as an offset to earlier fears of a broader slowdown. On inflation, Masu said Japan has “fully transitioned into inflation”, with CPI running above 2%, but he expects the headline pace to decelerate to below 2% in the first half of 2026 as the impact of earlier food price rises wanes and government measures to address rising prices take effect. He singled out food as the dominant driver, noting the 2025 surge in rice prices and emphasising the risk that rice-driven price psychology spills into broader processed food inflation, a channel he is watching closely. Masu also addressed the yen, noting that currency weakness has been a double-edged influence on the economy. While a weaker yen has supported corporate profits and exporters’ earnings, he acknowledged that it has also contributed to imported inflation, particularly through higher food and energy costs. He stressed that the BoJ is closely monitoring the extent to which exchange-rate moves feed through into prices and inflation expectations, especially given the sensitivity of household sentiment. Masu reiterated that excessive or disorderly currency moves are undesirable, and said exchange-rate developments remain an important consideration in assessing the balance between sustaining growth and containing inflation pressures. Masu’s comments keep USD/JPY sensitive to inflation persistence and yen pass-through, reinforcing the risk that further BoJ normalisation, alongside Ministry of Finance vigilance, caps tolerance for renewed currency weakness.Masu also spent time on rates and “room to move”. He noted the policy rate was lifted to 0.75% in December 2025, but argued real interest rates remain materially negative, meaning financial conditions are still accommodative. He discussed the neutral-rate concept, citing estimates that imply a nominal neutral range roughly around 1.0–2.5%, while stressing the uncertainty around any single point estimate. On the policy path, Masu said the BoJ has exited unprecedented easing, implemented four rate hikes since March 2024, and held rates in January 2026 to monitor data. If the January outlook for activity and prices is realised, he said the boj will continue to raise the policy rate and adjust accommodation as it completes normalisation, but he warned against excessive tightening that could disrupt the “virtuous cycle” of wages and prices. Finally, Masu detailed balance-sheet normalisation. He noted the BoJ decided on ETF disposal guidelines in September 2025, and argued sales must be paced carefully given the scale of holdings. On JGBs, he highlighted the boj holds about half of outstanding supply and is reducing purchases to support market stability, with annual buying set to fall from a peak above JPY130trn to slightly under JPY30trn by FY2027, while JGB holdings are projected to fall by nearly 20% by March 2027. Masu is a former chief financial officer of trading house Mitsubishi Corp. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Japan’s inflationary phase is a big deal for traders, especially with the BoJ’s cautious approach to policy normalization. The Bank of Japan (BoJ) is signaling a commitment to balance wage growth with price stability, which could impact the yen’s strength against other currencies. If inflation continues to rise, we might see a shift in interest rates that could affect forex pairs like USD/JPY. Traders should keep an eye on the BoJ’s balance-sheet tapering as it could lead to increased volatility in the yen. On the flip side, if the BoJ moves too slowly, it could create opportunities for short positions in the yen as traders react to potential delays in policy shifts. Watch for key economic indicators that could influence the BoJ’s decisions, particularly wage growth data and inflation reports in the coming weeks. 📮 Takeaway Keep an eye on Japan’s inflation data and BoJ policy moves; a shift could impact USD/JPY significantly in the near term.

US “leave Iran now” warning resurfaces, but advisory dates back to January

Renewed attention on US advice to leave Iran reflects old guidance, but it reinforces lingering geopolitical risks rather than signalling a new escalation.Summary:Renewed social-media attention on US advice to “leave Iran now” reflects recycled guidance from mid-January, not new escalation.The warning stems from widespread anti-government protests, crackdowns and detention risks, not a fresh diplomatic trigger.US officials stress Americans should not rely on government assistance to exit, given the lack of a US embassy in Tehran.While not new, the advisory keeps geopolitical risk premia alive amid already fragile Middle East sentiment.Oil markets remain sensitive to any perceived deterioration in Iran’s internal stability or regional security.Fresh attention on US advice urging citizens to “leave Iran now” has circulated widely on social media in recent hours, but the warning itself is not new and dates back to mid-January, according to US government statements.As of 12-13 January 2026, the U.S. Department of State and the US Virtual Embassy in Tehran advised all American citizens in Iran to depart immediately, citing escalating security risks, violent and widespread anti-government protests, and the heightened risk of arbitrary detention. The guidance emphasised that Americans should leave without relying on US government assistance, given the absence of a physical US embassy in the country.The advisory followed what officials described as the largest anti-government demonstrations in years, accompanied by lethal crackdowns, intermittent internet shutdowns and rising regional tensions. US authorities warned that dual US-Iranian nationals face particularly high risks, as Iran does not recognise dual citizenship, increasing the chance of detention.Because Washington has no embassy presence in Tehran, consular services are extremely limited. From a market perspective, the resurfacing of the warning is less about new information and more about persistent geopolitical fragility. While there has been no fresh escalation, reminders of internal unrest in Iran tend to keep investors alert to tail risks across the Middle East, particularly where energy supply and shipping routes are concerned.—US and Iranian officials are scheduled to talk in Muscat today, Friday, February 6, 2026. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight The US warning to leave Iran isn’t new, but it highlights ongoing geopolitical tensions that could impact market sentiment. For traders, this situation is a reminder to monitor how geopolitical risks can influence oil prices and broader market volatility. If unrest escalates, we could see a spike in crude oil prices, which often reacts sharply to Middle Eastern tensions. Keep an eye on the $80 per barrel level for WTI crude; a breach could trigger further volatility across commodities and related equities. Additionally, watch for any shifts in US foreign policy that could affect sanctions or military presence, as these factors often ripple through global markets, impacting everything from forex to equities. On the flip side, while the warning may seem like a standard advisory, the potential for increased sanctions or military action could create hidden opportunities for traders looking to capitalize on volatility. Be prepared for rapid price movements, especially if the situation escalates or if there are significant developments in the protests. This is a time to stay alert and adjust positions accordingly. 📮 Takeaway Watch for crude oil prices around $80 per barrel; geopolitical tensions in Iran could lead to significant market volatility and trading opportunities.

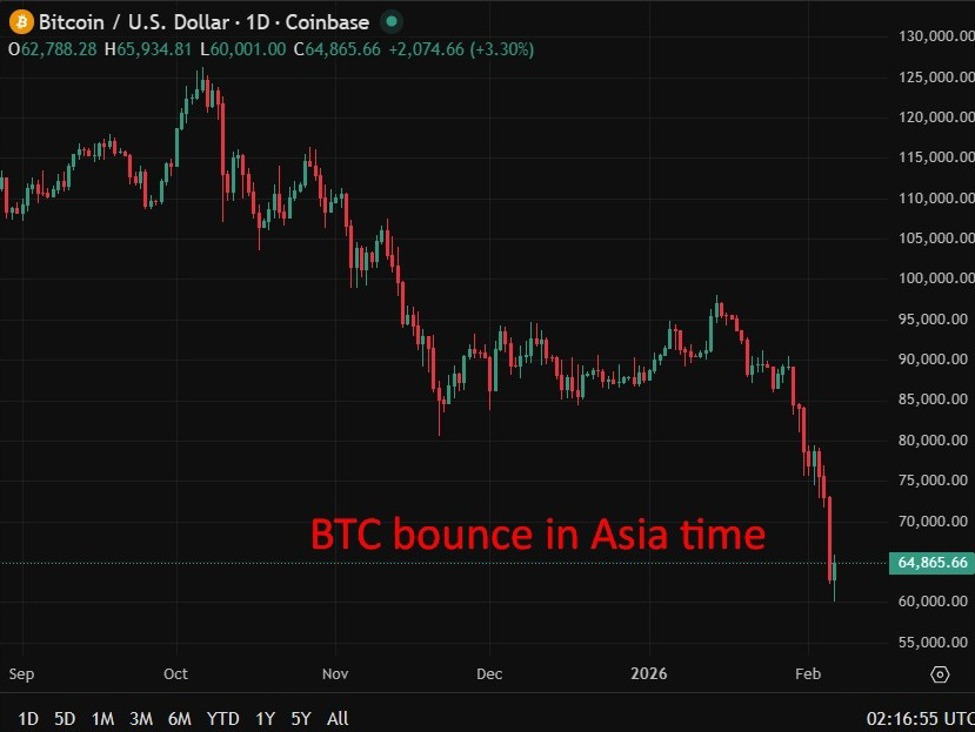

Bitcoin, Ether bounce in Asia, swings continue

BTC up around 4% while ETH up just a little more that that. Crypto has seen epic selling. BTC was circa 125K in October 2025. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Bitcoin’s recent 4% surge is a breath of fresh air amid heavy selling pressure, but don’t get too comfortable. With BTC currently at $65,826, traders need to consider the broader context of its previous highs around $125K in October 2025. This recent uptick could signal a short-term recovery, but it’s crucial to watch for resistance levels that could cap further gains. If BTC can hold above $65,000, it might attract more buying interest, but any slip below could trigger additional selling. Ethereum’s modest rise to $1,922.22 suggests that while BTC is leading the charge, ETH isn’t far behind. Keep an eye on the BTC/ETH ratio; a strengthening BTC could weigh on ETH’s performance if it doesn’t catch up. Here’s the thing: while the current momentum is positive, the market’s volatility remains high. Traders should monitor for any significant pullbacks or news that could sway sentiment. Watch for key levels around $66,500 for resistance and $64,000 for support. If BTC breaks either of these, it could set the tone for the next trading session. 📮 Takeaway Watch BTC closely around $66,500 resistance and $64,000 support; a break could dictate the next move in crypto markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether