The meeting decision today is likely to be a non-event. And if so, the ECB will have done their job well. The central bank won’t be making any changes to key interest rates and the statement language should be left untouched as well. As such, that leaves just ECB president Lagarde’s press conference as the only interesting bit.So, what can we expect to see from the ECB today and moving forward? Let’s dive into some analyst commentaries ahead of the key risk event later.Deutsche Bank- No more rate cuts in 2026- “It would be wrong to characterise the February meeting as a non-event. The environment is marked by high uncertainty and two-sided risks. Understanding how the ECB is thinking about risks is important to gauging the path of policy going forward.”- “We expect the ECB to remain comfortable with 2% policy rates. The ECB is likely to emphasise an ability to be patient on the one hand – time and evidence is needed to assess the risk of sufficiently large and persistent deviations of inflation from target – and nimbleness on the other – the ECB’s willingness to take policy action in either direction as soon as necessary.”- “In our baseline, the ECB is on hold at 2% through 2026 and the next move is a hike in mid-2027 driven by fiscal easing, a tight labour market and future inflation risks moving above target. This year, the risks are skewed towards further easing.”ING- No more rate cuts in 2026- “We don’t expect any changes from the European Central Bank at next week’s meeting. However, the recent strengthening of the euro could revive the debate about another rate cut.”- “… as long as these geopolitical risks and uncertainties do not translate into substantial changes to the eurozone outlook, the ECB will watch but not act.”- “The recent euro appreciation will not be a big enough concern for the ECB to change course next week. For now, the central bank will stay in its good place, and we don’t expect Lagarde to say anything more on the exchange rate, beyond noting that the ECB will monitor it closely. However, if the latest trend continues and if the ECB wants to send a signal that a slight undershoot of inflation is as much a concern as a slight overshoot, the chances of a rate cut in March would clearly increase.”Commerzbank- No more rate cuts in 2026- “At first glance, next week’s ECB monetary policy meeting is likely to be fairly unspectacular. Financial markets and analysts do not expect any adjustment to interest rates. Hardly any analysts anticipate a change in interest rates for the rest of the year either.”- “However, central bankers will have to discuss a number of risks, particularly the implications of the high level of trade policy uncertainty and the sharp rise in gas prices for the economy and inflation.”- “Finally, the members of the ECB Governing Council are expected to discuss the spreads between eurozone bond yields next week. Last year, the spread between French and German government bond yields widened significantly amid political uncertainty in France. However, the yield spread has fallen noticeably since this week, as the French budget is likely to be passed soon. Although this does not provide for any significant savings, it should at least buy a year of political stability.”Nomura- No more rate cuts in 2026- “We believe the ECB will continue to emphasise data dependence and a meeting-by-meeting approach, with no change in its guidance.”- “ECB President Lagarde is likely to highlight that the ECB is well positioned – with rates currently around neutral – to navigate ongoing uncertainty due to US policy.”- “Lagarde will likely be asked about EUR/USD following its rise to 1.20, a level above which Guindos previously said would be “complicated” for the ECB (owing to additional disinflationary pressures). However, we expect Lagarde to push back and underscore that the ECB does not target the exchange rate, saying the ECB will look through end-of-forecast horizon deviations from target that are minimal and not persistent.”Goldman Sachs- No more rate cuts in 2026- “Next week’s ECB meeting on February 5 is likely to be uneventful, with the Governing Council leaving rates and all other policy parameters on hold.”- “That is because the incoming data have been broadly in line with the staff’s projections, there has been no significant shift in the economic outlook, and ECB officials continue to see the current policy stance as appropriate. President Lagarde is therefore likely to reiterate that policy is in a “good place” for the sixth consecutive meeting.”- “Looking ahead, our growth and inflation forecasts are similar to the staff projections, and we agree with the Council’s assessment that monetary policy can stay on hold for the time being. We therefore continue to expect the policy rate to remain at 2% for the foreseeable future.” This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight The ECB’s decision to maintain interest rates is a strategic move that could stabilize the eurozone markets. With no changes expected, traders should focus on the ECB president’s comments for hints on future monetary policy. If the language remains unchanged, it signals confidence in current economic conditions, which could support the euro against other currencies. However, if there are subtle shifts in tone or hints at future tightening, that could lead to volatility in forex pairs like EUR/USD. Keep an eye on the 1.05 level for potential support or resistance as traders react to the news. The real story is how the market interprets the ECB’s stance in the context of rising inflation and global economic pressures. Watch for any shifts in sentiment that could impact related assets, particularly European equities and bonds, as they often respond to central bank signals. 📮 Takeaway Monitor the ECB president’s comments closely; any hints at future policy changes could trigger volatility, especially around the 1.05 level in EUR/USD.

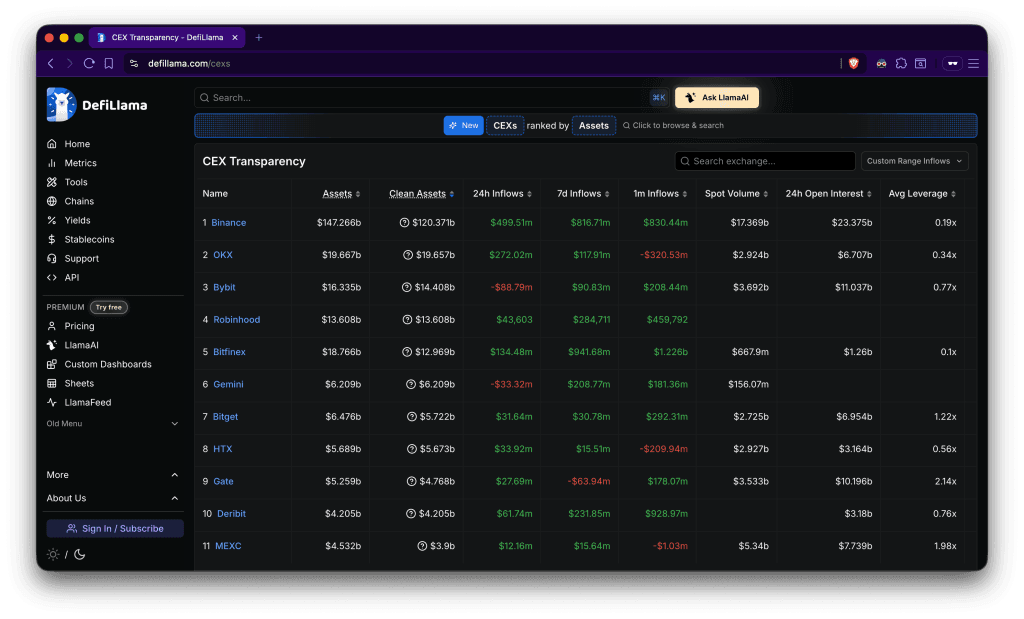

Binance Records $700M Net Inflow in 24 Hours: What This Means for Crypto Traders and Airdrop Farmers

The cryptocurrency exchange landscape recently witnessed a significant milestone as Binance recorded nearly $700 million in net inflows within a single 24-hour period, according to DeFiLlama’s CEX Transparency data. This … Read moreBinance Records $700M Net Inflow in 24 Hours: What This Means for Crypto Traders and Airdrop Farmers Der Beitrag Binance Records $700M Net Inflow in 24 Hours: What This Means for Crypto Traders and Airdrop Farmers erschien zuerst auf airdrops.io. 🔗 Source 💡 DMK Insight Binance’s $700 million net inflow signals renewed confidence in crypto markets, and here’s why that matters: This surge in inflows could indicate a shift in trader sentiment, especially as we approach key resistance levels in Bitcoin and Ethereum. With institutional players possibly re-entering the market, day traders should watch for volatility spikes and potential breakout patterns. If Bitcoin can hold above its recent support level, we might see a rally that could push it toward higher targets. But don’t overlook the potential for profit-taking as traders react to these inflows. On the flip side, while this inflow is promising, it’s crucial to consider that such rapid inflows can lead to equally rapid outflows. Traders should keep an eye on Binance’s liquidity metrics and monitor for any signs of a reversal, especially if market sentiment shifts due to external factors like regulatory news or macroeconomic data. Watch for key levels around $30,000 for Bitcoin and $2,000 for Ethereum, as these could dictate the next moves in the market. 📮 Takeaway Monitor Bitcoin’s ability to hold above $30,000 and Ethereum’s $2,000 level, as these will be crucial for potential upward momentum following Binance’s $700 million inflow.

Canada’s CIRO formalizes interim crypto custody framework

The Canadian self-regulatory organization outlined custody limits, capital thresholds and reporting rules while long-term regulation remains in progress. 🔗 Source 💡 DMK Insight Canada’s new custody limits and capital thresholds could reshape the crypto trading environment. With self-regulatory measures being introduced, traders need to assess how these changes will impact liquidity and operational costs. The outlined rules may lead to increased compliance burdens for crypto firms, potentially driving smaller players out of the market. This could create a more concentrated trading environment, where larger institutions dominate. Keep an eye on how these regulations affect trading volumes and price volatility in Canadian crypto assets. If liquidity decreases, we might see wider spreads and increased slippage, which can impact day trading strategies significantly. On the flip side, these regulations could instill greater trust among institutional investors, potentially leading to increased capital inflows in the long run. Watch for any announcements from major exchanges or funds regarding their compliance strategies, as this could signal shifts in market dynamics. The immediate focus should be on how these regulations play out in the next few weeks, especially during any major trading events or announcements. 📮 Takeaway Monitor the impact of Canada’s new custody rules on liquidity and trading costs, especially in the coming weeks as firms adapt.

Critics tell UK Lords stablecoins are not future money

At a House of Lords hearing, witnesses cast doubt on stablecoins as mainstream money, backing strict Bank of England oversight and criticizing the “disastrous” US GENIUS Act for letting non‑banks into “the money business.” 🔗 Source 💡 DMK Insight The skepticism around stablecoins is rising, and here’s why that matters: regulatory scrutiny could reshape the market. With witnesses at the House of Lords questioning stablecoins’ viability as mainstream currency, traders need to pay attention to potential regulatory shifts. The Bank of England’s push for stricter oversight could lead to increased compliance costs for stablecoin issuers, impacting liquidity and adoption rates. If the US GENIUS Act is perceived as a failure, it might deter investment in non-bank financial entities, creating a ripple effect across crypto markets. This could lead to volatility in stablecoin prices, especially if traders start to doubt their peg to fiat currencies. Watch for key developments from the Bank of England and any responses from major stablecoin issuers. If regulatory clarity emerges, it could either stabilize or destabilize the market, depending on how strict the measures are. Keep an eye on trading volumes and price movements in related assets like Bitcoin and Ethereum, as they often react to shifts in stablecoin sentiment. 📮 Takeaway Monitor regulatory updates from the Bank of England and watch for volatility in stablecoin prices, especially if compliance costs rise.

Crypto investors prioritize infrastructure over DeFi, survey finds

Senior decision-makers flagged liquidity constraints and market depth as key barriers to institutional crypto adoption in 2026. 🔗 Source 💡 DMK Insight Liquidity constraints are a major hurdle for institutional crypto adoption, and here’s why that matters: With senior decision-makers highlighting market depth issues, traders need to be aware that these barriers could lead to increased volatility and wider spreads, especially during high-impact news events. If institutions struggle to enter or exit positions efficiently, it could deter them from making significant investments, stalling the broader market’s growth. This is particularly relevant as we approach key regulatory decisions and potential ETF approvals, which could either alleviate or exacerbate these liquidity concerns. Look for signs of institutional interest in related assets like Bitcoin and Ethereum, as their movements could indicate broader market sentiment. If liquidity improves, we might see a rally; if it worsens, expect choppy trading conditions. Keep an eye on trading volumes and market depth metrics in the coming weeks to gauge how these barriers are evolving and their potential impact on your trading strategies. 📮 Takeaway Watch for changes in liquidity metrics and trading volumes, as these will signal institutional interest and potential market volatility in the coming weeks.

What Dubai’s ban on Monero and Zcash signals for regulated crypto

Dubai’s ban on privacy coins highlights how regulators are prioritizing transparency over anonymity in institutional crypto and regulated exchanges. 🔗 Source 💡 DMK Insight Dubai’s ban on privacy coins is a game changer for crypto traders: it signals a shift towards regulatory transparency that could reshape market dynamics. This move reflects a broader trend where regulators are tightening their grip on anonymity in crypto transactions, particularly in institutional settings. For traders, this means that assets previously considered safe havens for privacy, like Monero or Zcash, might face increased scrutiny and volatility. If institutional players start to shy away from these coins, we could see a ripple effect across the market, impacting liquidity and trading strategies. Traders should keep an eye on how this affects the overall sentiment towards privacy-focused assets and whether it leads to a flight towards more compliant cryptocurrencies. On the flip side, this could create opportunities for coins that align with regulatory standards, as they may gain favor among institutional investors looking for safer bets. Watch for any announcements from other jurisdictions that may follow Dubai’s lead, as these could further influence market trends and trading volumes in the coming weeks. 📮 Takeaway Monitor the impact of Dubai’s privacy coin ban on market sentiment and consider adjusting positions in privacy-focused assets as regulatory trends evolve.

Telegram's Durov slams Spain's online age verification proposal

The proposed laws are meant to create a mass-surveillance state and are not about protecting children, Pavel Durov warned on Wednesday. 🔗 Source 💡 DMK Insight Pavel Durov’s warning about proposed laws highlights a critical tension between privacy and regulation in the tech space. For traders, this isn’t just a political issue; it’s a potential market mover. If these laws lead to increased surveillance, companies in the tech sector could face backlash, impacting their stock prices and overall market sentiment. Look at how similar regulatory pressures have affected tech stocks in the past—investors often react swiftly to perceived threats to privacy. On the flip side, if companies adapt and find ways to comply while maintaining user trust, we could see a different narrative emerge. Keep an eye on major players in the tech sector and their responses to these developments. Watch for shifts in stock prices, particularly in firms heavily reliant on user data. The next few weeks could be pivotal as the market digests these implications. 📮 Takeaway Monitor tech stocks closely for volatility as proposed laws on surveillance could significantly impact market sentiment and company valuations.

CFTC pulls Biden-era proposal to ban sports, political prediction markets

CFTC Chair Mike Selig described the proposal as a “frolic into merit regulation” by the Biden administration. 🔗 Source 💡 DMK Insight CFTC Chair Mike Selig’s comments on the Biden administration’s proposal highlight a growing tension in regulatory approaches, and here’s why that matters for traders: Regulatory clarity—or the lack thereof—can significantly impact market sentiment, especially in the crypto space. If the administration is perceived as overreaching with merit regulation, it could stifle innovation and drive institutional investors away. This could lead to increased volatility in crypto assets as traders react to potential regulatory changes. Watch for how this sentiment plays out in the coming weeks, particularly as we approach key regulatory deadlines that could influence market dynamics. On the flip side, if the proposal leads to a more structured regulatory environment, it might attract more institutional money into the market, providing a potential bullish catalyst. Traders should keep an eye on the overall market reaction to regulatory news, especially around major assets like Bitcoin and Ethereum, which often serve as barometers for the broader crypto market. A significant move in these assets could signal a shift in trader sentiment and market direction. 📮 Takeaway Monitor regulatory developments closely; a shift in sentiment could lead to increased volatility in major crypto assets like Bitcoin and Ethereum.

Crypto firms offer ideas to break market structure gridlock: Report

Some crypto companies have proposed giving community banks a bigger stablecoin role as Senate negotiations stall over the contentious market structure bill. 🔗 Source 💡 DMK Insight Senate gridlock on the market structure bill is pushing crypto firms to pivot towards community banks for stablecoin integration. This move could reshape the landscape of stablecoin issuance and regulation, especially if community banks can offer more localized solutions. Traders should keep an eye on how this shift might affect the liquidity and adoption of stablecoins in the broader market. If community banks start to gain traction, we could see a ripple effect impacting major stablecoins like USDC and USDT, especially if they begin to compete more aggressively with traditional banking systems. Watch for any announcements from community banks or regulatory bodies that could signal a shift in policy or operational capabilities, as these could create volatility in related crypto assets. The next few weeks could be crucial as negotiations continue, so staying updated on this front will be key for traders looking to position themselves effectively. 📮 Takeaway Watch for developments in community bank involvement with stablecoins, as this could impact liquidity and volatility in major stablecoins over the coming weeks.

Coinbase fends off Nevada’s emergency bid to halt prediction markets

A Nevada judge declined to grant regulators’ bid to halt Coinbase’s event contract markets, as the exchange presses a CFTC preemption argument in federal court. 🔗 Source 💡 DMK Insight Coinbase just scored a win in court, and here’s why that matters for ADA: The Nevada judge’s decision not to halt Coinbase’s event contract markets is a significant boost for the exchange, especially as it leans on a CFTC preemption argument. This ruling could set a precedent that might influence how other exchanges operate under regulatory scrutiny. For ADA holders, this could mean increased trading activity on Coinbase, potentially driving demand and impacting price positively. If ADA can break above its current level of $0.27, we might see a bullish momentum shift, especially if broader market sentiment remains favorable. But let’s not ignore the flip side—regulatory uncertainty is still a looming threat. If the CFTC or other regulators push back harder, it could lead to volatility. Traders should keep an eye on ADA’s price action around key resistance levels, particularly if it approaches $0.30. Watch for any news from the CFTC that could affect market sentiment in the coming weeks, as that could dictate short-term price movements. 📮 Takeaway Monitor ADA closely; a break above $0.30 could signal bullish momentum, but watch for CFTC developments that might introduce volatility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc