Behind the scenes, the esports powerhouse has moved hundreds of terabytes of content to a decentralized data layer built for scale. 🔗 Source 💡 DMK Insight So, esports is going decentralized, and here’s why that matters: this shift could redefine content ownership and monetization in the gaming industry. By moving hundreds of terabytes of content to a decentralized data layer, the esports powerhouse is not just enhancing scalability but also potentially reducing reliance on traditional centralized platforms. This could lead to lower costs and increased revenue streams for content creators and teams alike. For traders, this development signals a growing trend towards decentralization in various sectors, including gaming and entertainment. If this model gains traction, it could ripple through related markets, impacting cryptocurrencies that support decentralized storage solutions. Keep an eye on tokens associated with decentralized data services, as they might see increased interest and volatility in the coming weeks. Here’s the thing: while mainstream coverage might hype the technology, the real story is how this could disrupt existing revenue models. Traders should monitor partnerships and integrations that emerge from this shift, as they could provide early indicators of which assets will benefit most. 📮 Takeaway Watch for developments in decentralized data solutions in esports; they could impact related crypto assets significantly in the coming weeks.

Cathie Wood's Ark Invest Doubles Down on BitMine, Coinbase Stocks Amid Bitcoin Plunge

Cathie Wood’s investment firm, Ark Invest, added exposure to crypto-related equities despite a continuing slide in crypto prices. 🔗 Source 💡 DMK Insight Ark Invest’s recent move to increase its crypto equity exposure amidst falling prices is a bold bet on the sector’s recovery. This strategy reflects a long-term bullish outlook, suggesting that they see value where others might be panicking. For traders, this could signal a potential bottoming out in crypto equities, especially if Ark’s investments align with a broader market recovery. Keep an eye on correlated assets like Bitcoin and Ethereum, as their price movements often influence crypto stocks. If Bitcoin stabilizes above key support levels, say around $25,000, it could trigger a wave of buying in related equities. However, it’s worth questioning whether this is a contrarian play or if Ark is simply trying to catch a falling knife. The risk of further declines remains, especially if macroeconomic factors like interest rates continue to pressure risk assets. Watch for any signs of institutional buying in the coming weeks, as that could provide a clearer signal for traders looking to enter the market. 📮 Takeaway Monitor Bitcoin’s stability around $25,000; Ark’s moves could indicate a potential bottom in crypto equities.

Bitcoin Plummets to 15-Month Low as Crypto, Stock Prices Tumble

The price of Bitcoin nearly touched $73,000 on Tuesday for the first time since November 2024 as investors flee risk assets. 🔗 Source 💡 DMK Insight Bitcoin’s near $73,000 mark is a significant psychological level, especially as risk assets face pressure. With investors looking for safe havens amid market volatility, Bitcoin’s price action reflects a shift in sentiment. If it breaks above $73,000, we could see a surge in buying interest, potentially triggering a rally towards previous highs. On the flip side, if it fails to hold this level, we might see a quick retracement, which could impact altcoins and related markets. Keep an eye on trading volume and momentum indicators; a spike in volume could signal strong conviction from buyers. For those trading Bitcoin, monitoring the $70,000 support level will be crucial. A drop below this could lead to increased selling pressure, while a sustained move above $73,000 could attract more institutional interest, further driving prices up. 📮 Takeaway Watch for Bitcoin to hold above $70,000; a break above $73,000 could trigger significant buying momentum.

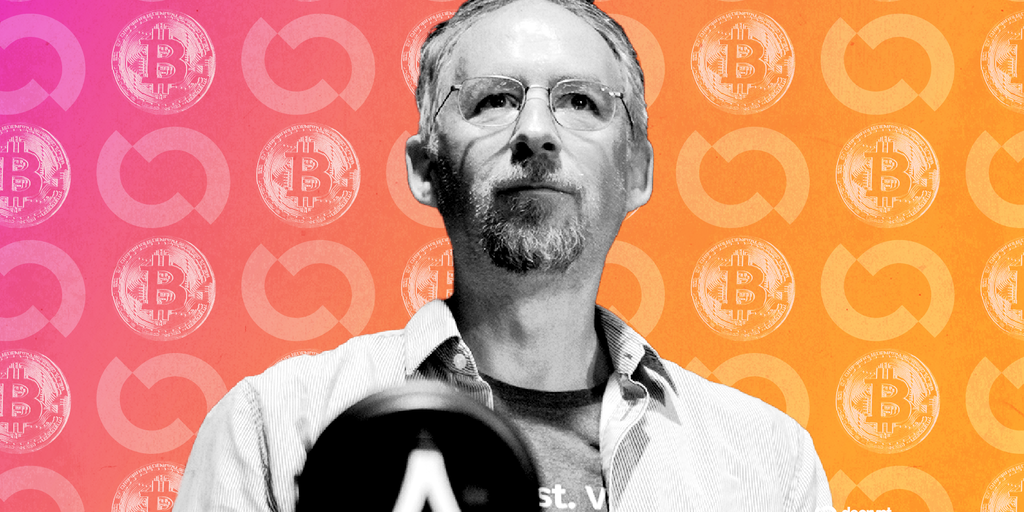

Jeffrey Epstein Invested in Bitcoin Firm Blockstream, Invited Founder Adam Back to Island

Adam Back confirmed that convicted sex offender Jeffrey Epstein invested in Blockstream as newly released emails point to a planned island visit. 🔗 Source 💡 DMK Insight The revelation of Epstein’s investment in Blockstream raises serious ethical questions for crypto investors. With ADA currently at $0.29, traders should consider the potential reputational risks associated with companies linked to controversial figures. This could lead to volatility in ADA and similar assets if public sentiment shifts against them. It’s worth noting that the crypto space is already under scrutiny, and this news could amplify regulatory concerns. Traders should keep an eye on ADA’s support levels around $0.25 and resistance at $0.32, as any negative sentiment could push it towards the lower end. Watch for market reactions over the next few days as more details emerge, which could create trading opportunities or risks depending on how the narrative unfolds. 📮 Takeaway Monitor ADA closely; if it breaks below $0.25, it could signal further downside risk amid reputational concerns.

France Considers Restricting VPNs to Support Under-15 Social Media Ban

A French official said the government is looking at ways to stop the use of VPNs to evade an incoming social media ban for kids under 15. 🔗 Source 💡 DMK Insight So France’s government is eyeing a crackdown on VPNs to enforce a social media ban for kids under 15, and here’s why that matters: this could set a precedent for stricter digital regulations across Europe. If implemented, this move could impact tech stocks and VPN service providers, as parents and guardians may seek alternative solutions to protect their children online. The broader implications could ripple through the digital privacy market, potentially affecting crypto transactions that rely on anonymity. Traders should keep an eye on how this regulatory environment evolves, especially with upcoming discussions in the EU about digital rights and privacy laws. Look for volatility in tech stocks and VPN services as the situation develops. Key indicators to watch include any legislative updates or public responses from major VPN providers, which could signal market shifts. Also, monitor social media sentiment around this issue, as public opinion could influence government actions and market reactions. 📮 Takeaway Watch for updates on France’s VPN regulations, as they could impact tech stocks and digital privacy markets significantly.

Crypto Dev Launches Site for AI to Hire Humans

Riding OpenClaw’s viral moment, a new startup called RentAHuman.ai pitches itself as the “meatspace layer” for autonomous agents—letting bots pay people to do the things software still can’t. 🔗 Source 💡 DMK Insight So RentAHuman.ai is trying to capitalize on the buzz around OpenClaw, and here’s why that matters: this could signal a shift in how we think about automation and labor. As autonomous agents become more prevalent, the need for human intervention in tasks that require creativity or emotional intelligence might increase. This startup’s model suggests a future where bots can outsource tasks to humans, potentially creating a new market segment. For traders, this is a pivotal moment to watch how tech stocks, especially those involved in AI and automation, react. If RentAHuman.ai gains traction, it could influence the broader tech sector, especially companies that are heavily invested in AI development. Keep an eye on related stocks and ETFs, as they might experience volatility based on this new trend. Also, consider monitoring the performance of OpenClaw and similar platforms, as their success could create ripple effects across the market. The real story is whether this model can scale and what that means for labor markets. If it does, we might see a shift in investor sentiment towards companies that can adapt to this new landscape. 📮 Takeaway Watch for how RentAHuman.ai’s success impacts tech stocks and AI-related investments, particularly in the next quarter.

AI Made Sam Altman Feel 'Useless and Sad'—X Users Tried to Make Him Feel Worse

OpenAI CEO Sam Altman said Codex made him feel useless. X users responded by roasting his vulnerability—and airing months of anger over AI job losses. 🔗 Source 💡 DMK Insight Sam Altman’s candid admission about feeling useless due to AI advancements highlights a growing sentiment among workers facing job displacement. This isn’t just a personal revelation; it’s a reflection of broader market anxieties regarding AI’s impact on employment. As AI technologies like Codex evolve, they threaten to disrupt various sectors, particularly those reliant on routine tasks. Traders should keep an eye on sectors that could be most affected, like tech and customer service, as they may experience volatility in stock prices as companies adjust to these changes. Moreover, the backlash from users indicates a potential shift in public sentiment towards AI, which could influence regulatory actions. If governments respond with stricter regulations on AI development, it could slow down innovation and affect the growth trajectories of tech companies. Traders might want to monitor key tech stocks for any signs of weakness or strength in response to these developments. Watch for any significant price movements in AI-related stocks, especially if they start breaking key support or resistance levels in the coming weeks. 📮 Takeaway Keep an eye on tech stocks for volatility as AI advancements spark public backlash and potential regulatory changes; watch key support levels closely.

French Police Raid X’s Paris Office in Probe of Grok AI and Illegal Content

The French action comes as investigations into X’s Grok chatbot expand across multiple jurisdictions, including the UK and EU. 🔗 Source 💡 DMK Insight The expansion of investigations into X’s Grok chatbot by French authorities signals a growing scrutiny of AI technologies, and here’s why that matters for traders: regulatory actions can lead to volatility in tech stocks and related sectors. As governments tighten their grip on AI, companies involved in this space may face increased compliance costs and operational hurdles, potentially impacting their bottom lines. For traders, this could mean watching tech stocks closely, especially those heavily invested in AI, as they might experience fluctuations based on news cycles around these investigations. If the scrutiny leads to significant regulatory changes, it could reshape market dynamics, especially for firms like X that are at the forefront of AI development. Keep an eye on related assets, such as software and cloud service providers, which could be affected by shifts in investor sentiment towards AI technologies. In the short term, monitor any announcements from regulatory bodies and the market’s reaction, particularly during earnings reports from major tech players. These developments could create trading opportunities, especially if you can anticipate market overreactions to regulatory news. 📮 Takeaway Watch for regulatory updates on X’s Grok chatbot; they could trigger volatility in tech stocks, especially those in AI, impacting trading strategies.

'We Need a New Path': Ethereum Founder Vitalik Buterin Rips Up L2-Focused Roadmap

Some layer-2 networks have made concessions when it comes to decentralization, Buterin said, and shouldn’t be “branded” as extensions of Ethereum. 🔗 Source 💡 DMK Insight Ethereum’s layer-2 networks are facing a critical identity crisis, and here’s why that matters for traders right now: Vitalik Buterin’s comments highlight a growing concern about decentralization in these networks, which could impact investor confidence. If layer-2 solutions are perceived as too centralized, it might lead to a sell-off in ETH and related assets, especially if traders fear that these networks won’t deliver on their promises of scalability and security. Keep an eye on how this narrative evolves, as it could affect ETH’s price trajectory, currently at $2,236.99. Moreover, if layer-2 networks struggle to maintain their unique value propositions, we could see a shift in capital flows back to ETH itself, potentially pushing it higher. Watch for key support levels around $2,200 and resistance near $2,300. The sentiment around decentralization will be crucial in the coming weeks, especially as traders assess the viability of these layer-2 solutions against Ethereum’s core principles. 📮 Takeaway Monitor ETH’s price around $2,200 for support; a failure to hold could trigger broader sell-offs in layer-2 assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether