Data suggests Bitcoin is unlikely to fall further than its year-to-date low of $74,680. Cointelegraph explains why. 🔗 Source 💡 DMK Insight Bitcoin’s year-to-date low of $74,680 seems like a solid floor, but here’s why traders should be cautious. While the data suggests a strong support level, it’s essential to consider the broader market sentiment and potential external pressures. If Bitcoin approaches this low again, watch for volume spikes or lack of buying interest, which could indicate a breakdown. Additionally, macroeconomic factors like interest rate changes or regulatory news could impact crypto prices significantly. If Bitcoin holds above this level, it could trigger a short-term rally, but if it breaks below, expect heightened volatility and possible cascading effects on altcoins and related markets. Keep an eye on the daily chart for any bearish patterns forming, and monitor the $74,680 level closely. If it fails to hold, traders may want to reassess their positions quickly, especially in leveraged trades. The real story is that while support levels are crucial, they can be tested in turbulent times, so stay alert for any shifts in market dynamics. 📮 Takeaway Watch Bitcoin’s $74,680 support closely; a break below could signal increased volatility and affect altcoins significantly.

Bitcoin hits ‘fire-sale’ value as capital flows capitulate: Bitwise

Bitcoin flashed a major discount signal after capital outflows increased following BTC’s abrupt drop below $75,000. Historical data now points to a potential 10% rebound rally in the short-term. 🔗 Source 💡 DMK Insight Bitcoin’s recent dip below $75,000 is more than just a blip—it’s a potential buying opportunity. With capital outflows increasing, traders should note that historical patterns suggest a possible 10% rebound rally could be on the horizon. This isn’t just about price; it’s about market sentiment shifting. If BTC can reclaim that $75,000 level, it might trigger a wave of buying interest, especially from retail investors looking for a bargain. Keep an eye on the $78,000 resistance level; a breakout there could signal further upside. But here’s the flip side: if BTC fails to hold above $75,000, we could see further selling pressure, which might push it down to lower support levels. Watch for volume spikes as they can indicate whether the rebound is genuine or just a temporary bounce. The next few days will be crucial for determining the short-term direction of Bitcoin. 📮 Takeaway Monitor Bitcoin’s performance around the $75,000 level—holding above it could trigger a 10% rally, while failure may lead to more downside.

$41M in Losses as Crypto Wrench Attacks Hit Record High in 2025

Crypto wrench attacks soared by 75% year-on-year, with France at the epicenter of the crime wave, according to a new report from CertiK. 🔗 Source 💡 DMK Insight Crypto wrench attacks spiking 75% is a wake-up call for traders: security matters more than ever. With France leading this surge, traders need to rethink their security protocols. As the market grows, so does the attention from criminals, and this trend could lead to increased volatility. If exchanges or wallets face breaches, we could see rapid sell-offs, impacting prices across the board. Traders should monitor security updates from platforms they use and consider diversifying their holdings to mitigate risks. The real story here is how these attacks could affect market sentiment, especially if high-profile breaches occur. Keep an eye on news from exchanges and wallets for any security incidents that could trigger market reactions. Watch for shifts in trading volumes or price movements in the wake of any reported incidents, as these could signal broader market implications. 📮 Takeaway Traders should prioritize security measures and watch for any exchange breaches that could trigger market volatility.

Morning Minute: Bitcoin Hit $75k After Weekend Washout

Trump’s Warsh nomination seemingly set off a sell cascade for crypto majors, starting Thursday and running all weekend. 🔗 Source

Russia’s Largest Crypto Miner BitRiver Faces Bankruptcy as CEO Under House Arrest: Report

Court filings show insolvency proceedings against BitRiver’s main owner after years of financial strain and sanctions pressure. 🔗 Source 💡 DMK Insight BitRiver’s insolvency news is a wake-up call for crypto traders: financial strain is real. With SOL currently at $103.88, this development could lead to increased volatility in the broader crypto market, especially for assets tied to mining operations. Traders should keep an eye on SOL’s support levels around $100, as a breach could trigger further selling pressure. This situation might also ripple through related assets, particularly those linked to mining or energy costs. If institutions start pulling back due to perceived risks, we could see a broader market correction. But here’s the flip side: if SOL holds above $100, it could attract bargain hunters looking for a rebound. Watch for trading volumes and sentiment shifts in the coming days to gauge market reactions more accurately. 📮 Takeaway Monitor SOL closely; a drop below $100 could signal increased selling pressure, while holding above may attract buyers.

Tom Lee's BitMine Buys the Ethereum Dip, Even as Unrealized Losses Top $6 Billion

Publicly traded Ethereum treasury BitMine Immersion Technologies is still buying as ETH plunges, despite the firm’s growing losses. 🔗 Source 💡 DMK Insight BitMine’s continued ETH purchases amid falling prices could signal a contrarian play. While many traders might be skittish with ETH at $2,326.91, BitMine’s strategy suggests they see long-term value despite short-term losses. This could indicate a potential bottoming out for ETH, especially if institutional players start to follow suit. Keep an eye on the $2,300 support level; a bounce here could attract more buying interest. On the flip side, if ETH breaks below this level, it might trigger further selling pressure, especially among retail traders. Watch for any news from BitMine regarding their treasury strategy or any shifts in their purchasing patterns. Their actions could influence other institutional players and set the tone for ETH’s next move. 📮 Takeaway Monitor ETH closely around the $2,300 level; a bounce could signal institutional confidence, while a break might lead to increased selling pressure.

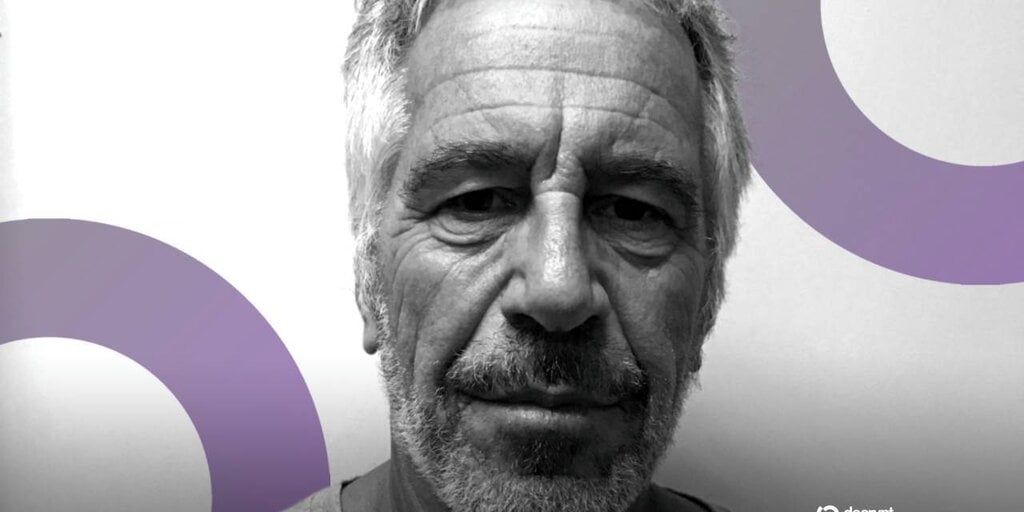

Jeffrey Epstein Was an Early Investor in Coinbase, Emails Reveal

Coinbase co-founder Fred Ehrsam appears to have been personally aware and supportive of the convicted sex offender’s early investment in the company. 🔗 Source 💡 DMK Insight This revelation about Fred Ehrsam’s awareness of a convicted sex offender’s investment in Coinbase raises serious questions about the company’s governance and ethical standards. For traders, this could impact Coinbase’s reputation and stock performance, especially if it leads to regulatory scrutiny or a loss of consumer trust. The crypto market is already sensitive to negative news, and any fallout could result in increased volatility for Coinbase’s stock and the broader crypto sector. Watch for potential price reactions in Coinbase’s shares and related assets like Bitcoin and Ethereum, as sentiment shifts could trigger sell-offs. On the flip side, if Coinbase manages to navigate this situation without significant backlash, it could present a buying opportunity for those looking to capitalize on a dip. Keep an eye on trading volumes and market sentiment over the next few weeks to gauge how this news affects investor confidence. 📮 Takeaway Monitor Coinbase’s stock closely for volatility; any significant drop could signal a buying opportunity if the fallout is contained.

Bitcoin, Ethereum ETF Investments Flip Negative for 2026 as Crypto Funds Shed $1.7B

U.S.-listed crypto funds led withdrawals as Bitcoin and Ethereum prices slid after Donald Trump’s nomination of Kevin Warsh for Fed chair. 🔗 Source 💡 DMK Insight Crypto funds pulling back signals a shift in sentiment, and here’s why that matters: With Bitcoin and Ethereum both seeing price declines, the nomination of Kevin Warsh as Fed chair could be a catalyst for tightening monetary policy, which historically pressures risk assets like crypto. Traders should be wary of potential volatility as institutions reassess their positions. The current ETH price at $2,326.91 is crucial; a sustained drop below this level could trigger further sell-offs, especially if it breaks through key support levels. Watch for reactions from large holders and institutions, as their moves could amplify market trends. On the flip side, this could also present a buying opportunity for those looking to accumulate at lower prices, especially if the market stabilizes around these levels. Keep an eye on the broader economic indicators and Fed communications, as they will likely influence market sentiment in the coming weeks. 📮 Takeaway Monitor ETH closely at $2,326.91; a drop below this level could signal increased selling pressure and volatility.

Strategy's Bitcoin Bet Dips Underwater as Firm Adds to $56 Billion BTC Stash

Strategy’s Bitcoin bet showed losses on paper for the first time in years, as it tumbled below the firm’s average purchase price on Sunday. 🔗 Source 💡 DMK Insight Bitcoin’s recent dip below its average purchase price is a wake-up call for traders. This marks the first time in years that a prominent strategy has shown losses on paper, raising concerns about market sentiment and potential sell-offs. Traders should be cautious as this could trigger a wave of profit-taking, especially if Bitcoin continues to struggle around key support levels. If the price fails to reclaim its average purchase price soon, we might see increased volatility, possibly dragging down altcoins as well. Watch for Bitcoin’s behavior around this psychological level; a sustained drop could lead to cascading effects across the crypto market. On the flip side, this situation could present a buying opportunity for those with a long-term outlook. If Bitcoin stabilizes and rebounds, it might attract fresh capital from investors looking to capitalize on lower prices. Keep an eye on volume trends and sentiment indicators to gauge the market’s next move. 📮 Takeaway Monitor Bitcoin’s average purchase price closely; a failure to reclaim this level could signal increased volatility and potential sell-offs in the broader crypto market.

AceTrader Teams Up With Myriad for $30K Prediction Contest

Myriad users can put their smarts to the test and predict on the AceTrader 100, as elite traders compete for a $1M USDC trade fund. 🔗 Source 💡 DMK Insight The AceTrader 100 competition is a big deal for traders looking to sharpen their skills and potentially earn a hefty reward. With a $1M USDC trade fund on the line, it’s not just about bragging rights; this could attract serious players who might influence market movements. Competitions like this often lead to increased volatility as participants jockey for position, which can create opportunities for day traders and swing traders alike. Keep an eye on the trading volume and price action around the competition dates, as spikes in activity could signal shifts in sentiment or liquidity. Also, consider how this might affect correlated assets—if traders are feeling bullish, we might see upward pressure on major cryptocurrencies or forex pairs as they leverage their strategies in the competition. Watch for any announcements or updates from AceTrader that could impact the competition’s dynamics, as well as the broader market reaction to the event. 📮 Takeaway Monitor trading volume and volatility around the AceTrader 100 competition; it could create actionable opportunities in major crypto and forex markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether