The lawsuit alleges Marc Andreessen sold $118.7 million in Coinbase shares through Andreessen Horowitz, while CEO Brian Armstrong offloaded about $291.8 million. 🔗 Source 💡 DMK Insight Coinbase insiders cashing out big raises eyebrows, and here’s why that matters: With Marc Andreessen selling $118.7 million and CEO Brian Armstrong offloading $291.8 million in shares, traders should be wary of potential insider sentiment impacting SOL’s price. This kind of selling could signal a lack of confidence in the stock’s near-term performance, which could ripple through the crypto market, especially for assets like SOL that are closely tied to Coinbase’s trading volume and overall health. If SOL is currently at $116.52, watch for any significant pullbacks or resistance levels around $110, as these could indicate broader market reactions to insider selling. Keep an eye on trading volumes and sentiment in the coming days, as they could provide clues about whether this selling is a one-off or part of a larger trend. On the flip side, if SOL manages to hold above $115, it could suggest that traders are looking past this insider selling and focusing on the fundamentals. But be cautious—if SOL breaks below that level, it could trigger stop-loss orders and lead to further declines. Watch for any news or developments from Coinbase that might influence market sentiment as well. 📮 Takeaway Monitor SOL closely; a break below $115 could trigger further selling pressure, while holding above that level may indicate resilience despite insider selling.

Crypto billionaires deploy $40M to fight California wealth tax and union power

Ripple co-founder Chris Larsen and venture capitalist Tim Draper are backing Grow California, a new political effort aimed at countering union-backed wealth tax proposals. 🔗 Source 💡 DMK Insight Ripple’s Chris Larsen and Tim Draper’s push against wealth taxes could signal a shift in crypto’s political landscape. This initiative highlights the growing intersection of cryptocurrency and politics, especially as regulatory pressures mount. For traders, this is a reminder that political developments can impact market sentiment and asset valuations. If wealth taxes gain traction, it could deter investment in crypto and other assets, leading to volatility. On the flip side, if this movement successfully rallies support, it could bolster confidence in the crypto sector, potentially driving prices higher. Keep an eye on how this political effort unfolds, as it might influence institutional sentiment and trading strategies in the coming weeks. Watch for any legislative updates or public responses from major crypto players, as these could create significant market reactions. 📮 Takeaway Monitor developments from Grow California, as political shifts could impact crypto sentiment and trading strategies in the near term.

US Treasury sanctions Iran-linked crypto exchanges for first time

The US Treasury has sanctioned two UK-registered crypto exchanges tied to Iran’s financial system, marking the first time Washington has targeted digital asset platforms. 🔗 Source 💡 DMK Insight The US Treasury’s sanctions on UK crypto exchanges linked to Iran are a game changer for the market. This move signals a tightening regulatory environment for crypto, especially as governments ramp up efforts to control illicit financial flows. Traders should be wary of increased volatility in crypto assets, particularly those that may have exposure to these exchanges. It’s also worth noting that this could lead to a ripple effect across other exchanges, as scrutiny intensifies. If you’re holding positions in crypto, keep an eye on regulatory news and be prepared for potential sell-offs or shifts in market sentiment. Watch for key support levels in major cryptocurrencies; a break below these could trigger further selling pressure. On the flip side, this could create opportunities for exchanges that comply with regulations, potentially leading to a flight of capital towards more compliant platforms. Keep an eye on how institutional players react to this news, as their movements could set the tone for the market in the coming weeks. 📮 Takeaway Watch for increased volatility in crypto assets as regulatory scrutiny intensifies; key support levels could be tested in the wake of these sanctions.

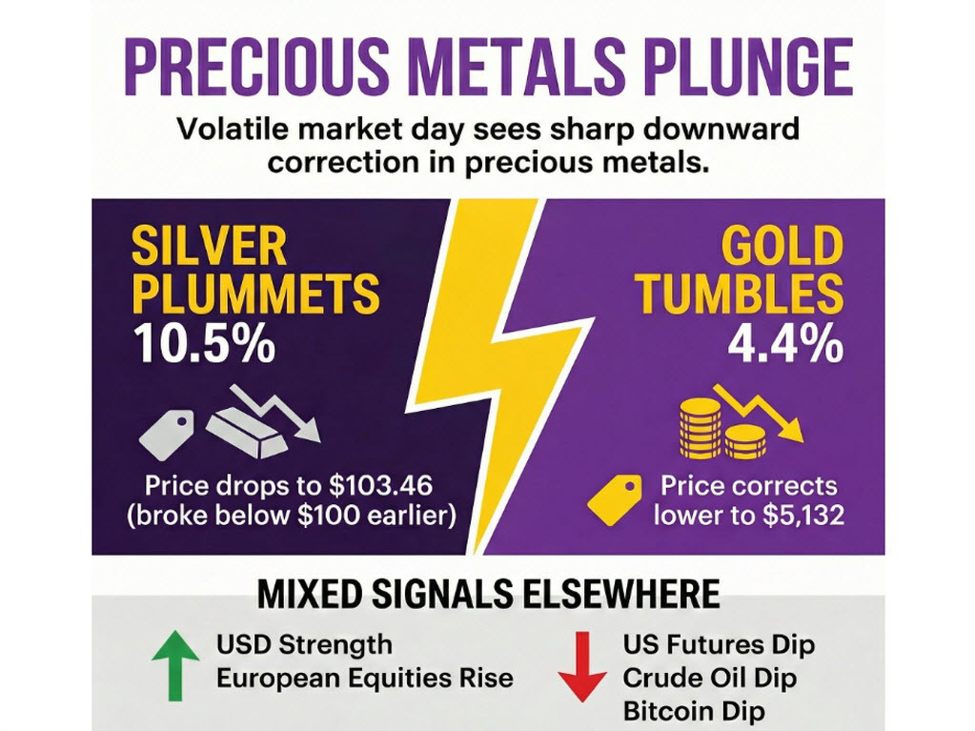

investingLive European markets wrap: Precious metals dive, Trump picks Warsh as Fed chair

Headlines:Silver sinks below $100, gold tumbles below $5,000Precious metals continue to tumble as the heavy selling continuesSilver dropped by more than 20% in just two days amid massive profit-taking. What’s next?Have we reached a short-term top in gold after the sharp swing lower?US futures push lower as the risk mood holds more mixed todayTrump nominates Kevin Warsh to be the next chairman of the Federal ReserveHow have interest rate expectations changed after this week’s events?Bavaria January CPI +2.1% vs +1.7% y/y priorSpain January preliminary CPI +2.4% vs +2.3% y/y expectedGermany Q4 preliminary GDP +0.3% vs +0.2% q/q expectedFrance Q4 preliminary GDP +0.2% vs +0.2% q/q expectedSpain Q4 preliminary GDP +0.8% vs +0.6% q/q expectedItaly Q4 preliminary GDP +0.3% vs +0.2% q/q expectedEurozone consumer inflation expectations rise to the highest level since the survey beganMarkets:Precious metals in the spotlight as gold and silver tumble hard, correcting lowerGold down 4.4% to $5,132 with the low breaking under $5,000 earlierSilver down 10.5% to $103.46 with the low breaking below $100 earlierUSD leads, JPY lags on the dayDollar steadier amid selling in precious metals and traders digesting Kevin Warsh being Trump’s Fed chair pickEuropean equities higher across the board; S&P 500 futures down 0.3% but well off earlier lows of a decline of 0.9%WTI crude oil down 0.5% to $65.10Bitcoin down 2.0% to $82,724What a wild end to the week it’s all setting up to be. The showstoppers today are once again the same as it has been all through this month, that being precious metals. Gold and silver both tumbled hard today amid a further run of profit-taking after the warning from yesterday already.Gold dropped by over 7% at one point, poised for its worst day since April 2013 with the fall breaking under $5,000. That before a slight recovery now to be down 4.4% to $5,132 with volatile swings still persisting. Meanwhile, silver crashed hard by over 16% at the lows in a break below $100 before some light recovery again to around $103 levels now – still down over 10% on the day.The moves are coming at neck-breaking speeds, with extreme volatility kicking into gear for precious metals as January comes to an end.That’s having some reverberations elsewhere too with the dollar holding firmer across the board. However, the greenback is seeing gains trimmed during the session and also right as Trump announced Kevin Warsh as his pick for the next Fed chair.EUR/USD dipped down to around 1.1900 earlier before recovering to 1.1940 now, down 0.2% on the day. USD/JPY is seen up 0.5% to 153.85 but off earlier highs above 154.00 with yen-tervention risks still in play.Meanwhile, USD/CAD is seen up 0.1% to 1.3505 and AUD/USD down 0.3% to 0.7020 with the dollar seeing gains ease a little from earlier.In the equities space, things were also quite nervy amid all the chaos that is going on. European indices held calmer in rebounding from yesterday’s losses. But US futures were struggling earlier amid the unsettling mood in precious metals, with S&P 500 futures dropping by as low as 0.9% at one point. That before a slight recovery now to be down just 0.3% on the day.In terms of data releases, there were quite a handful in Europe but all overshadowed by other market happenings. Euro area Q4 GDP reaffirmed more resilience in the economy towards the end of last year while early indications from Germany and Spain suggest that inflation pressures are still keeping more stubborn to start the new year.It’s now back to gold and silver watch again in US trading later before the weekend. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight Silver’s plunge below $100 and gold’s drop below $5,000 signal a critical shift in precious metals. The recent 20% drop in silver over just two days is a stark reminder of how quickly sentiment can shift, especially amid profit-taking. Traders should be wary of the potential for further declines if selling pressure persists. This sharp sell-off could indicate that we’ve hit a short-term top for gold, especially if it fails to reclaim the $5,000 level. Watch for key support levels; if silver breaks below $80, it could trigger more selling as traders reassess their positions. On the flip side, this could present a buying opportunity for contrarian traders if they believe the long-term fundamentals for precious metals remain intact. Keep an eye on US futures as they could influence market sentiment further, especially if risk appetite continues to wane. The immediate focus should be on how these metals react in the coming days, particularly around the $5,000 mark for gold and $80 for silver. 📮 Takeaway Watch for silver’s support at $80 and gold’s resistance at $5,000; a break below these levels could trigger further selling pressure.

Germany January preliminary CPI +2.1% vs +2.0% y/y expected

Prior +1.8%HICP +2.1% vs +2.0% y/y expectedPrior +2.0%Core CPI Y/Y +2.5% vs +2.4% priorFull report hereSlightly higher than expected figures but won’t change anything for the ECB. Policymakers have repeatedly said that they won’t respond to small or short-term deviations from the 2% inflation target.The euro’s strength recently has caught the ECB’s attention as it crossed the 1.20 level against the dollar. Policymakers have mentioned that in case euro’s appreciation starts to negatively affect inflation, it will have consequences for monetary policy, suggesting a potential rate cut.Traders will keep a close eye on the euro, on Eurozone inflation and policymakers’ signals in the next months.There’s been minimal market reaction to the data as it doesn’t change anything for the future interest rates outlook. The focus will now turn to the US Dollar as we get many top tier economic reports next week that will culminate with the US NFP on Friday. Strong data is likely to trigger a relief rally in the greenback, while soft figures could keep on weighing on it. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight Inflation data just came in slightly higher than expected, but here’s why it won’t shake the ECB’s resolve. With HICP at 2.1% and Core CPI at 2.5%, these numbers are above expectations yet still within the ECB’s tolerance. Traders should note that the central bank has been clear about not reacting to minor fluctuations around the 2% target. This means the euro’s recent strength could continue, as the ECB’s stance suggests no immediate tightening is on the horizon. For day traders, this could mean a stable euro against major pairs, while swing traders might want to watch for any shifts in sentiment if inflation trends persist. However, there’s a flip side: if inflation continues to rise, even slightly, it could pressure the ECB to reconsider its position. Keep an eye on the euro’s performance around key technical levels, particularly if it approaches resistance or support zones. Watch for any shifts in market sentiment that could suggest a change in ECB policy, especially in the coming weeks as more data rolls in. 📮 Takeaway Monitor the euro’s strength against major pairs; any sustained inflation increase could shift ECB policy, impacting trading strategies.

US December PPI final demand Y/Y +3.0% vs +2.7% expected

Prior was +3.0%PPI M/M +0.5% vs 0.2% expectedPrior +0.2%Core PPI Y/Y +3.3% vs +2.9% expectedPrior +3.0% (revised to 3.1%)Core PPI M/M +0.7% vs +0.2% expectedPrior +0.0%These are much higher than expected figures and we’re seeing a hawkish reaction in the markets with upside in the dollar and Treasury yields, and downside in stocks and precious metals.The agency notes that the December increase in prices for final demand can be traced to a 0.7-percent advance in the index for final demand services. Prices for final demand goods were unchanged.Fed Chair Powell mentioned that they expect the Core PCE Y/Y to be around 3.0% in December. This PPI report is unlikely to trigger big market moves as we await next week’s data, with the US NFP report being the main highlight.The market is pricing 52 bps of easing by year and that’s unlikely to change much with this report. The Fed upgraded the current economic outlook in their last policy statement to reflect the improvement in the data. In December, the Fed projected just one cut in 2026, so we will need more labour market deterioration or bigger than expected fall in inflation to see them going faster on rate cuts.WHAT THE US PPI MEASURES?The Producer Price Index (PPI) is an economic indicator that measures the average change over time in the selling prices received by domestic producers for their output. In simpler terms, it tracks inflation from the perspective of the seller/business rather than the consumer like the Consumer Price Index (CPI). This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight PPI numbers just came in hotter than expected, and here’s why that matters: inflation pressures are back on the table. With the Core PPI Y/Y at 3.3% versus the 2.9% forecast, traders should brace for potential Fed action. The immediate market reaction has been a strengthening dollar and rising Treasury yields, which could signal a shift in risk sentiment. If the dollar continues to gain, it might pressure commodities and emerging markets, particularly those sensitive to currency fluctuations. Watch the 10-year Treasury yield closely; a sustained move above recent highs could indicate a longer-term trend shift. But don’t overlook the flip side—if the Fed does tighten, it could slow economic growth, impacting equities. Keep an eye on the S&P 500 and key support levels; if it breaks below recent lows, it could trigger a wave of selling. The next few days will be crucial as traders digest these numbers and adjust their positions accordingly. 📮 Takeaway Monitor the 10-year Treasury yield for signs of sustained upward movement, as it could indicate a shift in market sentiment and impact equities significantly.

Canada GDP for November +0.0% vs +0.1% expected

Prior -0.3%December preliminary GDP +0.1%StatCan notes that Real GDP was essentially unchanged in November following a 0.3% decline in October, as contractions in goods-producing industries offset expansions in services-producing industries.Goods-producing industries declined 0.3% in November, down for the third time in four months, driven by contractions in the manufacturing and agriculture, forestry, fishing and hunting sectors in the month. Services-producing industries edged up 0.1%, with expansions in the retail trade, educational services and transportation and warehousing sectors. Overall, 10 of the 20 industrial sectors grew in November.What does the monthly GDP measure?In Canada, the Monthly GDP is a measure of the country’s economic output by industry (Real GDP by Industry). Unlike many other countries that only report GDP quarterly, Statistics Canada releases this data every month to provide a more frequent “pulse check” on the economy.Statistics Canada breaks the report down into two main sectors:Goods-Producing Industries: Includes manufacturing, construction, and mining/oil & gas. This sector has been volatile lately due to shifting trade policies and energy prices.Services-Producing Industries: Includes retail, healthcare, and professional services. This usually provides the “floor” for the economy, though it has slowed as consumers pull back on spending. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight Canada’s GDP stagnation is a red flag for traders: here’s why. The latest data shows a 0.1% increase in December GDP, but with November’s real GDP unchanged after a 0.3% drop in October, the underlying trend is concerning. Goods-producing sectors are struggling, down 0.3% for the third time in four months, primarily due to manufacturing woes. This stagnation could signal broader economic weakness, impacting consumer sentiment and spending. For traders, this means keeping an eye on the Canadian dollar and related forex pairs, especially if the Bank of Canada reacts with dovish policies. Look for key support levels in USD/CAD around recent highs, as any further economic deterioration could push the loonie lower. But don’t overlook the potential for a bounce-back in services, which could provide a counterbalance. If services can sustain growth, it might mitigate some of the negative sentiment. Watch for upcoming economic indicators and central bank commentary that could shift market expectations. The immediate focus should be on how these GDP figures influence the Bank of Canada’s next moves, especially in the context of inflation and interest rates. 📮 Takeaway Monitor USD/CAD closely; if Canadian GDP trends worsen, expect potential weakness in the loonie, especially if the Bank of Canada signals dovishness.

Fed's Bostic: I want clear evidence of a return to 2% inflation

Federal Reserve Bank of Atlanta President Raphael Bostic signaled a firm stance on monetary policy, suggesting the central bank should remain patient and restrictive as the path to 2% inflation remains clouded by potential price shocks.Despite market hopes for a faster easing cycle, Bostic’s recent commentary paints a picture of a cautious central bank grappling with persistent price pressures and a shifting economic landscape.Bostic expressed clear frustration with the current state of price stability, noting that inflation has been “stuck in place” for two years. He emphasized that the Fed is still waiting for “clear evidence” of a return to the 2% target.A significant headwind in this battle is the looming impact of trade policy. Bostic highlighted that tariff effects have yet to fully filter through to consumer prices, with expectations that these impacts will persist through the first half of 2026. Consequently, he expects inflation to “mark time” for the majority of this year.In light of these risks, Bostic argued against immediate rate cuts. The Fed needs to remain “somewhat restrictive” to ensure inflation doesn’t become entrenched. A “two-cut” scenario is not his baseline expectation, given how stubborn inflation has proven to be.While he acknowledges that inflation and employment risks are currently in balance, he noted that “downside risk to employment is much further away now,” giving the Fed more room to focus on prices. “The Fed does not need to be moving down right now. We still have ways to go on inflation and need to remain vigilant.”Regarding the Fed’s balance sheet, Bostic advocated for a “Treasury-only” approach. He suggested the Fed should exit its holdings of Mortgage-Backed Securities (MBS) and eventually allow the balance sheet to grow organically in line with the broader economy.Bostic also addressed the incoming leadership changes and the nomination of Kevin Warsh. While calling Warsh “thoughtful,” Bostic reminded observers that the Federal Open Market Committee (FOMC) is a collective body. “Every chair comes with a view,” he noted, but ultimately, rate decisions are the product of a 12-person consensus, safeguarding the Fed’s institutional independence. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight Bostic’s comments are a wake-up call for traders banking on quick rate cuts. His insistence on a patient and restrictive approach highlights the Fed’s commitment to controlling inflation, which could keep interest rates elevated longer than anticipated. This stance contradicts the market’s optimistic outlook, where many were betting on a more dovish pivot. If inflation data continues to show volatility, we could see increased pressure on equities and risk assets, as higher rates typically dampen growth prospects. Watch the S&P 500 closely; a sustained break below key support levels could trigger further selling. On the flip side, this could create opportunities in sectors that thrive in a high-rate environment, like financials. Keep an eye on upcoming inflation reports and Fed speeches for any shifts in tone. The real story is whether the market can digest this hawkish narrative without a significant pullback. 📮 Takeaway Traders should monitor the S&P 500 for key support levels; a break could signal broader market weakness amid Bostic’s hawkish stance.

Fed's Waller: Dissented in favour of rate cut because policy remains too much restrictive

Federal Reserve Governor Christopher Waller maintains his dovish stance, explaining why he dissented in favor of a 25 bps cut at the latest policy meeting. Waller’s stance underscores a growing concern that the central bank’s current restrictive policy is stifling economic activity despite superficially solid growth figures.Waller’s primary concern lies in a unhealty labor market. While headline economic growth remains steady, he argues that underlying demand is weakening. He warned that the market should prepare for significant downward revisions to last year’s data, suggesting that “payroll growth in 2025 was virtually unchanged”.Looking ahead, Waller sees more weakness for 2026 due to reports of multiple planned workforce reductions. He is skeptic regarding the potential for new job creation and sees a “significant risk” of a substantial deterioration in employment conditions.Waller judges the current federal funds rate range of 3.50–3.75% is far too restrictive. To prevent weakness, he advocates for a quick shift toward a neutral policy, positioning the target rate closer to 3%.Addressing the recent uptick in prices, Waller noted that while tariffs have elevated headline inflation, the underlying trend remains positive. He says that inflation excluding tariff effects is already near the Fed’s 2% target and because long-term inflation expectations remain stable, Waller argues that monetary policy should “look through” the temporary noise of trade-related price hikes and focus on the cooling labor market.Full speech here This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source

Tech stumbles while telecom soars: Today's market dynamics

Sector OverviewThe U.S. stock market presents a diverse range of performances today, with notable swings across sectors. Technology is painting a mixed picture; software infrastructure like Microsoft (MSFT) is up 0.59%, whereas semiconductor giant Nvidia (NVDA) remains almost flat at -0.06%. Meanwhile, Advanced Micro Devices (AMD) struggles, plunging by 4.84%.Telecommunications emerge as the day’s winner, with T-Mobile (TMUS) climbing 1.47% and Verizon (VZ) surging 4.07%. The sector benefits from consistent demand and potential market optimism regarding upcoming developments.Market Mood and TrendsToday’s market exhibits a mixed sentiment, with a cautious eye on technology amidst broader economic uncertainties. Investors are reacting to data releases and are likely balancing portfolios accordingly, given the tech sector’s volatility.The decline in semiconductors, led by AMD’s substantial drop, may point to concerns over supply chain disruptions or competitive pressures.Strategic RecommendationsInvestors are advised to focus on telecommunications as a stable sector amid volatility. The solid performance of TMUS and VZ suggests potential opportunities for those seeking growth and income stability.Monitor the technology sector closely, particularly semiconductors, for any news on supply chain improvements or further market shifts that could present opportunities.Diversification is key during these fluctuating times, as different sectors respond differently to economic cues. Staying informed with real-time market data and insights is crucial for adapting strategies effectively. This article was written by Itai Levitan at investinglive.com. 🔗 Source 💡 DMK Insight AMD’s 4.84% drop is a red flag for tech traders, signaling potential sector weakness. While Microsoft shows modest gains, Nvidia’s flat performance suggests a lack of momentum in semiconductors. This divergence could indicate that traders are rotating out of high-flying tech stocks into more stable options. For those in the semiconductor space, AMD’s decline could be a warning sign; if it breaks below recent support levels, it might trigger further selling. Keep an eye on the broader tech sector’s performance as it could influence related stocks. Watch for AMD to hold above key support levels to avoid a deeper correction, and consider how this might impact ETFs or funds heavily invested in tech. If the trend continues, it could lead to a broader market pullback, especially if other sectors start to follow suit. 📮 Takeaway Monitor AMD’s support levels closely; a break could signal further declines in tech stocks, impacting related sectors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether