The S&P 500 is off to a flyer this year, but beneath the surface of the headline index, a handful of names are absolutely ripping. While the broader market debates the “soft landing” versus “no landing” scenarios, these 25 stocks have already cleared the +20% hurdle less than a month into the year.The clear standout is Sandisk ($SNDK), which has nearly doubled in value (+99.6%) following a massive re-rating in the storage and memory space. It’s not alone; the semiconductor and equipment trade is dominating the leaderboards, with Micron (+40%), Western Digital (+37.2%), and Lam Research (+27.3%) all riding the wave of high-performance computing demand.Here is a look at the top performers so far this year:Intel was near the top of this list until Friday’s nearly 20% decline. That’s a demonstration of the risk of wading into some of these volatile stocks.More importantly, what does the return of those stocks tell us about how they will do the rest of the way? Here is a look at some of the top performers in January 2025?As we’ve seen many times in markets, winners tend to keep on winning. That said, the top performer in 2024 in January was Super Micro (SMCI) with an 89% gain but over the remainder of the year, it gave much of it back. Nvidia though gained 24% and went into gain 171%.What you’re looking for here are lasting themes and the question is whether you like the memory supply cruch? Higher US defense spending? Moderna making an MRNA breakthrough including with a better seasonal flu vaccine? Oil services? Gold? Lithium? Electricity?To me, many of those themes sound tired, but you could say the same about Nvidia and AI in early 2024.For reference, the 2025 winners and how they later did: This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight The S&P 500’s strong start is masking significant divergences in stock performance, and here’s why that matters: While the index is up, individual stocks are showing explosive gains, with 25 names already surpassing the +20% mark. This could signal a rotation into riskier assets as traders seek higher returns, especially if the ‘soft landing’ narrative gains traction. For day traders and swing traders, this presents a ripe opportunity to identify momentum plays. Keep an eye on SOL at $122.43; if it breaks above recent resistance levels, it could attract more buyers. Conversely, if the broader market sentiment shifts towards caution, these high-flying stocks might face sharp corrections. It’s worth noting that while the S&P 500 reflects overall market health, the underlying volatility in individual stocks could lead to rapid price swings. Traders should monitor key technical indicators, such as moving averages and RSI levels, to gauge entry and exit points. Watch for any shifts in economic data that could impact sentiment—especially around inflation and interest rates—as these could trigger broader market reactions. 📮 Takeaway Watch SOL closely; a break above $125 could signal further upside, while any weakness in the S&P 500 might lead to a pullback in high-flying stocks.

investingLive Asia-pacific market news wrap: USD/JPY falls through 154, gold breaks $5000

USD/JPY falls to a fresh low as official sees a “high sense of urgency”Australia is closed today for Australia Day but AUD hits the highest in 15 monthsGold blasts through $5000 to all time high. What to look for nextChinese President Xi Jinping launched the largest military purge in yearsJapan PM Takaichi Sunday yen verbal intervention. Follows USD/JPY Friday rate check slam.Markets:Gold up $89 to $5071Silver up 4.6% to $107.70WTI crude up 12-cents to $61.19S&P 500 futures down 20 pointsJapan 10-year yields down 1.4 bpsJPY leads, USD lagsIt was a dramatic start to the trading week as USD/JPY fell nearly 200 pips and broke through 154.00. Note that the pair was above 159 on Friday before the dramatic reversal on various reports/rumors of a rate check. That was followed up today and on the weekend by more signs of verbal intervention as Takaichi ahead of the Feb 8 election.What further weighed on the US dollar was that the odds of a US government shutdown rose after a tragic weekend in Minnesota. That’s something of a wild card but it underscores the divisions in US politics that are certainly adding some angst. A big beneficiary of that is the precious metals complex as gold broke through $5000 for the first time and promptly added nearly $100 more. Silver also cruised through $100 to as high as $109.77 before some minor profit taking.Adding to the sense of unease was a major military purge by China’s Xi on the weekend, including the top uniformed military official and a member of the Politburo. So far that hasn’t hit Chinese stock markets but it’s a sign of a tumultuous world.Australian was on holiday but that didn’t stop AUD/USD from rising to a fresh 15 month high.US equity futures opened sharply lower but halved the decline in fairly short order and are now trading down just 0.3%. Eyes will be on a heavy slate of earnings this week. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight The USD/JPY’s fresh low signals a critical shift in market sentiment, especially with Japan’s officials emphasizing urgency. This decline could be linked to broader economic concerns, particularly as the AUD rallies to a 15-month high, suggesting a shift in risk appetite among traders. With gold breaking through $5000, it’s clear that investors are seeking safe havens amid geopolitical tensions, especially with Xi Jinping’s military purge adding to uncertainty. Traders should watch for potential support levels in USD/JPY, as further declines could trigger stop-loss orders and exacerbate the move. On the flip side, the AUD’s strength might attract attention from those looking to capitalize on commodity-linked currencies. Keep an eye on the upcoming economic data releases that could influence these trends, particularly any statements from the Bank of Japan regarding monetary policy adjustments. 📮 Takeaway Watch for USD/JPY support levels as further declines could trigger stop-loss orders; also monitor AUD’s strength against commodity trends.

Japanese yen pushes higher as intervention risks mount

The first supposed ‘rate check’ took place in European trading on Friday and then there was another late on in US trading. Although on the latter, the dollar was already crumbling across the board so USD/JPY traders also took that as a sign to abandon long positions. The nerves are continuing to Asia trading today with the pair opening with a sharp gap lower of roughly 100 pips.The selling has continued since the open, with the pair now down 1% to near 154.00. That’s the lowest level since mid-November last year with the 100-day moving average nearby now at 153.55. For some context, the pair hasn’t tested any of its key daily moving averages since September last year. That reflects on the Takaichi trade for the most part, after she officially won the prime minister race in October.After the ‘rate check’ on Friday, markets know very well that actual intervention is on the cards next. That was the case back in September 2022 and July 2024. So, that’s likely causing those piling on yen shorts to rush for the exits.Adding to the positive news for the yen today is Japan prime minister Takaichi seeing a drop in approval ratings ahead of the snap election.Her administration’s public approval rating in a survey via the Nikkei newspaper dropped to 67% from 75% in December. And that’s the first time the figure dipped below 70% since she took over as prime minister in October.Meanwhile, a separate poll by Kyodo news showed her approval rating declining to 63% from 68%. And another one from the Mainichi newspaper showed a drop to 57% from 67% before.As a reminder, Takaichi’s goal in calling for the snap election is to consolidate power. But evidently, her economic and fiscal plans are being met with heavy and growing skepticism it would seem. Fears continue to grow over her proposed stimulus package, with worries that it won’t be enough to address the cost of living crisis among Japanese households.Then, there’s also market concerns that the additional debt that the government will be taking on will break the bond market – more so than it already has.So, that’s setting the stage for how things are going to play out this week with traders surely expecting possible action if USD/JPY continues to keep on the higher side. As a reminder, the pair is still up ~650 pips following the gap higher in the early stages of October last year. This article was written by Justin Low at investinglive.com. 🔗 Source

US futures see nervous start to the week, big tech earnings in focus

It’s a nervous start to the week in the equities space as risk trades are reserving some caution amid the madness elsewhere. The Japanese yen is a key focus point with intervention risks on the extreme while precious metals continue to fly as the parabolic move continues. All of this with the dollar continuing to be bashed across the board as well.What a truly wild first month of 2026 this has been.Amid the chaotic start to this week as well, stock futures down with Asian indices also keeping lower as we approach the closing stages. Geopolitical tensions remain in the picture as well but at least for now, we’re not seeing much escalation.S&P 500 futures are down 0.2% but that’s a stark improvement after having opened with a gap down of nearly 1%. Nasdaq futures are down 0.3% while Dow futures are also down 0.2%, reaffirming the slightly softer sentiment for now.While other market happenings, geopolitical issues, and also the Fed will factor into the equation this week, perhaps the most important thing on the agenda for Wall Street will be key earnings releases. And this week, we’ll get four of the Magnificent 7 reporting. So, that’s quite the blockbuster list of companies reporting right there.On Wednesday, we’ll get Microsoft, Meta, and Tesla all after the close. And on Thursday, Apple will be the one reporting after the close.Big tech aside, there are also other notable names reporting this week with it being the second busiest week in terms of the Q4 earnings schedule. The likes of Boeing, UnitedHealth, ASML, Visa, Mastercard, and Exxon Mobil are all also set to report.And don’t forget, there’s also month-end flows to factor into the picture with it being the final trading week of January. So, strap yourselves in. It’s going to be quite the ride for markets this week. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight Equity markets are feeling the jitters, and here’s why that matters: risk sentiment is shifting as traders eye the Japanese yen and precious metals. With intervention risks looming for the yen, traders should be on alert for volatility spikes. The Bank of Japan’s potential actions could lead to significant moves, especially if the yen breaks key support levels. Precious metals are on a tear, indicating a flight to safety, which could further pressure equities. If gold and silver continue their upward trajectory, we might see a broader risk-off sentiment that could drag down stocks. Keep an eye on the daily charts for the yen around critical levels, as a decisive move could set the tone for the week. But don’t overlook the flip side: if the yen stabilizes or strengthens, it could provide a temporary boost to equities, especially in export-driven sectors. Watch for any comments from central banks that could shift this dynamic quickly. 📮 Takeaway Monitor the Japanese yen closely for intervention signals; a break below key support could trigger broader market volatility this week.

FX option expiries for 26 January 10am New York cut

There aren’t any major expiries to take note of on the day, with the full list seen below.Trading sentiment continues to revolve around the same factors from Friday last week. The Japanese yen is in its own world, with traders needing to deal with intervention risks bordering on the extreme now. That especially after the suspected ‘rate check’ from Tokyo at the end of last week.As a reminder, previous episodes in July 2024 and September 2022 did result in actual intervention after. So, there’s certainly an element of danger and USD/JPY longs are in a race to the exits now in trying to cover their positions.For other dollar pairs, it’s a rather straightforward driver with it being the greenback itself. The dollar is struggling across the board as the debasement trade continues to run alongside the continued de-dollarisation narrative in general. The erratic and uncertain US administrative policies to start the year all but serves as a reminder to that.And as such, that’s sending the precious metals trade into overdrive as well. Today, we’re seeing gold soar above $5,000 quite comfortably and silver also cruising past the $100 mark without any hesitation or profit-taking. Just be wary though that these moves are really running parabolic and while I am an advocate for precious metals, to imagine this kind of start to the year is really something else. Absolutely bewildering.So, that leaves us to where we are now to start the new week. But later on in the coming sessions, just be wary of month-end flows as well with this being the final trading week of January.For more information on how to use this data, you may refer to this post here.Head on over to investingLive (formerly ForexLive) to get in on the know! This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight The lack of major expiries today means traders can focus on existing trends without distraction. With the Japanese yen facing extreme intervention risks, volatility could spike unexpectedly. Traders should keep an eye on how the yen reacts to any news from the Bank of Japan, as this could influence broader market sentiment. If the yen weakens significantly, we might see a ripple effect across related currencies and commodities, particularly if risk-off sentiment takes hold. Watch for key levels in the yen, as breaks could signal larger moves in forex pairs like USD/JPY or EUR/JPY. Given the current trading sentiment, which is still influenced by last week’s developments, it’s crucial to stay alert for any sudden shifts that could impact your positions. 📮 Takeaway Monitor the Japanese yen closely for intervention signals, as volatility could impact related forex pairs significantly this week.

Chinese airlines extend free cancellation for Japan flights as tensions linger

With all else that is going on in the world, it’s easy to forget that China and Japan are still in the midst of a political spat since the latter stages of last year. As a reminder, all of this came about after Japan prime minister Takaichi took office. And she was quoted in saying that a Chinese attack on Taiwan could constitute an “existential crisis” for Japan, in which they be allowed to take military action for self-defense.Naturally, that didn’t go down well with Beijing – not least with Tokyo trying to meddle with the affairs in Taiwan. This has resulted in China hitting back at Japan by asking citizens not to travel to Japan and also afterwards leading to stricter export controls of dual-use items and rare earth minerals.The former looks to be continuing with the media outlet above reporting that Chinese airlines are extending free cancellations for flights to Japan up until 24 October. All this as part of Beijing’s push to not want to support the Japanese economy as the diplomatic row continues.As for the latter i.e. rare earth minerals ban, this isn’t the first involving China and Japan. As a reminder, the two also fought over the long-contested Senkaku Islands dispute over a decade ago and that resulted in Beijing undertaking an undeclared ban on rare earth exports to Japan.In response, Tokyo sought to diversify their reliance on Chinese rare earth minerals and made a deal with Australia after. And that in turn resulted in the Lynas project that is stationed in Malaysia. The rare earth minerals processing plant there is the largest outside of China, which has made it an attractive and strategic point of interest that even saw US president Trump step in last year. This article was written by Justin Low at investinglive.com. 🔗 Source

US Dollar tumbles across the board as USD/JPY rate checks rattle markets: More pain ahead?

FUNDAMENTAL OVERVIEWUSD:The US Dollar sold off across the board on Friday following rumours of the NY Fed conducting rate checks on the USD/JPY pair. The market took that as a signal of a potential intervention to strengthen the Japanese Yen and the unwinding of positions weighed on the greenback. This wasn’t a fundamental-driven move but a “technical” one. In general, such reactions are eventually faded in the following days. The problem for the dollar is that there’s no strong reason for it to appreciate yet. This week, we have the FOMC decision on Wednesday where the central bank is expected to keep interest rates unchanged and maintain a data-dependent approach for the next rate cuts. There shouldn’t be any surprise at this meeting. February might be key for the US Dollar as we get another set of economic data, with the NFP report likely being pivotal for the market pricing. In fact, we’ve been seeing notable improvements in the US Jobless Claims data that could point to a re-acceleration in the labour market. The market is still pricing 48 bps of easing by year-end. Those bets are likely to be pared back in case the data strengthens and should provide support for the greenback.EUR:On the EUR side, Trump scrapped his tariffs threat after he reached a “framework” of a deal for Greenland in Davos, so that growth risk got priced out. In terms of monetary policy, the ECB remains in a neutral stance reaffirming its data-dependent and meeting-by-meeting approach to policy decisions. ECB members continue to repeat that the current policy is appropriate, and they won’t respond to small or short-term deviations from their 2% target. The data has been supporting the central bank’s neutral stance, with inflation data recently surprising to the downside and PMIs showing a bit of a slowdown. EURUSD TECHNICAL ANALYSIS – DAILY TIMEFRAMEOn the daily chart, we can see that EURUSD rallied hard last week and almost reached the cycle high around the 1.1918 level. This is where we can expect the sellers to step in with a defined risk above the cycle high to position for a drop into the 1.14 handle. The buyers, on the other hand, will want to see the price breaking higher to increase the bullish bets into the 1.23 handle next.EURUSD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAMEOn the 4 hour chart, we can see more that we have an upward trendline defining the bullish momentum on this timeframe. From a risk management perspective, the buyers will have a better risk to reward setup around the trendline to position for a rally into new highs. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 1.14 handle next.EURUSD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAMEOn the 1 hour chart, we can see that we have the gap acting as support. The buyers will likely step in here with a defined risk below the gap to keep pushing into new highs, while the sellers will look for a break lower to extend the pullback into the trendline. The red line define the average daily range for today. UPCOMING CATALYSTSTomorrow we have the weekly US ADP jobs data and the US Consumer Confidence report. On Wednesday, we have the FOMC policy announcement. On Thursday, we get the latest US Jobless Claims figures. On Friday, we conclude the week with the US PPI report. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight The USD’s recent sell-off signals potential volatility ahead, especially for pairs like USD/JPY. With the NY Fed’s rumored rate checks, traders should brace for intervention risks that could impact not just the Yen but also correlated assets like cryptocurrencies. If the USD continues to weaken, we might see a bullish trend in crypto assets like SOL, currently at $122.46, as investors seek alternatives. Watch for key support levels in the USD/JPY pair; a break below recent lows could trigger further selling pressure on the dollar. Keep an eye on the broader economic indicators, especially any Fed commentary that could hint at future monetary policy shifts. This environment could create opportunities for swing traders looking to capitalize on short-term fluctuations in both forex and crypto markets. 📮 Takeaway Monitor the USD/JPY pair closely; a significant break below recent support could lead to increased volatility in SOL and other assets.

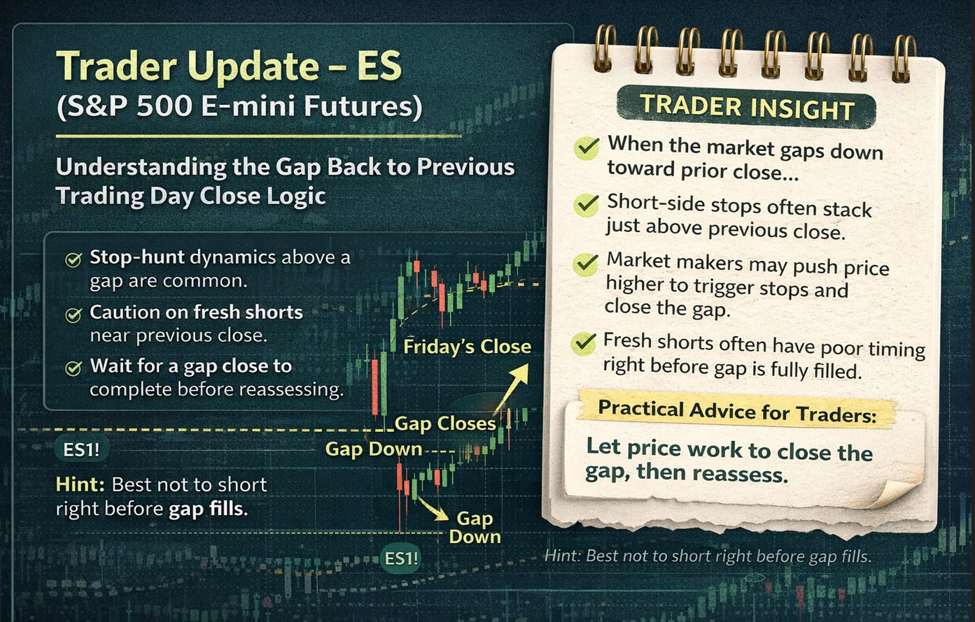

S&P 500 Technical Analysis After Today's Gap Down

S&P 500 Technical Analysis After the Gap Down at This Week’s Open – Why Traders Needed Patience Near Friday’s CloseThe S&P 500 opened the new trading week on Monday, January 26, 2026, with what looked like a scary gap down. From Friday’s close near 6,933.75, futures briefly dropped to around 6,879, a move of more than 50 points.For many traders, that kind of opening move immediately triggers fear, urgency, and short-selling instincts.But this is exactly where a solid technical map matters.Instead of reacting emotionally to the size of the gap, experienced traders focus on key technical junctions, how price behaves around them, and what that behavior tells us about probability. In this case, the early price action delivered an important lesson about gap dynamics, liquidity, and why shorting too early is often a mistake.Why the Previous Trading Day Close Matters After a Gap DownWhen markets gap down at the open, especially after a weekend, many traders talk about “yesterday’s close.” In reality, the reference point is the previous trading day close, which in this case was Friday, since Sunday trading was closed.As price moved higher during Monday’s session, futures were still slightly below Friday’s close, shown by the small negative percentage on the chart. That detail matters more than it may seem.Here is why.After a gap down, a common pattern unfolds:Some traders short the market early, assuming momentum will continue lowerOthers wait for a partial retracement and then enter shortsMany of those shorts place their stop-loss orders just above Friday’s closeThis creates a clear liquidity pocket above the previous close. Market participants with size, including algorithms and market makers, are well aware of this behavior.Liquidity attracts price.Stop-Hunt Dynamics Near the Gap FillAs price grinds higher toward the previous close, two forces often combine.First, stop-hunt dynamics come into play. When stops are clustered just above a well-known reference level like Friday’s close, it becomes easier for price to push slightly higher, close the gap, and even overshoot briefly. That move clears out short positions and releases liquidity into the market.Second, natural dip buying often joins the move. Some buyers are not thinking about stops at all. They are responding to technical structure, support, or broader trend context and simply see value.When these forces align, the probability of a full gap close increases sharply.This is why shorting the market right before a gap is filled is often poor timing. Even if the broader outlook later turns bearish, the risk-reward at that moment is usually unfavorable.Technical Structure That Supported BuyersBeyond gap mechanics, the chart itself provided several constructive signals.The gap down landed directly on a retest of a bullish structure, including a channel and a bull flag. That retest held cleanly, and buyers stepped in decisively.There was also an anchored VWAP reference from a prior contract rollover period. Notably, buyers did not even allow price to reach that VWAP level before stepping in. That behavior often signals urgency from buyers, not weakness.Another subtle but important detail was the formation of a higher low. The most recent low was slightly higher than the previous one, and neither touched VWAP. This tells us buyers were willing to defend price earlier and earlier, a classic sign of underlying strength.These are the kinds of details that separate reactive trading from informed decision-making.Why Many Traders Misread the Gap DownFrom a purely visual perspective, a 50-plus point drop from Friday’s close looks bearish. On higher timeframes, it can feel dramatic and intimidating.That is why many traders rushed to short the market early.However, without understanding where price is relative to key references, those trades lack context. A gap down does not automatically mean continuation lower. What matters is how price reacts at known junctions.In this case, the market showed clear signs of buyer defense well before the gap was filled. That alone should have made traders cautious about pressing shorts.Waiting for confirmation does not mean missing opportunity. Often, it means avoiding bad trades.Practical Takeaway for TradersWhen the market gaps down and then begins grinding higher:Watch how price behaves near the previous trading day closeBe cautious with shorts as the gap approaches completionUnderstand that liquidity often sits just above obvious reference levelsLet the market finish its business before looking for the next setupThis does not mean the market cannot turn lower afterward. It simply means that timing matters, and probability shifts as price approaches key levels.Good trading is not about prediction. It is about recognizing when risk-reward is no longer in your favor.Please note, S&P 500 TradersWhat looked like a frightening start to the week turned into a valuable technical lesson. Buyers defended key structure, the gap began to close, and traders who stayed patient avoided unnecessary losses.This type of behavior repeats across markets and instruments. Understanding it can save capital and improve decision-making over time.For more market perspectives, educational insights, and trade discussions, visit investingLive.com, check out our YouTube channel, and join the investingLive Stocks Telegram channel, which is free.Stay disciplined, stay patient, and have a strong trading week ahead. This article was written by Itai Levitan at investinglive.com. 🔗 Source 💡 DMK Insight The S&P 500’s gap down from Friday’s close signals potential volatility ahead, and here’s why that matters for traders: With ETH currently at $2,895.90, the correlation between equities and crypto markets is worth monitoring. A significant drop in the S&P 500 can lead to risk-off sentiment, impacting crypto assets like Ethereum. Traders should be cautious, especially if the S&P fails to reclaim key support levels around 6,900. If the index continues to slide, it could trigger a broader sell-off in crypto, as investors may liquidate positions to cover losses elsewhere. Look for ETH to hold above $2,850 to maintain bullish momentum. Conversely, a break below this level could signal a shift in sentiment, prompting a reevaluation of long positions. Here’s the flip side: if the S&P manages to recover quickly, it could provide a lift to crypto markets, especially if institutional buying resumes. Keep an eye on the upcoming economic data releases, as they could

Germany January Ifo business climate index 87.6 vs 88.2 expected

Prior 87.6Current conditions 85.7 vs 86.0 expectedPrior 85.6Expectations 89.5 vs 90.3 expectedPrior 89.7German business sentiment stagnates to start the year with the expectations/outlook index dropping a little. The current conditions shows a marginal improvement but it’s nothing optimistic and doesn’t really suggest a material betterment in business activity. As price pressures continue to hold higher, that’s biting at the overall economy.The manufacturing sector also remains on edge, still in recession territory, and that’s offsetting any positive momentum from the services sector. That has been the case for well over a year now in Germany.Meanwhile, employment conditions are also starting to worsen as of late and that will be another worrying spot to watch out for this year for the economy. This article was written by Justin Low at investinglive.com. 🔗 Source 💡 DMK Insight German business sentiment just stagnated, and here’s why that matters: The latest figures show the current conditions index at 85.7, slightly up from 85.6, but expectations dropped to 89.5 from 90.3. This stagnation indicates a lack of confidence among businesses, which could weigh on economic growth and, by extension, the euro. Traders should keep an eye on how this sentiment impacts the euro against the dollar, especially if it leads to a shift in ECB policy. If the euro weakens, we might see a stronger dollar, affecting forex pairs like EUR/USD. But here’s the flip side: if current conditions improve further, it could signal a potential rebound in business activity. Watch for any upward revisions in the coming weeks, especially as we approach key economic indicators like GDP growth rates. The immediate focus should be on the 85.0 support level for the euro; a break below could trigger further selling pressure. 📮 Takeaway Monitor the 85.0 support level for the euro; a break could lead to increased selling pressure against the dollar.

It's hysteria in the gold market as prices hit another record high: Is this justified?

FUNDAMENTAL OVERVIEWGold extended the gains into new record highs today following a strong selloff in the US Dollar on yen intervention risks. The narratives underpinning gold continue to be de-dollarisation, geopolitical tensions, and so on. Nothing new really. I would say that this is now more about FOMO rather than something fundamental. I’m not saying that the long-term trend is over, but the current levels are not justified in the short-term. I think we are at an inflection point and February could be the first major negative month for precious metals if the right conditions fall in place. This week, the focus will be on the FOMC decision on Wednesday and the US jobs data on Tuesday and Thursday. The biggest event could eventually be the new Fed chair announcement. Betting markets now see BlackRock’s Rieder as the favourite. Rieder or Waller would ease Fed independence risks and could weigh on precious metals. The other major catalyst could be the US NFP report next week. We’ve been seeing improvements in the US Jobless Claims data that seem to suggest a pickup in labour market activity. A strong report would trigger a hawkish repricing in interest rate expectations and put pressure on gold. In case we don’t get the bearish catalysts, gold could keep climbing just by inertia. GOLD TECHNICAL ANALYSIS – DAILY TIMEFRAMEOn the daily chart, we can see gold broke through the 5,000 level and extended the gains into new record highs. We might have formed a channel, and the price is now trading right at the top trendline. The sellers will likely step in around these levels with a defined risk above the channel to position for a correction into the bottom trendline. The buyers, on the other hand, will look for a break higher to increase the bullish bets into new record highs.GOLD TECHNICAL ANALYSIS – 4 HOUR TIMEFRAMEOn the 4 hour chart, we can see that we have a minor upward trendline defining the bullish momentum on this timeframe. The buyers will likely continue to lean on the trendline to keep pushing into new record highs, while the sellers will look for a break lower to pile in for a drop into the next trendline.GOLD TECHNICAL ANALYSIS – 1 HOUR TIMEFRAMEOn the 1 hour chart, we can see that the price is trading at the upper bound of the average daily range for today. In such instances, we can generally see some consolidation or a pullback before the next move. More aggressive sellers might look for a break below the minor swing level at 5050 to pile in for a pullback into the trendline. UPCOMING CATALYSTSTomorrow we have the weekly US ADP jobs data and the US Consumer Confidence report. On Wednesday, we have the FOMC policy announcement. On Thursday, we get the latest US Jobless Claims figures. On Friday, we conclude the week with the US PPI report. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight Gold’s record highs signal a shift in trader sentiment, driven by dollar weakness and FOMO. As the US Dollar faces pressure from yen intervention risks, gold is benefiting from a classic flight to safety. Traders are increasingly looking at gold not just as a hedge against inflation but as a strategic asset amid geopolitical tensions. The current narrative of de-dollarisation is gaining traction, which could further fuel demand for gold. If this trend continues, we might see gold testing key psychological levels, with traders eyeing $2,100 as a potential target. However, it’s worth questioning whether this rally is sustainable. FOMO can lead to sharp corrections, especially if the dollar rebounds or if central banks signal a shift in monetary policy. Keep an eye on the dollar index and any news related to US monetary policy, as these could provide critical insights into gold’s next moves. Watch for volatility in the coming weeks, particularly around key economic data releases, which could impact both gold and the dollar significantly. 📮 Takeaway Monitor gold’s price action around $2,100 and watch for dollar index movements to gauge potential corrections.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether