Many in the industry expect it could be weeks before lawmakers on the Senate Banking Committee return to consider a markup for the CLARITY Act. 🔗 Source 💡 DMK Insight The delay in the Senate Banking Committee’s markup of the CLARITY Act is a crucial moment for crypto traders. With lawmakers potentially weeks away from making decisions, uncertainty looms over regulatory clarity, which could impact market sentiment significantly. Traders should be aware that this indecision might lead to increased volatility in crypto assets as investors react to news cycles. If the Act passes, it could provide a more structured framework for digital assets, potentially boosting institutional investment. Conversely, prolonged delays could lead to a bearish sentiment, especially if traders perceive a lack of urgency from regulators. Keep an eye on related assets like Bitcoin and Ethereum, as their price movements often reflect regulatory news. Watch for key levels around recent support and resistance points, and be prepared for potential swings as market participants react to any updates from the Senate. The next few weeks could be pivotal, so stay alert for any announcements or shifts in sentiment that could signal a trading opportunity. 📮 Takeaway Monitor the Senate Banking Committee’s progress on the CLARITY Act; delays could trigger volatility in crypto markets, especially around key support and resistance levels.

White House threatens to pull support for crypto bill after Coinbase standoff: Report

Coinbase withdrew support for the CLARITY Act, warning the draft would restrict DeFi, ban tokenized equities and eliminate stablecoin rewards. 🔗 Source 💡 DMK Insight Coinbase’s withdrawal from the CLARITY Act is a big deal for DeFi traders and investors. This move signals potential regulatory tightening that could stifle innovation in decentralized finance. If the draft passes as is, we could see restrictions on tokenized equities and a ban on stablecoin rewards, which would directly impact liquidity and trading strategies. Traders should be wary of how this might affect the broader crypto market, especially assets tied to DeFi protocols. Watch for volatility in related tokens, particularly those that rely on stablecoin rewards for yield generation. On the flip side, this could create buying opportunities for projects that adapt quickly to regulatory changes. Keep an eye on key support levels in DeFi tokens; if they hold, it might indicate resilience against regulatory fears. Overall, the next few weeks will be crucial as the market digests this news and anticipates further developments. 📮 Takeaway Monitor DeFi tokens closely; potential regulatory changes could create volatility and impact trading strategies significantly in the coming weeks.

What Is MT5 – A Beginner’s Guide to MetaTrader 5 Trading

Introduction: What Is MT5?MetaTrader 5, often called MT5, is a trading platform created by MetaQuotes in 2010. It is the next version after MT4. While MT4 was mainly made for trading forex (foreign exchange), MT5 allows trading in many different markets such as shares, commodities, indices, futures, and cryptocurrencies, depending on the broker you use.MT5 includes all the essential features of MT4, such as user-friendly charts and automated trading with Expert Advisors (EAs), while providing a reliable trading environment. Additionally, it offers advanced tools like 21 timeframes, an economic calendar, various order types, and improved backtesting options.Example: A trader using MT5 can look at the S&P 500 index, set a pending buy order, establish stop-loss and take-profit levels, and even automate trades using custom algorithms, all from the same platform.Because of its speed, flexibility, and more features, MT5 is a popular choice for traders who want to trade various asset types while still enjoying the simplicity of the MetaTrader environment.Why MT5 Was CreatedMT5 was developed to improve upon MT4 and to meet the increasing needs of traders who wanted to access more asset classes and advanced tools. Here are the main reasons MetaQuotes introduced MT5 in 2010:Multi-Asset Trading: Unlike MT4, which focused mainly on forex, MT5 allows trading in shares, commodities, indices, futures, and cryptocurrencies, depending on your broker.More Timeframes and Indicators: MT5 offers 21 timeframes (compared to 9 in MT4) and over 38 built-in indicators, helping traders gain better market insights.Advanced Order Types: MT5 has added new types of pending orders, like Buy Stop Limit and Sell Stop Limit, giving traders more options for executing trades.Faster Performance: The platform’s updated structure makes it quicker, more stable, and better for running automated trading strategies.Economic Calendar: MT5 includes a built-in economic calendar that shows news events, helping traders keep track of important data without leaving the platform.Regulatory and Broker Needs: MT5 supports both netting and hedging modes, making it more versatile for brokers that serve both retail and institutional clients in various asset classes.Tip for beginners: Although MT5 offers more tools than MT4, it can feel complex initially. Start with the basics and gradually learn about the advanced features.Key Features of MT5MT5 enhances the foundation of MT4 by introducing additional tools, supporting a broader range of assets, and improving performance. Here are its most important features:Multi-Asset Support: You can trade forex, shares, indices, commodities, futures, and cryptocurrencies, depending on your broker.Expanded Charting Tools: MT5 offers 21 timeframes (compared to 9 in MT4), over 38 built-in indicators, and 44 graphical tools. You can also open unlimited charts at once.Advanced Order Types: Along with standard market and pending orders, MT5 supports:Buy Stop LimitSell Stop LimitThis allows for more precise trade setups.Economic Calendar Integration: Stay informed about news releases, forecasts, and economic events directly within the platform.Faster Backtesting: MT5 has a multi-threaded strategy tester, which allows for quicker and more accurate backtesting of trading strategies.Netting and Hedging:Netting mode: Common in stock and futures markets (only one position per instrument).Hedging mode: Allows multiple positions (both long and short) on the same asset, which is popular among forex traders.Automated Trading with EAs: Just like MT4, MT5 supports Expert Advisors (EAs), but they are written in MQL5, a more advanced programming language that offers greater flexibility.Multi-Device Access: MT5 can be used on Windows, Mac (using emulators), web browsers, Android, and iOS, allowing traders to manage trades wherever they are.Example: A trader analyzing gold on MT5 could open multiple charts with different timeframes, apply indicators like MACD and RSI, set a Buy Stop Limit order, and track U.S. economic news all from the platform.How to Download and Set Up MT5Getting started with MT5 is easy. Follow these steps to set up the platform:Step 1 – Choose a Broker:Open an account with a regulated broker that offers MT5. Not all brokers support MT5, so check if they do before registering.Step 2 – Download the Platform:Go to your broker’s website for a direct download link or download it from the official MetaQuotes website. You can find versions for desktop, web, and mobile.Step 3 – Install MT5:Run the installer and follow the instructions on your screen. After installation, open MT5 from your desktop or device.Step 4 – Log In to Your Account:In MT5, go to File > Login to Trade Account. Enter your broker’s server, account number, and password. You can choose between a demo (practice) account or a live (real money) account.Step 5 – Explore the Interface:Key sections include:Market Watch: Shows live quotes of instruments.Navigator: Provides quick access to accounts, indicators, and Expert Advisors.Toolbox (Terminal): Shows your trade history, alerts, news, and account details.Step 6 – Start with a Demo Account:Before risking real money, practice on a demo account. This allows you to test strategies with virtual funds in real market conditions.Beginner Tip: Use the demo account to practice both manual trading and automated strategies before trading with real money.How to Use MT5 to Trade – Step by StepOnce your MT5 platform is set up, you can start trading. Here’s how to do it:Step 1 – Select a Market:Open the Market Watch panel and choose an instrument (e.g., EUR/USD, Gold, Apple shares, or Bitcoin).Step 2 – Open a Chart:Right-click on the instrument and select “Chart Window.” Customize it with indicators, drawing tools, and different timeframes.Step 3 – Place an Order:Click the New Order button or press F9. In the order window, you can:Select the instrument.Choose lot size (trade volume).Set stop-loss and take-profit levels.Pick the order type (Market Order or Pending Order).Step 4 – Execute the Trade:Buy: If you think the price will rise.Sell: If you think the price will fall.Your trade will show up in the Toolbox (Terminal) window.Step 5 – Manage the Trade:You can adjust stop-loss and take-profit levels directly on the chart. You can also add trailing stops to secure profits as the price moves. Close positions manually with a single click.Step 6 – Analyze Results:Check your performance in the History tab. Review wins, losses, and strategy outcomes to improve over time.Example: You believe Apple shares will

investingLive European FX news wrap: markets steady, oil prices on the rise again

How have interest rate expectations changed after this week’s events?Indian Rupee targeting new record lows as RBI’s interventions continue to failNo big surprises expected from the BOJ at next week’s meeting – BarclaysGold remains stuck in a tight consolidation as traders await new catalysts for next moveItaly December final CPI +1.2% vs +1.2% y/y prelimOil back in the spotlight as US-Iran showdown may not be overJapan finance minister Katayama continues with the verbal intervention on the yen currencyBOJ finally set to commence selling of its ETF holdingsWhat are the main events for today?Germany December final CPI +1.8% vs +1.8% y/y prelimFX option expiries for 16 January 10am New York cutLive Nasdaq Technical Analysis for TodayJapanese yen remains in focus as we look towards the end of the weekUK statistics office evaluates potential delay to its overhauled jobs survey – reportIt’s been a fairly slow session with very limited economic data and newsflow. There were no real highlights with just the Japanese Finance Minister Katayama continuing with verbal intervention. The JPY spiked in the Asian session as Katayama threatened joint intervention with the US. Since then, it’s just been bouncing around the session highs.In the markets, the most notable mover has been crude oil. Prices have been surging throughout the session in what looks like hedging into the weekend risk. Late yesterday, we got a report from Fox News saying that US air, land and sea military assets were moving to the Middle East and added that US military transit to the Middle East is expected to take a week.Now, we might say that a lot can change in a week and that there’s still time before worrying about an escalation, but you never know what might happen over the weekend with Trump. The other notable movers have been US Treasury yields as the momentum since yesterday’s strong US jobless claims data persisted.In the American session, we get Canadian Housing Starts, US Industrial Production and Capacity Utilization, and the US NAHB Housing Market Index. All these indicators are rarely market-moving unless there are big deviations. We will also have some Fedspeak with Fed’s Bowman and Fed’s Jefferson being the main highlights, but it’s unlikely they will add anything new at this point. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Source 💡 DMK Insight Interest rate expectations are shifting, and here’s why that matters for traders: SOL is currently at $143.88, reflecting broader market sentiment influenced by global economic indicators. With the Indian Rupee hitting new record lows, the Reserve Bank of India’s interventions seem ineffective, which could lead to increased volatility in forex pairs involving the INR. This situation might also create ripple effects in crypto markets, particularly for assets like SOL, as traders seek refuge in digital currencies amid fiat instability. Additionally, the upcoming BOJ meeting could provide clarity on Japan’s monetary policy, potentially impacting global risk appetite. If the BOJ maintains its stance, we might see a stronger USD, which could further pressure emerging market currencies and influence crypto flows. Traders should keep an eye on SOL’s support and resistance levels, especially if it breaks below $140 or pushes above $150. These levels could dictate short-term trading strategies. Watch for any significant news from the BOJ or further developments in the Indian currency market, as these could trigger sharp movements in both forex and crypto markets. 📮 Takeaway Monitor SOL closely; a break below $140 could signal further downside, while resistance at $150 may offer short-term trading opportunities.

Canada strikes tariff deal with China on agriculture and electric vehicles

Canada and China are re-setting ties after leaders Mark Carney and Xi Jinping met in Beijing.The leaders agreed to lower tariffs on each others products in a move that could boost bi-lateral trade but risks irking the United States.The main deal dealt with near-term tariff levels and saw both sides dropping tariffs: Canada will allow up to 49,000 Chinese electric vehicles into the Canadian market, with the most-favoured-nation tariff rate of 6.1%China will lower tariffs on Canadian canola seed to a combined rate of approximately 15% from 85%Canadian canola meal, lobsters, crabs, and peas will not be subject to relevant anti-discrimination tariffs Canada has set a goal to increase exports to China by 50% by 2030Xi Jinping commits to visa-free travel for CanadiansCanada cites two-way opportunities batteries, solar, wind, and energy storageAs for the auto deal, here is how the Prime Minister’s office framed it:This amount corresponds to volumes in the year prior to recent trade frictions on these imports (2023-2024), representing less than 3% of the Canadian market for new vehicles sold in Canada. It is expected that within three years, this agreement will drive considerable new Chinese joint-venture investment in Canada with trusted partners to protect and create new auto manufacturing careers for Canadian workers, and ensure a robust build-out of Canada’s EV supply chain. With this agreement, it is also anticipated that, in five years, more than 50% of these vehicles will be affordable EVs with an import price of less than $35,000, creating new lower-cost options for Canadian consumers.There were two separate releases, the second dealt with the larger strategic picture:Carney and Xi Jinping agree to deepen strategic tiesCanada reaffirms One China policy during official visitbilateral trade roadmap signed to resolve economic issuesministerial energy dialogue launched for clean power and oilBank of Canada renews currency swap with ChinaCarney has made it a political cornerstone to diversify trade away from the United States after the US raised tariffs and talked of annexation. This is a big step in that direction but the lowered China auto tariffs — even on a limited set of cars — will irk the domestic auto manufacturing industry and the White House.The Canadian dollar is unmoved on this deal, which comes as a modest surprise. There has been some talk of a deal but it looked like it wasn’t going to happen earlier this week. While the deal itself is good, it adds some fresh risks for the loonie if Trump throws a tantrum.USD/CAD was last flat on the day at 1.3890. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight Canada and China’s tariff reduction could shake up global trade dynamics, and here’s why that matters for traders: With ADA currently at $0.40, any significant uptick in trade between these two nations could lead to increased demand for commodities and cryptocurrencies as alternative investments. If bilateral trade strengthens, it might boost market sentiment, particularly in sectors sensitive to trade policies. Traders should keep an eye on how this impacts the broader crypto market, especially if ADA starts to correlate with commodity prices. But don’t overlook the potential backlash from the U.S. This could lead to volatility in related markets, especially if the U.S. retaliates with its own tariffs. Watch for ADA’s price action around key support and resistance levels, particularly if it approaches $0.45 or drops below $0.35. The next few weeks will be crucial as traders react to these geopolitical shifts and their implications for market liquidity and sentiment. 📮 Takeaway Monitor ADA closely; a break above $0.45 could signal bullish momentum, while a drop below $0.35 may indicate bearish sentiment amid trade tensions.

Is Rick Rieder the darkhorse for the Fed job?

The final candidate for Fed Chairman met with President Trump this week and maybe he still has a chance. The President is notoriously fickle and has a flair for the dramatic so maybe the final impression was the best one.Fox Business reports that the Chief Investment Officer of Global Fixed Income at BlackRock had one big thing going for him:”He’s the only person on the finalists list that has no previous Federal Reserve Experience. Two Senior Administration Officials tell me the people in the room for the interview viewed that as a big positive,” writes Fox’s Edward Lawrence.The meeting was attended by Trump, Vance, Bessent, Chief of Staff Susie Wiles, and Deputy Chief of Staff Dan Scavino.The report said Rieder talked about Fed profitability, the importance of monetary policy stability, and US debt dynamics.I would suspect Bessent is pushing for Rieder as he’s undoubtedly the candidate that markets would feel most-comfortable with, alongside Waller. That said, Trump himself has repeatedly said Kevin Warsh and Kevin Hassett are his favored candidates. Both are seen as ‘yes-men’ for the President who will be more-likely to lower rates, but only if they can convince the rest of the board.Rieder has long commentated on markets and has developed a strong reputation as a smart analyst and sober assessor of the economy. Early this year, he released a playbook for investing in 2026 and said the year is going to be about selectively investing, rather than the ‘buy anything’ market that lifts all boats.He is worried about the labor market and said:Underlying slack is moving the wrong way.Layoffs are now about “efficiency” (cost-cutting) rather than cyclical weakness.Healthcare hiring has been masking weakness everywhere else. Excluding healthcare, job growth is negative.He also forecast 2% GDP Growth largely driven by AI capex and suggested buying quality fixed income.If he were selected, I’d expect to see the long end rally but it could still be a positive for the US dollar as it removes tail risks around the loss of independence. I would also expect to see gold slump.Bessent has said the decision will come before the end of the month. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight So the Fed Chairman candidate’s meeting with Trump could shake up markets. If he gets the nod, expect volatility in both equities and bonds. Traders are already pricing in potential shifts in monetary policy, and any hints from the meeting could send ripples through the forex market, especially with the dollar. Look, if the candidate leans towards a more hawkish stance, we might see yields rise, which could strengthen the dollar against major currencies. Conversely, a dovish approach could lead to a weaker dollar and a rally in risk assets. Keep an eye on the 10-year Treasury yield; a break above recent highs could signal a shift in sentiment. Also, watch for any statements from the Fed that might hint at future rate hikes. This meeting is a pivotal moment, and the market’s reaction could be immediate, so stay alert for any news that could impact your positions. 📮 Takeaway Watch the 10-year Treasury yield closely; a breakout could signal a shift in market sentiment following the Fed Chairman candidate’s meeting.

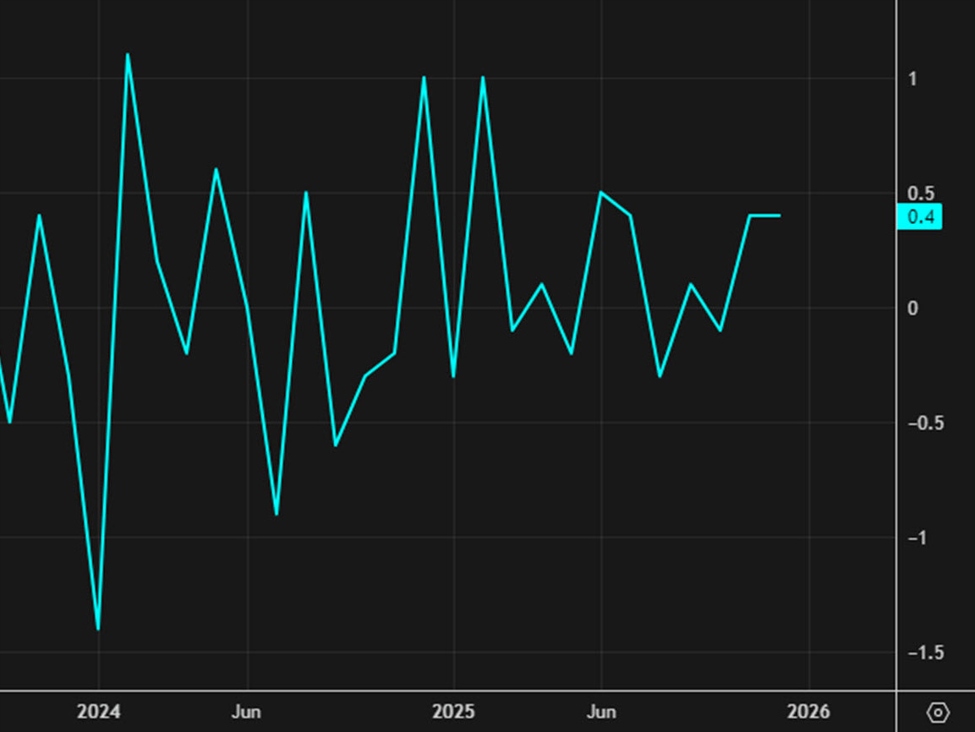

US industrial production rises more than expected in December

The good news continues to roll in for the US economy as December industrial production rose 0.4%, beating the 0.1% consensus. The November reading was also boosted to +0.4% from +0.2%.With that, capacity utilization rose to 76.3% from 76.0%. Manufacturing production rose by 0.2% compared to -0.2% expected. The November manufacturing number was also boosted to +0.3% from +0.2%.Those are signs that the US industrial strategy is beginning to bear fruit but when you scale out, it’s still a long way to go. Production rose at an annualized rate of just 0.7% in Q4 while capacity utilization is 3.2 percentage points below its long-term average.Breaking down the numbers, industrial production’s 0.4% December rise was primarily driven by a sharp 2.6% increase in utilities, largely influenced by a 12.0% surge in natural gas, something that’s unlikely to last. Manufacturing output also rose 0.2%, supported by a 0.3%increase in nondurables—specifically food, beverage, and petroleum products. Durable manufacturing edged up 0.1 percent, with significant gains in primary metals (2.4 percent) and aerospace equipment (1.5 percent) offsetting declines in motor vehicles and wood products.Among market groups, consumer goods climbed 0.7 percent, driven by nondurables, while business equipment rose 0.8 percent due to strength in transit and industrial equipment. These gains outweighed a 0.7 percent drop in mining output, allowing the total index to finish the year 2.0 percent above 2024 levels.If you zoom out even further, US production is flat over the past 20 years, despite a huge boom in oil production. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight US industrial production is showing unexpected strength, and here’s why that matters: The December rise of 0.4% in industrial production, surpassing the 0.1% consensus, signals a robust economic backdrop that could influence Fed policy. Capacity utilization climbing to 76.3% indicates that factories are operating closer to their limits, which often leads to increased investment and hiring. For traders, this could mean a bullish sentiment in sectors tied to manufacturing and industrials. If this trend continues, we might see upward pressure on commodities and related equities, particularly in sectors like materials and energy. But don’t overlook the flip side: if the Fed interprets this data as a sign to tighten monetary policy sooner, we could see volatility in equities and a stronger dollar. Keep an eye on the S&P 500 and industrial ETFs for potential breakouts or pullbacks. Watch for key resistance levels around recent highs, and monitor economic indicators closely for any shifts in sentiment. The next few weeks will be crucial as traders digest this data and its implications for future Fed actions. 📮 Takeaway Watch for how the Fed reacts to this strong industrial data; key resistance levels in the S&P 500 could be tested if bullish sentiment continues.

Tech and semiconductor stocks surge while healthcare faces a downturn

Sector OverviewToday’s market shows a robust performance in the technology and semiconductor sectors, with companies like Nvidia (NVDA) and Advanced Micro Devices (AMD) leading the gains. Nvidia soared +1.26%, while AMD saw an impressive rise of +2.16%. The semiconductor boom is further bolstered by Micron Technology (MU), climbing +6.55%.On the other side of the spectrum, the healthcare sector is showing signs of struggle, with major players like Eli Lilly and Company (LLY) dropping by -0.36% and UnitedHealth Group (UNH) declining -1.25%. This reflects ongoing market apprehensions surrounding healthcare regulations and industry pressures.Market Mood and TrendsThe current market mood is largely bullish, especially within tech-driven sectors. The positive momentum in technology and semiconductors aligns with optimistic investor sentiment regarding innovations and demand in these industries. However, the decline in healthcare stocks indicates caution among investors regarding healthcare policy changes and economic impacts.The mixed results in different sectors suggest diverse market dynamics, with investor focus shifting towards tech-centric opportunities while remaining tentative about long-term healthcare investments.Strategic RecommendationsGiven today’s market dynamics, investors might consider increasing their exposure to technology and semiconductor sectors, taking advantage of current uptrends. Stocks like Nvidia and AMD present strong potential for growth. Invest in Technology and Semiconductors: Leverage the growth potential in tech by focusing on high-performing stocks in this sector.Healthcare Caution: Investors should exercise caution in healthcare investments, keeping an eye on regulatory changes that could impact stock performance.Diversification: Maintain a diversified portfolio by balancing high-risk tech stocks with stable investments to mitigate potential downturn risks.As always, staying informed and agile allows investors to navigate the changing market landscape effectively. For continuous updates and expert insights, visit InvestingLive.com and keep abreast of market movements that could impact your investment decisions. This article was written by Itai Levitan at investinglive.com. 🔗 Source 💡 DMK Insight Nvidia and AMD’s gains signal a strong tech sector rebound, but here’s why traders need to stay cautious. The semiconductor sector is heating up, with Nvidia up 1.26% and AMD up 2.16%. Micron’s impressive 6.55% rise indicates robust demand, likely driven by AI and data center expansions. However, while these gains are encouraging, they come amid broader economic uncertainties, including inflation and interest rate hikes. Traders should be wary of potential profit-taking, especially if the market sentiment shifts. Key resistance levels for Nvidia are around recent highs, while AMD’s breakout could be tested at its previous peaks. Look for any signs of volatility in the coming days, particularly as earnings reports roll in. If the tech sector can maintain momentum, it could pull other markets along, but a sudden reversal could lead to sharp corrections. Keep an eye on Micron’s performance as a bellwether for the sector; a drop could signal trouble ahead. Watch for Nvidia and AMD to hold their gains over the next week to confirm bullish sentiment. 📮 Takeaway Monitor Nvidia and AMD closely; if they hold their gains this week, it could indicate a sustained tech rally, but be ready for volatility.

US NAHB January home builder sentiment index 37 vs 40 expected

Prior was 39Current single-family home sales 41 vs 42 priorProspective buyers 23 vs 26 priorHome sales expectations over the next six months 49 vs 52 priorIn the past month, US 30-year yields have ticked 5-7 basis points higher but there have been signs of buyers wading in via the latest existing home sales report.The latest survey also revealed that 40% of builders reported cutting prices in December, marking the second consecutive month the share has been at 40% or higher since May 2020. It was 41% in November. Meanwhile, the average price reduction was 5% in December, down from the 6% rate in November. The use of sales incentives was 67% in December, the highest percentage in the post-Covid period.The NAHB/Wells Fargo Housing Market Index (HMI) is a monthly economic indicator that gauges builder confidence in the U.S. single-family housing market. Based on a survey of National Association of Home Builders members, it operates on a scale of 0 to 100. A reading above 50 indicates that more builders view conditions as “good” rather than “poor.”The index is a weighted average of three specific components:Current Sales Conditions (59%): Builders rate current sales volume.Future Sales Expectations (14%): Outlook for sales over the next six months.Prospective Buyer Traffic (27%): The volume of potential buyers visiting model homes.Currently, the index is low because builders are caught in a “dual squeeze.” On the demand side, high mortgage rates and prices have hurt affordability, forcing builders to offer costly incentives. On the supply side, they are dealing with rising construction costs, labor shortages, and regulatory hurdles, all of which keep confidence below the neutral 50 mark and near the pandemic lows. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight Home sales are cooling, and here’s why that matters for traders: declining buyer sentiment can impact broader economic indicators. Current single-family home sales dropped to 41 from 42, while prospective buyers fell to 23 from 26. This trend signals a potential slowdown in the housing market, which could ripple through sectors tied to consumer spending and mortgage rates. With US 30-year yields rising 5-7 basis points recently, higher borrowing costs could further deter buyers. Traders should keep an eye on how these housing metrics affect related markets, especially real estate investment trusts (REITs) and financial stocks. The flip side? If yields stabilize or reverse, we might see a rebound in buyer sentiment. Watch for any shifts in the next monthly report, particularly if home sales expectations, currently at 49, begin to trend upward again. This could indicate a market correction or renewed interest from buyers, impacting asset prices across the board. 📮 Takeaway Monitor home sales expectations and US 30-year yields closely; a rebound could signal renewed buyer interest and impact related markets.

Trump: I may want to keep Hassett where he is

Trump seems to rule out Hassett as Fed chair in comments.Trump said that Hassett was good on TV today and that he “may want to keep him where he is”. He added that “we’ll see how it works out”.Trump said to Hassett at a health care event, “I actually want to keep you where you are, if you want to know the truth.”Some Republican Senators have expressed reservations about Hassett because he’s so close to Trump, so he could be harder to confirm than the other three candidates.We have seen some US dollar buying on this headline, as it underscores that the Fed decision is mostly about political credibility. Of the candidates, Hassett is seen as the least independent, which in turn is the most-dovish due to Trump’s longstanding desire to cut rates.Along the same lines, gold is quickly lower on the headlines and has touched the lowest since Tuesday in a quick $35 decline (now a $60 decline).Hassett has been the White House spokesman on economic matters as director of the National Economic Council. He frequently appears to speak about economic policies, including tariffs. In the betting markets, Hasset is down to 17% from about 35% earlier today.The prospect of a less-dovish Fed chair is also weighing slightly on equity markets, which fixed income markets are little changed.The betting favorite for the job is Kevin Warsh, who was the runner up to Powell in Trump’s first term. He’s been relentlessly lobbying for the job for years after quitting the Fed as a governor in a tiff over quantitative easing during the financial crisis. Earlier today, a report highlighted that Trump’s team also liked Blackrock fixed income CIO Rick Rieder in part because he had no ties to the Federal Reserve. For what it’s worth, I don”t necessarily view Trump’s comments as overly telling. At the same time, the sharp declines in precious metals following the comments are an indication that plenty is riding on the decision. However the rise in the dollar after the headlines could be an indication to Trump that Hassett is the right pick, as the President wants a lower dollar.Treasury Secretary Bessent said a decision will come before month end. This article was written by Adam Button at investinglive.com. 🔗 Source 💡 DMK Insight Trump’s comments about Hassett not being considered for Fed chair could signal a shift in monetary policy expectations. If Hassett remains in his current role, it suggests continuity in the Fed’s approach, which might impact interest rate forecasts and market sentiment. Traders should keep an eye on how this affects the dollar and bond yields, especially if the market was pricing in a more hawkish Fed under a new chair. Moreover, Trump’s remarks could influence the stock market as well, particularly sectors sensitive to interest rates like real estate and utilities. If the Fed maintains its current stance, it could lead to a more stable environment for equities, but any surprises in upcoming economic data could still shake things up. Watch for key economic indicators like inflation and employment figures, which could sway the Fed’s decisions regardless of who is at the helm. In the near term, keep an eye on the dollar index and 10-year Treasury yields for signs of market reaction to these developments. If yields start to rise significantly, it could indicate that traders are bracing for a shift in policy, even if Hassett stays put. 📮 Takeaway Monitor the dollar index and 10-year Treasury yields closely; any significant moves could indicate shifting market expectations around Fed policy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether