The CFTC plans to invite leading crypto executives, including Tyler Winklevoss and Kris Marszalek, to advise regulators on emerging technologies. 🔗 Source 💡 DMK Insight The CFTC’s move to consult crypto leaders signals a shift towards regulatory clarity, and here’s why that matters: Bringing in figures like Tyler Winklevoss and Kris Marszalek could lead to more informed regulations that align with industry realities. This could ease some of the uncertainty that’s been weighing on crypto markets, potentially attracting institutional investors who’ve been on the sidelines. If regulations become clearer, we might see a surge in trading volumes, especially in altcoins that have been heavily impacted by regulatory fears. Watch for how this advisory panel’s insights influence upcoming CFTC decisions, as they could set the tone for the next few months. However, there’s a flip side: if the recommendations lean too heavily towards restrictive measures, it could trigger a sell-off in the short term. Traders should monitor sentiment closely, especially around key events or announcements from the CFTC. Keep an eye on Bitcoin and Ethereum, as their price movements often reflect broader market sentiment and regulatory news. The next few weeks could be pivotal, so stay alert for any shifts in trading patterns or volume spikes. 📮 Takeaway Watch for CFTC announcements in the coming weeks; clear regulations could boost crypto trading volumes, especially in altcoins.

Meta to cut 10% of metaverse arm this week amid AI push: Report

Meta’s Reality Labs is set for cuts as the firm’s metaverse budget continues to decline amid push toward artificial intelligence development. 🔗 Source 💡 DMK Insight Meta’s shift from metaverse investments to AI development is a big deal for traders right now. This pivot signals a potential reallocation of resources that could affect not just Meta’s stock but also the broader tech sector. As Reality Labs faces budget cuts, it raises questions about the viability of the metaverse as a profitable venture in the near term. Traders should keep an eye on Meta’s stock performance, especially around earnings reports, as any further declines in metaverse spending could lead to volatility. Additionally, this shift might influence related stocks in the tech space, particularly those heavily invested in virtual reality or augmented reality. Here’s the thing: while many are focused on the AI hype, the metaverse’s decline could create hidden opportunities for short positions in companies that overextended themselves in that area. Watch for Meta’s stock to test key support levels; if it breaks below recent lows, it could trigger further sell-offs. Keep an eye on the next earnings call for more insights into how this transition is impacting their financials. 📮 Takeaway Monitor Meta’s stock closely; a break below recent support levels could signal further declines as metaverse investments wane.

Three ETH price charts suggest a move toward $4K may be brewing

ETH’s recent rally was driven by spot demand and a healthy use of futures market leverage, potentially setting Ether up for a move to $4,000. 🔗 Source 💡 DMK Insight ETH’s surge to $3,127.88 is more than just a number—it’s a signal of strong market sentiment. The recent rally, fueled by spot demand and strategic futures leverage, suggests traders are positioning for a breakout toward $4,000. This level isn’t just a psychological barrier; it’s a critical resistance point where profit-taking could occur. If ETH can maintain momentum above $3,100, it might attract more buyers, especially if we see increased volume on the daily charts. Watch for any pullbacks; a dip to around $3,000 could provide a solid entry point for those looking to ride the next wave up. But here’s the flip side: if ETH fails to hold above $3,100, we could see a quick reversal, potentially dragging it back toward $2,800. Keep an eye on the futures market for signs of over-leverage, as that could signal a correction. Overall, the market’s current bullish sentiment is promising, but caution is warranted as we approach key resistance levels. 📮 Takeaway Monitor ETH closely; a hold above $3,100 could lead to a rally toward $4,000, but a drop below this level may signal a reversal.

Bitcoin shows resilience amid Powell DOJ probe: Will BTC price hold?

Bitcoin rallied to $92,000 as Federal Reserve chair Jerome Powell spoke about a potential DOJ investigation into the Fed. Will BTC’s strength hold? 🔗 Source 💡 DMK Insight Bitcoin’s surge to $92,000 is a direct reaction to Powell’s comments, and here’s why that matters: The potential DOJ investigation into the Fed raises questions about monetary policy stability, which can drive investors toward Bitcoin as a hedge. With BTC now testing this psychological resistance level, traders should watch for a consolidation phase. If Bitcoin can hold above $90,000, it might signal further bullish momentum. However, if it dips below that mark, we could see a quick retracement back to lower support levels. Keep an eye on trading volumes; a spike could indicate strong conviction behind this rally. On the flip side, mainstream narratives might overlook the fact that this rally could be short-lived if macroeconomic indicators shift. If inflation data or employment figures come in stronger than expected, the Fed might pivot back to a more hawkish stance, which could negatively impact crypto markets. So, while the current sentiment is bullish, the underlying economic conditions are worth monitoring closely. 📮 Takeaway Watch for Bitcoin to hold above $90,000; a failure to do so could trigger a retracement, while strong volumes may indicate sustained bullish momentum.

VanEck says policy clarity could make Q1 a ‘risk-on’ quarter

VanEck expects stronger risk appetite in Q1 on improved fiscal and monetary visibility, while warning that Bitcoin’s cycle signals remain mixed. 🔗 Source 💡 DMK Insight VanEck’s bullish outlook for Q1 hinges on improved fiscal and monetary conditions, but Bitcoin’s mixed cycle signals raise caution. Traders should pay attention to how fiscal policies and interest rate decisions unfold in the coming weeks, as these could significantly influence risk appetite across markets. If we see a sustained shift towards risk-on sentiment, assets like Bitcoin might experience upward pressure. However, the mixed signals from Bitcoin’s cycle indicate potential volatility, suggesting that traders should be prepared for rapid price swings. Monitoring key technical levels will be crucial; for instance, if Bitcoin can break above recent resistance levels, it could signal a stronger bullish trend. On the flip side, if fiscal visibility falters or monetary tightening resumes, we could see a sharp reversal in sentiment. This duality means traders need to stay nimble and watch for shifts in market sentiment, especially around major economic announcements or central bank meetings. Keep an eye on Bitcoin’s price action around these events to gauge potential entry or exit points. 📮 Takeaway Watch Bitcoin’s resistance levels closely; a break could signal a bullish trend, but mixed cycle signals suggest caution amid changing fiscal policies.

Bipartisan Senate Bill Seeks Clarity on Crypto Developer Liability Under Federal Law

The bill aims to define when and how crypto developers can face liability, as enforcement actions have intensified the debate. 🔗 Source 💡 DMK Insight The push for clearer liability definitions in crypto is a game changer for developers and traders alike. As enforcement actions ramp up, this bill could reshape the landscape of crypto development. If passed, it might clarify the legal risks developers face, potentially encouraging more innovation but also increasing scrutiny. Traders should watch how this could impact projects in the pipeline—especially those relying on ambiguous regulatory frameworks. If developers feel more secure, we might see a surge in new projects, which could ripple through the market, affecting altcoins and related assets. On the flip side, if the bill imposes strict liabilities, it could stifle creativity and lead to a slowdown in new launches, impacting market sentiment negatively. Keep an eye on any updates regarding this legislation, as its passage could create volatility in crypto prices, particularly for projects that could be directly affected by these new rules. 📮 Takeaway Watch for updates on the crypto liability bill; its passage could significantly impact developer activity and market sentiment.

Democrats Test Crypto Fundraising Reset With BlueVault Launch

The new platform aims to help Democratic campaigns win over crypto donors ahead of the 2026 mid-term elections. 🔗 Source 💡 DMK Insight Democratic campaigns are targeting crypto donors, and here’s why that matters now: As the 2026 mid-term elections approach, the push to engage crypto investors could reshape campaign financing. With crypto assets gaining traction, candidates tapping into this demographic might not only secure funding but also signal a broader acceptance of digital currencies in mainstream politics. This could lead to increased volatility in crypto markets as political narratives shift, especially if candidates advocate for favorable regulations. Traders should watch for any policy announcements or endorsements that could impact crypto sentiment. On the flip side, while this strategy could boost crypto prices in the short term, it also raises questions about the sustainability of such support. If political backing wanes or if regulatory scrutiny increases, we could see a rapid reversal in market sentiment. Keep an eye on key indicators like trading volumes and sentiment shifts in crypto communities as the election cycle heats up. The next few months will be crucial for gauging how this political engagement influences market dynamics. 📮 Takeaway Watch for policy announcements from candidates as they could significantly impact crypto market sentiment and trading volumes leading up to the 2026 elections.

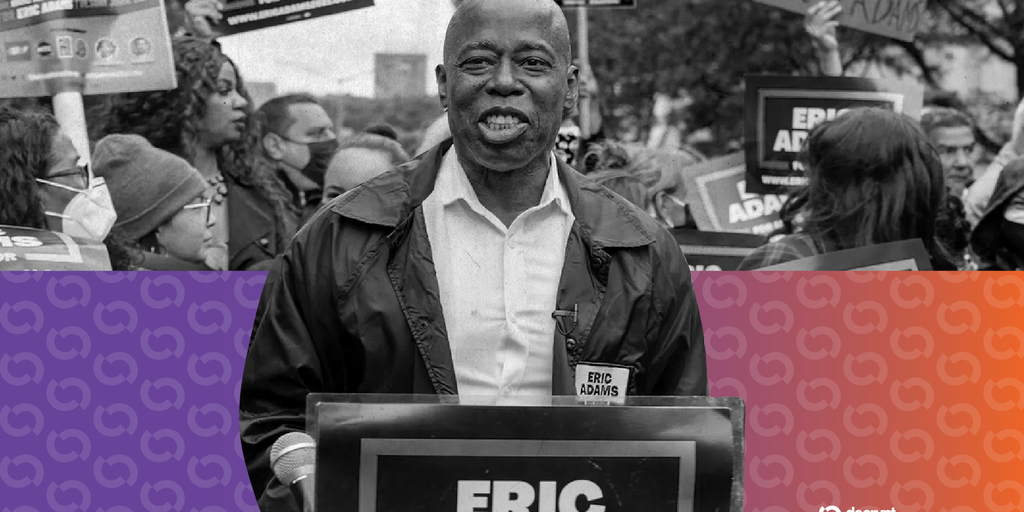

Eric Adams' NYC Token Crashes Amid Liquidity Extraction Allegations

On-chain data shows unexplained liquidity withdrawals as Eric Adam’s NYC token’s market cap continues to bleed. 🔗 Source 💡 DMK Insight Liquidity withdrawals from ADA are raising eyebrows, and here’s why that matters: With ADA currently at $0.39, the unexplained outflows could signal underlying weakness in market sentiment. This isn’t just a blip; it reflects broader concerns about the token’s market cap erosion, which could be indicative of larger trends in the crypto space. If traders are pulling liquidity, it often leads to increased volatility, especially if it coincides with negative news or market shifts. Keep an eye on the $0.35 support level; a breach could trigger further selling pressure. On the flip side, this situation might present a buying opportunity for contrarian traders if they believe the fundamentals of ADA remain strong. However, the risk is palpable—if liquidity continues to drain, it could lead to a cascade effect, impacting related assets like ETH and BTC as traders seek safer havens. Watch for any news that could either stabilize or further destabilize ADA’s market position in the coming days. 📮 Takeaway Monitor ADA closely around the $0.35 support level; further liquidity withdrawals could lead to increased volatility and selling pressure.

Why Bitcoin May Be Underpricing January Rate Cut Odds

Bitcoin’s rangebound price action and volatility may compound mispriced odds of a Fed rate cut ahead of key CPI data, analysts say. 🔗 Source 💡 DMK Insight Bitcoin’s current rangebound action is more than just sideways movement—it’s a signal of underlying market uncertainty. With volatility low, traders might be mispricing the potential impact of upcoming CPI data on Fed rate decisions. If inflation comes in hotter than expected, it could lead to a hawkish shift, pushing Bitcoin lower as risk appetite wanes. Conversely, a softer CPI could spark a rally, especially if it reignites hopes for a rate cut. Watch the $27,000 level closely; a break below could trigger further selling, while a bounce could signal renewed bullish sentiment. Keep an eye on correlated assets like Ethereum, which often follows Bitcoin’s lead, and consider how institutional players might react to these economic indicators. The real story is how traders position themselves ahead of this data release—are they hedging against a bearish scenario or betting on a bullish surprise? The next few days will be crucial for setting the tone for the rest of the month. 📮 Takeaway Monitor Bitcoin’s price action around $27,000 as CPI data approaches; volatility could spike based on inflation results.

Another Day, Another Crypto Wrench Attack in France

Armed robberies targeting crypto investors have surged, with criminals using kidnapping and home invasions to steal digital assets. 🔗 Source 💡 DMK Insight Crypto investors are facing a new threat: armed robberies are on the rise, and here’s why that’s crucial for traders. With criminals resorting to extreme measures like kidnappings and home invasions, the safety of assets—both physical and digital—is now a pressing concern. This uptick in violent crime could lead to increased scrutiny from regulators, potentially impacting market sentiment and trading volumes. Traders should be aware that heightened security risks might drive some investors to liquidate positions or seek safer assets, which could create volatility in the crypto markets. Additionally, this situation could ripple into related sectors, such as insurance for digital assets, which may see increased demand as investors look to protect their holdings. Keep an eye on how this trend influences market behavior, particularly among retail investors who may react more strongly to safety concerns. Monitoring trading volumes and sentiment indicators will be key in gauging the market’s response to these developments. The real story here is how safety fears could shift investor behavior and impact price movements in the coming weeks. 📮 Takeaway Watch for shifts in trading volumes and sentiment as safety concerns could lead to increased volatility in crypto markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether